Florida

Prepare the paperwork for a mortgage loan with these ready-made Florida Mortgage Forms.

- The availability of mortgage financing in Florida is not a problem. Buyers can finance up to 75% of the value of the property.

- The Florida Department of Banking and Finance, Division of Finance, regulates mortgage broker licensing in the State.

- All persons who solicit mortgage loans, accept applications for mortgage loans, or negotiate the terms of such a loan must be licensed.

Sort by

Display per page

Florida Balloon Mortgage

Florida lenders, prepare a Balloon Mortgage for borrowers with this easy-to-use 17-page template.

- The mortgage contains uniform covenants with respect to payment of principal and interest, taxes and insurance, prior mortgages, preservation of the property, acceleration and remedies on default, and other standard mortgage clauses.

- The mortgage and note securing the mortgage may be sold without prior notice to the borrower.

- The mortgage form includes a Rented Property Addendum to be used if the mortgaged property is rental property.

- This template is in MS Word format and is fully editable. You can download the digital file right after purchasing it.

- Intended to be used only in the State of Florida.

$19.99

Florida Balloon Mortgage Note

Florida mortgage lenders, prepare a Mortgage Note to secure a balloon mortgage with this easy-to-use template.

- Under this form of Mortgage Note, the borrower agrees to make monthly payments against the secured amount, until the date of the final payment which will be a balloon payment.

- On the final payment date, the entire balance of principal and interest outstanding is due.

- The Note is secured by a mortgage on the borrower's property.

- This form template is available in MS Word format and is fully editable.

- Intended for use only in the State of Florida.

$11.99

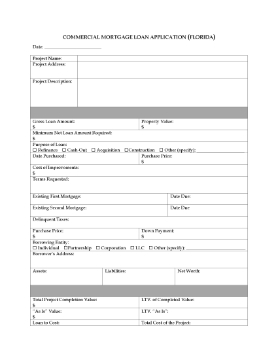

Florida Commercial Mortgage Loan Application

Use this Commercial Mortgage Loan Application for corporate borrowers looking for mortgage funding.

- This application form is intended for use in Florida, but can be adapted for use in any other State.

- Applicants must provide information about the property and any existing mortgages or encumbrances.

- If there are guarantors, their personal details must be provided as well.

- The borrower must disclose the use of the proceeds, and any amounts that the borrower is investing.

The Florida Commercial Mortgage Loan Application form is a free download - just click the Download button to get your copy.

$0.00

Florida Contract for Deed

You've found a buyer for your home, but they can't qualify for a conventional mortgage. If you can let them pay the purchase price over time, then this Florida Contract for Deed is for you.

- Under the Contract for Deed (or 'land contract'), the seller essentially becomes the mortgage lender. The buyer makes payments against principal and interest to the seller instead of to a bank.

- At the end of the agreed period of time, the remaining balance is payable in one balloon payment.

- If the buyer defaults, the seller has the right to terminate the agreement and take possession of the property. The buyer would forfeit all payments made.

- Available in MS Word format.

- Intended to be used only in the State of Florida.

$17.99

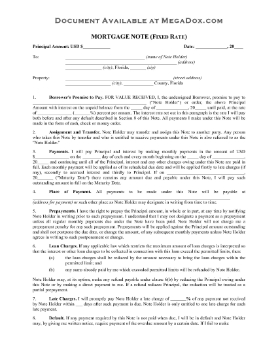

Florida Fixed Rate Mortgage Note

If you're funding a loan to a friend or family member which will be secured by a mortgage, you will also need to have them sign this Fixed Rate Promissory Note for Florida.

- The Note provides for equal monthly payments of principal and interest up until the maturity date, at which time any unpaid balance will be paid in full.

- The borrower agrees to pay a late charge on any payment that is not made when it is due.

- There is an acceleration clause which stipulates that if the borrower is in default under the note, the note holder has the option to demand repayment of the entire outstanding balance of principal and interest in 30 days.

- The Florida Fixed Rate Mortgage Note is a downloadable MS Word template. Convenient and easy to use.

$6.29

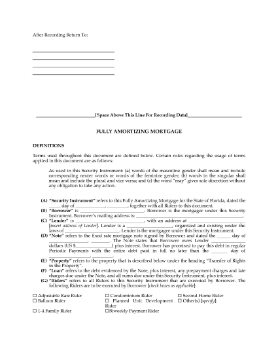

Florida Fully Amortizing Mortgage

Prepare a Fully Amortizing Mortgage for a borrower with this easy-to-use template form for Florida mortgage lenders.

- The mortgage loan is arranged so that it will be fully paid out at the maturity date.

- Uniform covenants with respect to payment of principal and interest, taxes and insurance, prior mortgages, preservation of the property, acceleration and remedies on default, and other standard mortgage clauses.

- If the lender requires it, the borrower shall obtain and maintain mortgage insurance as long as any portion of the mortgage remains outstanding.

- The borrower assigns to the lender all miscellaneous proceeds from the property (insurance proceeds, settlements, awards, etc.).

- The mortgage form includes a Rented Property Addendum to be used if the mortgaged property is rental property.

Once you've purchased the Fully Amortizing Mortgage template, you can download it and use it immediately. Re-use it as often as you need to.

$17.99

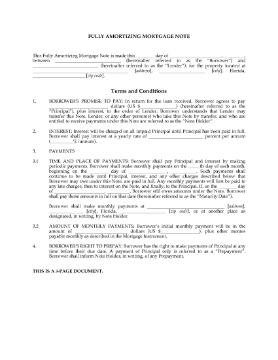

Florida Fully Amortizing Mortgage Note

This Mortgage Note is secured by a fully amortizing mortgage on a Florida real estate property.

- Under the Note, the borrower agrees to pay the lender the full amount of the mortgage loan, plus interest at the loan rate.

- Unlike a balloon note, there is no large payment to be paid on the maturity date. The final payment will be a regular payment.

- Payments on the loan will be made monthly.

- The borrower has the right to prepay the Note without penalty.

Get the Florida Fully Amortizing Mortgage Note by putting it in your cart and paying via the secure checkout server.

$12.49

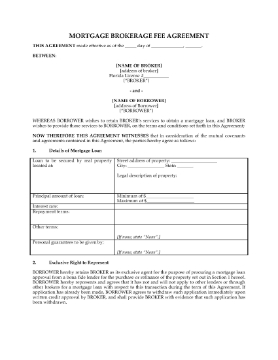

Florida Mortgage Brokerage Fee Agreement

This customizable Mortgage Brokerage Fee Agreement makes it easy for Florida mortgage brokers to prepare a contract for a new client.

- The client / borrower agrees that the broker will be the sole and exclusive agent for making the mortgage loan application.

- The broker will prepare the mortgage loan application and obtain a credit report and property appraisal.

- In addition to the broker fee paid by the borrower, the broker may receive additional compensation from the funding lender.

- The borrower agrees to pay a non-refundable application fee, which will be credited against the broker's fees at closing.

- The agreement contains the required Florida mortgage broker disclosures.

- The broker does not make any guarantee that the borrower will obtain a mortgage loan as a result of the broker's efforts.

- Available in MS Word format. Fully editable.

- Intended to be used only within the State of Florida.

$16.99