CANADA

Set up a partnership or joint venture in Canada with these template agreements and forms for Canadians. Fully editable and easy to customize to meet your needs.

Under Canadian laws, every partner in a general partnership is personally liable for all of the partnership's obligations, including negligence by another partner. So it's very important to choose your business partners wisely. Each province and territory of Canada has its own laws governing partnerships.

Partnerships are not taxed directly for income tax purposes. Instead, the partners pay the income tax. In the case of a joint venture with foreign partners, if the venture does business in Canada, the foreign partners will be taxed on their share of profits as if they were a Canadian branch operation.

Sort by

Display per page

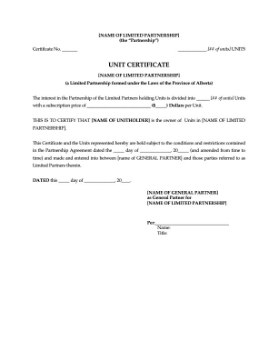

Alberta Certificate for Limited Partnership Units

Use this free template to prepare a Unit Certificate representing ownership of partnership units in an Alberta limited partnership.

- The form is available in MS Word format and can be used as a template to issue a certificate for each subscription for units.

- Easy to edit to fit your needs.

- Intended to be used only in the Province of Alberta, Canada.

$0.00

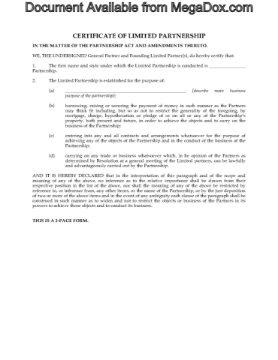

Alberta Certificate of Limited Partnership

Prepare a Certificate of Limited Partnership with this easy-to-use template form for Alberta partnerships.

- This form must be prepared by the General Partner, setting out the organizational details of the Limited Partnership, such as:

- the purpose for the partnership,

- the names and address of the general and limited partners,

- the contributions of the original partners,

- the share of profits to which each partner is entitled,

- restrictions on assignment or transfer of partnership interests.

- Available as a downloadable MS Word file.

- Intended to be used only in the Province of Alberta, Canada.

$6.50

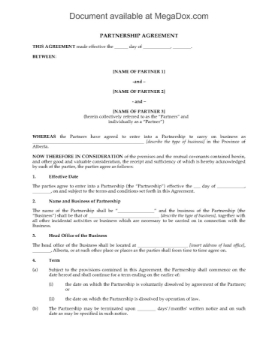

Alberta General Partnership Agreement

Prepare a General Partnership Agreement for an Alberta partnership with this comprehensive template.

- Net profits or losses will be shared or made up by the partners on a pro rata basis.

- Additional capital contributions will also be made pro rata among the partners.

- Provisions for designation of a managing partner.

- Procedure for performing an annual valuation.

- No assignment or transfer of a partner's interest is allowed without consent of the other partners.

- Procedure for withdrawal of a partner.

- This legal form template is provided in MS Word format and is fully editable to fit your needs.

- Intended for use only in the Province of Alberta, Canada.

$17.99

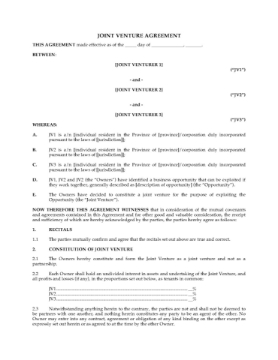

Alberta Joint Venture Agreement

Set up a joint venture to do business in the Province of Alberta with this template Joint Venture Agreement.

- One of the co-venturers will be the manager of the joint venture, and will be paid a management fee for doing so.

- If a co-venturer dies, their interest will automatically pass to their spouse or children.

- Each co-venturer has a right of first refusal and piggyback rights on the interest of the other parties, in the event of a sale or transfer.

- Any co-venturer may exercise a shot-gun buy-sell provision with respect to the interest of another co-venturer.

- This Joint Venture Agreement is available as a downloadable Microsoft Word file which is fully editable to meet your needs.

- The document is intended for use in the Province of Alberta, Canada.

$29.99

Alberta Land Development Partnership Agreement

Set up a partnership to develop and build a commercial office and retail project in Alberta with this Land Development Partnership Agreement template.

- The Agreement is between the owner of the land to be developed, and a managing partner (the Operator) who will be lending money to the project.

- Additional partners may be brought on if deemed necessary by the original partners.

- The Operator will advance sufficient funds to the partnership which will be lent to the owner interest-free for demolition and to secure surrender of existing leases.

- Details of the Operator's compensation for managing development, construction and completion of the project.

- Procedure for advances made to the partnership by a partner.

- Buy-sell provisions which give the other partners a right of first refusal to purchase the interest of a departing partner.

- Procedure for disposing of the partnership assets on termination or dissolution.

- Available in MS Word format and fully editable.

- Intended to be used only in the Province of Alberta, Canada.

$34.99

Alberta Land Development Partnership New Partner Agreement

Bring on a new partner to an Alberta land development partnership with this Admission Agreement.

- This Admission Agreement would be used to admit a new partner into a partnership which was formed for the purpose of constructing and developing a commercial office and retail project on land owned by one of the partners.

- Provisions of the Admission Agreement include:

- capital contribution to be made by the new partner;

- covenants, representations and warranties of each of the parties;

- cash distributions and repayments to be made to original partners at the time of the new partner's buy-in;

- amendments to be made to the original Partnership Agreement, including allocation of partnership profit or loss;

- a management committee appointed by the partners will be responsible for managing and operating the partnership affairs.

- This template is in MS Word format and is fully editable to fit your circumstances.

- Intended to be used in the Province of Alberta, Canada.

$46.99

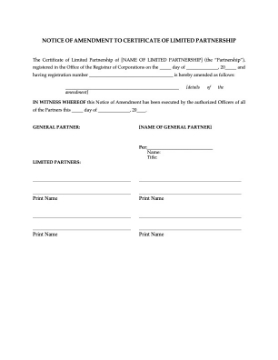

Alberta Notice of Amendment to Certificate of Limited Partnership

Give notice to interested parties of an amendment to the Certificate of Limited Partnership for an Alberta partnership with this free form.

- This form is available in MS Word format and is fully editable.

- Fill in the details, print, sign and send.

- Intended to be used only in the Province of Alberta, Canada.

$0.00

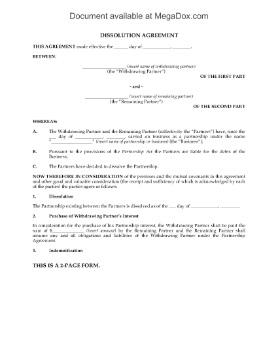

Alberta Partnership Dissolution Agreement

Wind up a general partnership in the Province of Alberta with this Partnership Dissolution Agreement.

- One partner buys out the interest of the other partner and assumes the partnership's debts and obligations.

- The remaining partner then continues to carry on the business of the partnership as a sole proprietorship.

- This is a fully editable template which can be easily customized to fit your circumstances.

- Intended to be used only in the Province of Alberta, Canada.

$6.50

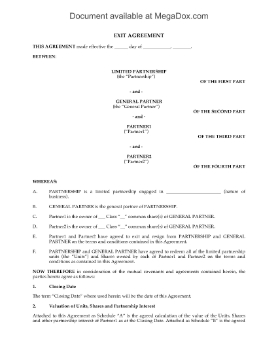

Alberta Partnership Exit Agreement

Facilitate the exit of a partner and deal with their partnership interest with this Partnership Exit Agreement for an Alberta limited partnership.

- The exiting partner's interest will be purchased by the general partner and the partnership.

- Once the sale of its interest is complete, the exiting partner is relieved of its rights and obligations under the Partnership Agreement.

- The purchasers will use best efforts to obtain a release of any guarantees of the partnership's debts given by the exiting partner and will indemnify the exiting partner against any claims or damages.

- This legal form template is available in MS Word format and is fully editable to meet your specific needs.

- Intended for use only in the Province of Alberta, Canada.

$17.99

Alberta Transfer of Limited Partnership Units

Transfer your interest in an Alberta limited partnership to another party with this Transfer of Limited Partnership Units.

- This form allows the withdrawing partner to transfer all of his or her interest to either a remaining partner or a new incoming partner.

- This form is in MS Word format and is easy to download and use.

- Intended for use only in the Province of Alberta, Canada.

$2.50