CANADA

Lease your crop and pasture lands with these Farm Land Lease Forms for Canadian land owners.

- Province-specific templates as well as generic forms that can be used in most provinces and territories except for Quebec.

- Downloadable and customizable standard form templates.

- Affordable and easy to use.

Alberta Cash Farm Lease Agreement

Lease farm land in Alberta to a tenant with this template Alberta Cash Farm Lease Agreement.

- This Lease allows the tenant to pay the annual cash rent in several payments.

- The tenant will use the land solely for agricultural purposes and will farm the land in accordance with normal farming practices.

- The tenant is responsible for control of weeds and soil erosion.

- The tenant shall not make major improvements without the landlord's consent.

- The tenant must carry adequate liability insurance naming the landlord as additional insured.

- The landlord will pay all taxes and levies against the land, and the tenant will pay all utilities, fuel, labour and other costs associated with farming the land.

- The landlord will grant the tenant a right of first refusal for any sale of the lands.

- This template is provided in MS Word format and is fully editable to fit your needs.

- The Cash Farm Lease Agreement is written in accordance with the laws of the Province of Alberta and should only be used for lands within that province.

Alberta Farm Land Services Agreement

Hire a farming services company to farm land marked for development with this Alberta Farm Land Services Agreement.

- The farming services company (Farmco) will provide site preparation services and farm the land, in order to ensure that the lands are assessed as farm land for the interim period prior to the land being developed and subdivided.

- Farmco will keep the land as free as possible of weeds and pests, and harvest a hay crop each year.

- The land developer will pay Farmco a maintenance fee on a per acre basis.

- If seed or fertilizer prices increase beyond a certain percentage, Farmco has the right to increase the maintenance fee.

- This legal contract template is available in MS Word format and is fully editable to fit your circumstances.

- Intended for use only in the Province of Alberta, Canada.

Alberta Farm Lease Agreement and Option to Purchase

AB land owners, rent out your farm land to a tenant and give them an option to buy the land with this Alberta Farm Lease Agreement and Option to Purchase template.

- The tenant must exercise its option to purchase within a specified option period, failing which the option expires.

- The landlord must give the tenant first right of refusal to purchase the land, prior to offering it for sale to a third party.

- The tenant must carry adequate liability insurance at all times during the term of the lease.

- The tenant agrees not to make any improvements or changes without the written consent of the landlord.

- This is a fully editable legal contract available in MS Word format.

- Intended for use in the Province of Alberta, Canada.

Alberta Reciprocal Grant of Access Easement

Does your property share a roadway with your neighbour's land? Write up a Reciprocal Grant of Access Easement with this downloadable template for Alberta land owners.

- The owners of each of the adjoining properties grants the other owner access over their respective land by way of a common approach and roadway that runs through both properties.

- The land owners agree to allow access across the land to third parties, such as utility providers.

- The land owners will be jointly responsible for the costs of maintenance of the roadway and approach.

- Each party indemnifies the other against claims for loss or damages.

- This downloadable legal form is easy to customize to fit your circumstances.

- Intended for use only in the Province of Alberta, Canada.

Canada Methods of Calculating Cash Rent for Farm Leases

Canadian land owners, do you have crop land to lease? Download this handy free guide outlining Three Methods of Calculating Cash Rent for Farm Leases.

The guide explains:- the Cost Approach (based on the landlord's estimated costs),

- the Crop Share Equivalent Approach,

- the Income Approach,

- includes sample worksheets for each method.

Ontario Farm Land Cash Lease

Lease farm land in Ontario to a tenant on a cash basis with this Ontario Farm Land Cash Lease.

- Annual rent is calculated by multiplying the number of acres leased by a base rent per acre.

- The rent will be paid in a series of installment payments.

- The tenant agrees to use the land for farming and agricultural purposes only.

- The tenant is responsible for care and maintenance of the land, including soil erosion and weed control.

- The tenant is also responsible for maintaining fences and other improvements on the land.

- The tenant must comply with all federal, provincial and local environmental laws, rules and regulations, and must ensure proper waste disposal and storage of chemicals.

- The tenant must carry sufficient insurance satisfactory to the landlord, including spill insurance.

- Available in MS Word format and fully editable to fit your needs.

- Intended to be used only in the Province of Ontario, Canada.

Ontario Farm Land Lease with Land Trust

Lease out Ontario agricultural land owned by a land trust with this Ontario Farm Land Lease Agreement.

Parties to the Agreement

The Farm Land Lease Agreement is between a land trust which purchased land from an Ontario land owner (lessor) and the land owner who is now leasing it from the land trust (lessee).

This strategy is sometimes used for tax purposes, to avoid creditors, or to avoid probate.

Lessee's Obligations Under the Lease

- The lessee agrees to use the land for agricultural and wildlife management purposes only.

- The lessee will pay all realty taxes and other assessments with respect to the land.

- The lessee is responsible for carrying all required insurance.

- The lessee will cultivate the land, control weeds and grass, and maintain culverts and underdrains to ensure proper drainage.

Format and Legal Jurisdiction

The Farm Land Lease Agreement template is available in MS Word format and is fully customizable to meet your exact needs.

This legal document was prepared in accordance with the Ontario Short Forms of Leases Act and should only be used in the Province of Ontario, Canada.

Ontario Farm Lease for Buildings Only

ON farm owners, lease the buildings on your property to a tenant with this Ontario Farm Lease Agreement template.

Term of Lease

The lease can either be for a fixed period of time or can run year to year. The lease is for the buildings only, not the farm land.

Tenant Obligations

- The tenant must allow incoming tenants or purchasers access to the land in order to harvest the crops and work the land.

- The tenant agrees to keep all buildings and fences in good repair.

- The tenant agrees not to keep vehicles of any kind in barns or sheds without the landlord's consent.

Right of Way

The landlord allows the tenant a right of way over the land owned by the landlord in order to access the buildings.

Dispute Resolution

The parties agree to arbitration in the event of a dispute.

Format and Jurisdiction

This Ontario Farm Lease Agreement template is provided in MS Word format and is fully editable to fit your circumstances.

This legal document is intended to be used only in the Province of Ontario, Canada.

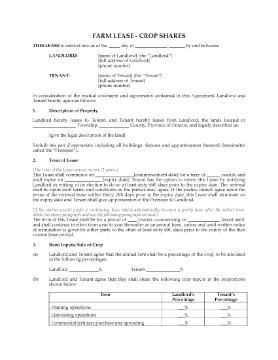

Ontario Farm Lease for Crop Shares

ON farmland owners, rent out your farm land to a tenant with this Ontario Farm Lease for Crop Shares.

- This Lease allows the tenant to use a percentage of the crops grown on the land as payment of the rent.

- The landlord and tenant will each pay a portion of the costs of planting, growing and harvesting the crop.

- The tenant agrees to use the land for farming and agricultural purposes only.

- The tenant is responsible for care and maintenance of the land, including soil erosion and weed control.

- The tenant is also responsible for maintaining fences and other improvements on the land.

- The tenant must comply with all federal, provincial and local environmental laws, rules and regulations, and must ensure proper waste disposal and storage of chemicals.

- The tenant must carry sufficient insurance satisfactory to the landlord, including spill insurance.

- Available in MS Word format, fully customizable to meet your needs.

- Intended to be used only in the Province of Ontario, Canada.

Ontario Pasture Lease

ON land owners, lease pasture land to a tenant with this Ontario Pasture Lease template.

- The term of the lease can be either for a fixed number of years with an option to renew, or a continuing term which reverts to a yearly lease after the initial term expires.

- The lease contains two options to determine how rent will be calculated - either based on (i) the number of acres of pasture land, or (ii) the number of livestock grazing the land.

- The tenant is responsible for ensuring that livestock do not break through fences, and must ensure that all animals meet the landlord's approval with respect to health, breed, sex, age, and number of animals.

- The tenant must use the land for agricultural purposes only.

- The tenant must comply with all federal, provincial and local environmental laws, rules and regulations, and must ensure proper waste disposal and storage of chemicals.

- The tenant must carry sufficient insurance satisfactory to the landlord, including spill insurance.

- 1

- 2