USA Wills

Affordable Last Will and Testament forms, probate and estate administration forms for residents of the United States, including a complete USA Legal Will Kit.

Sort by

Display per page

Affidavit of Survivorship | USA

Use this USA Affidavit of Survivorship to transfer title of real property to a surviving joint tenant after the other joint tenant has died.

- The affidavit must be sworn and filed in the appropriate County office to transfer the title into the name of the surviving owner.

- The Affidavit sets out the details of the deceased's passing and the value of the estate.

- The surviving joint tenant also declares whether or not there is any federal or state inheritance tax liability on the property.

- You must provide a copy of the death certificate when you register the affidavit.

- This legal form can be used in any U.S. state which does not have a prescribed form.

- There's no need to place the property in probate. Just sign this USA Survivorship Affidavit in front of a notary, record it with the land records office, and the title deed will be reissued in the name of the surviving joint tenant.

$2.29

Alaska Affidavit of Heirship

If a person dies without a will in Alaska, it may be necessary to file an Affidavit of Heirship to establish ownership of the deceased's property.

- The Affidavit lists all of the potential heirs of the deceased person.

- If the deceased person owned real estate, the Affidavit will need to be recorded with the county where the property is located. The property cannot be sold until heirship issues have been dealt with.

- The Affidavit of Heirship will help clear up intestacy matters and questions of property ownership.

- Available in MS Word format.

- Intended to be used only in the State of Alaska.

$11.99

Arizona Heirship Affidavit

Complete and file this Affidavit of Heirship for Arizona, to determine the ownership of property left by a person who died without a will.

- The person making the Affidavit (the affiant) must list all the potential heirs to the deceased person's estate.

- The affiant should not be a potential heir, but someone who knew the deceased person well enough to provide the required information.

- If there is real property (real estate) involved, the Affidavit will need to be recorded at the land records office before the property can be sold.

- Available in MS Word format.

- For use only in the State of Arizona.

$9.99

California Affidavit of Death - Community Property

Has your spouse recently passed away? If the two of you held title to real estate as community property in California, you need to file this California Affidavit of Death form.

- First you will need to sign the Affidavit in front of a Notary.

- Then you must file it with the County Clerk in order to have title to the property transferred solely into your name.

- You'll need to attach a copy of the Certificate of Death to the form.

- Buy and download the form, fill in your details, print it, and take it to a notary for signing.

- Available in MS Word format.

- Intended to be used only in the State of California.

$5.99

California Affidavit of Death of Joint Tenant

If you own property in joint tenancy with someone who has died, you can transfer title solely into your name with this California Affidavit of Death of Joint Tenant.

- This Affidavit is NOT for real estate that is community property. To transfer community property, you need the Affidavit of Death form for community property.

- You will need to attach a copy of the Certificate of Death to this Affidavit.

- Once the Affidavit has been sworn and notarized, you can register it in the Recorder's Office where the title deed is filed.

- There is no need to probate real estate owned by joint tenants. Once you file this Affidavit, title will be reissued in your name.

- Available in MS Word format.

- For use only in the State of California.

$4.99

California Affidavit of Surviving Spouse

File this California Affidavit of Surviving Spouse if you and your spouse owned property which was NOT held as community property before he or she passed away.

- The Affidavit is made under California Probate Code section 13540.

- The surviving spouse states that he/she and the deceased spouse at all times considered the property to be community property.

- The Affidavit must be filed 40 days after the decedent's death to protect the interest of your successors in title and that of other parties with an interest in the property (such as title insurers).

- The affiant must also attest that no election to probate the deceased's interest in the property has been or will be filed.

- Available in MS Word format.

- Intended to be used only in the State of California.

$6.29

California Affidavits for Release of Estate Property without Probate

Prepare Affidavits to release the property of a deceased person without probate with this package of template California forms.

- If you are acting as executor of an estate in California which is not going through probate or administration, you will require affidavits from the beneficiaries under the Will before you can release property to them.

- This package contains:

- Affidavit re Real Property of Small Value (Form DE-305), rev. April 28, 2025.

- Affidavit Under Probate Code S. 13101 (Probate Affidavit), rev. 2015.

- Affidavit for Collection of Personal Property, to transfer property such as bank accounts, stocks or items held in safe deposit boxes, rev. Jan. 1, 2020.

- Available in PDF format.

- Intended to be used only in the State of California.

$0.00

California Receipt from Distributee for Property Received

Estate executors, file this Receipt from Distributee with California Superior Court each time you distribute estate assets to a beneficiary.

- The beneficiary acknowledges receipt of specified property from the deceased's estate.

- The Receipt must then be filed with the Superior Court for each distribution of estate assets.

- This is a free downloadable form in PDF format.

- Available from the Superior Court of the State of California.

$0.00

Colorado Tangible Personal Property Memorandum

Colorado residents can use this free Tangible Personal Property Memorandum to pass on personal property to loved ones, in conjunction with doing a Last Will and Testament.

- Colorado law allows a testator (a person executing a will) to pass tangible personal property to beneficiaries by using a written statement or list referenced in the will, under C.R.S. S. 15-11-513.

- The advantage to using a separate Memorandum to list these items is that if there are any changes, you can make a new Memorandum without having to change your will.

- This free Tangible Personal Property Memorandum includes instructions on how to complete and sign it. Downloadable and fully editable.

- Intended to be used only in the State of Colorado.

$0.00

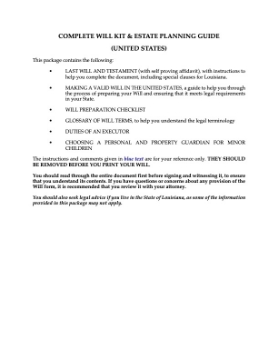

Complete Legal Will Kit | USA

If you were to die without a Will, your loved ones will have to pay court costs and legal fees to administer your estate. Don't let that happen. Get your complete USA Legal Will Kit and Estate Plan.

- The USA Legal Will Kit and Estate Plan package contains everything you need to make your will:

- Last Will and Testament with self proving Affidavit, with instructions to help you complete the document and special provisions for Louisiana.

- Making a Valid Will in the United States, a guide to help you through the process of making your will and ensuring that it meets legal requirements in your State.

- Will Preparation Checklist.

- Glossary of legal terms commonly used in a Will.

- Information about the duties and responsibilities of an executor.

- Guidelines for choosing a personal guardian for minor children and a property guardian for minor beneficiaries.

- If you own real estate or other assets, whether in the United States or elsewhere, you should have a Will to make sure your property is distributed in accordance with your wishes.

- No need to buy multiple copies - you, your spouse or partner, and other family members can each prepare a Will using the same template.

$19.99