- succession planning form (14)

- ,

- small business form (12)

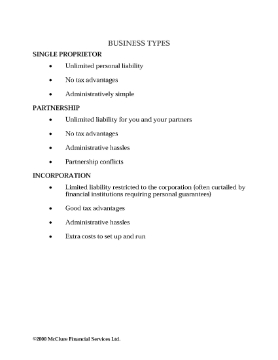

Business Succession Planning in Canada

Plan for the future of your small business - learn what you need to know about Business Succession Planning in Canada with this 8-page expert guide.

The guide describes the different types of business structures under Canadian laws, the pros and cons of each type of corporate entity. In addition, it discusses:

- how to extract value from your business,

- corporate investing,

- exit strategies,

- family businesses,

- tax planning and estate freezes.

Business Succession Planning in Canada is intended for Canadian businesses and is provided in PDF format.

Purchase of Business by Employee as Going Concern

Sell your business to an employee with this downloadable Agreement for Purchase of Business as Going Concern.

- The Agreement for Purchase of Business as Going Concern is a great succession planning tool if you have no family members able or willing to take over the business.

- The transaction will take place upon the winding up of current business operations by the present owner.

- The agreement terminates the employee's employment, and establishes an agency relationship between the employee as buyer and the owner as seller with respect to ongoing contracts and obligations of the business.

- The buyer, as agent for the seller, will pay the outstanding liabilities and will perform any required warranty or service work under existing contracts with clients.

- This is a generic legal contract template which does not contain references to the specific laws of any country or jurisdiction.

Succession Planning 101 - Building Success Into Your Succession Plan

Plan for the future of your business with this 8-page guide entitled Succession Planning 101 - Building 'Success' Into Your Succession Plan.

Sooner or later illness, death or old age will force you to either pass on your business or wind it up. But most owner managers have no succession plan in place and no plans to make one.This expert guide walks you through the basics of succession planning. Topics include:

- events that trigger a succession crisis,

- various succession planning options, including passing the business on to family members, senior management, or outsiders,

- common mistakes and pitfalls,

- a checklist for doing it right.

Get expert advice with this valuable guide, written by a lawyer who specializes in succession planning.

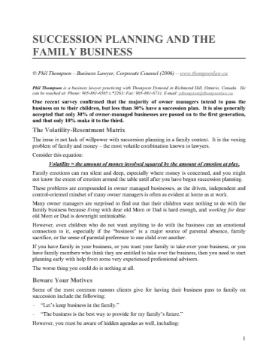

Succession Planning and the Family Business

Every family business should have a succession plan in place.

This article will help you identify the issues to consider when planning your succession plan / exit strategy so that you can retire and pass on your business to the next generation.

Why does a family business need a succession plan?

This article by the Harvard Business Review discusses the reasons why family business owners need to design a transition plan to avoid tension, discord and disruption to business operations.

Topics Discussed

The topics covered in "Succession Planning and the Family Business" include:

- Examining the reasons for leaving the business to a specific family member.

- The most common mistakes in crafting a family-based succession plan.

- Determining what is best for succeeding generations.

- Tips for creating a successful succession plan.

Author Credit

This expert guide was written by Phil Thompson, business lawyer and corporate counsel in Ontario, Canada.