Product tags

- transfer of title form (43)

- ,

- proof of death form (2)

- ,

- california affidavit form (2)

- ,

- community property form (6)

Related products

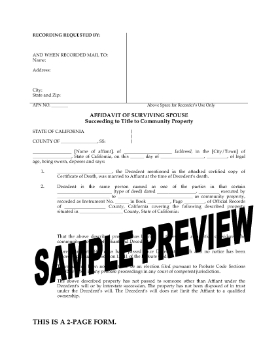

California Affidavit of Surviving Spouse

File this California Affidavit of Surviving Spouse if you and your spouse owned property which was NOT held as community property before he or she passed away.

- The Affidavit is made under California Probate Code section 13540.

- The surviving spouse states that he/she and the deceased spouse at all times considered the property to be community property.

- The Affidavit must be filed 40 days after the decedent's death to protect the interest of your successors in title and that of other parties with an interest in the property (such as title insurers).

- The affiant must also attest that no election to probate the deceased's interest in the property has been or will be filed.

- Available in MS Word format.

- Intended to be used only in the State of California.

$6.29

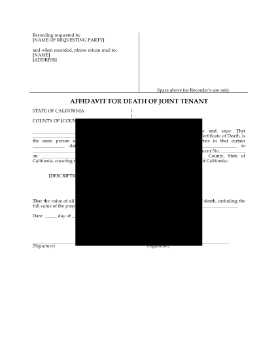

California Affidavit of Death of Joint Tenant

If you own property in joint tenancy with someone who has died, you can transfer title solely into your name with this California Affidavit of Death of Joint Tenant.

- This Affidavit is NOT for real estate that is community property. To transfer community property, you need the Affidavit of Death form for community property.

- You will need to attach a copy of the Certificate of Death to this Affidavit.

- Once the Affidavit has been sworn and notarized, you can register it in the Recorder's Office where the title deed is filed.

- There is no need to probate real estate owned by joint tenants. Once you file this Affidavit, title will be reissued in your name.

- Available in MS Word format.

- For use only in the State of California.

$4.99

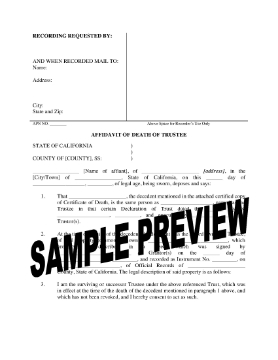

California Affidavit of Death of Trustee

Record the death of a trustee holding property under a declaration of trust with this California Affidavit of Death of Trustee form.

- The Affidavit is made by the successor trustee under the declaration of trust.

- Once sworn and notarized, the form is then filed with the County Records Office to have the trust property transferred into the name of the successor trustee.

- Available in MS Word format.

- Intended to be used only in the State of California.

$5.99

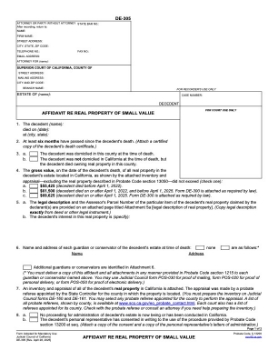

California Affidavits for Release of Estate Property without Probate

Prepare Affidavits to release the property of a deceased person without probate with this package of template California forms.

- If you are acting as executor of an estate in California which is not going through probate or administration, you will require affidavits from the beneficiaries under the Will before you can release property to them.

- This package contains:

- Affidavit re Real Property of Small Value (Form DE-305), rev. April 28, 2025.

- Affidavit Under Probate Code S. 13101 (Probate Affidavit), rev. 2015.

- Affidavit for Collection of Personal Property, to transfer property such as bank accounts, stocks or items held in safe deposit boxes, rev. Jan. 1, 2020.

- Available in PDF format.

- Intended to be used only in the State of California.

$0.00

California Homestead Declaration for Single Person

If you are a single person who owns a home in California, you should protect yourself against sale by creditors with this Homestead Declaration form.

- Filing the Declaration with the County Recorder creates what is called a declared homestead. A declared homestead protects your home from voluntary and/or forced sale.

- A single person homestead exemption will allow you to keep $75,000 of the equity you have built up in your property if your home is sold to satisfy debts or judgments, or if it acquired for public use.

- This is a template legal form which can be downloaded, filled in, and printed for signature.

- For use only in the State of California.

$6.29 $5.99

California Substitution of Trustee

Replace the original trustee named in a previously recorded Deed of Trust with this California Substitution of Trustee form.

- The form sets out the name and contact information for the replacement trustee.

- The new trustee must sign the form to acknowledge the appointment.

$6.29