Alabama

Downloadable Contract for Deed and Mortgage forms for Alabama lenders and brokers.

- All financial institutions and providers of credit, including mortgage lenders, are regulated by the State of Alabama Banking Department.

- Anyone holding a mortgage broker license may broker first and second mortgages, without any special licensing for the second mortgages.

- Alabama mortgages contain a power of sale clause, which allows the lender to foreclose and sell the property if the borrower defaults.

Sort by

Display per page

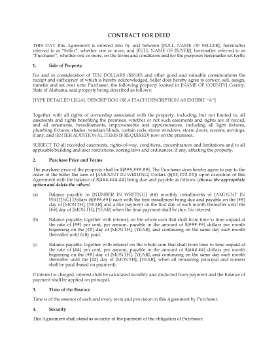

Alabama Contract for Deed

This Contract for Deed form allows the seller of a property in Alabama to assist the buyer by carrying part or all of the purchase price.

- The seller effectively becomes the mortgage lender for the balance of the purchase money.

- When the seller has received payment in full of the principal and interest, title to the property will be transferred over to the buyer.

- The seller has the right to take back the property if the buyer defaults on the payments.

- At the seller's option, the balance can be repaid by monthly payments with or without interest until paid, or monthly payments with interest for a fixed number of payments with a balloon payment at the end to pay out the balance.

- Available in MS Word format.

- This legal form is intended to be used solely within the State of Alabama.

$17.99

Alabama Mortgage

Alabama mortgage lenders can use this comprehensive template to prepare a mortgage to secure a loan for purchasing a property.

- Uniform Covenants: mortgage payments, taxes and insurance, prior charges on the land, hazard insurance, occupancy as principal residence, care and maintenance of the property, protection of the lender's security, etc.

- False Information. If the borrower gave any false or misleading information on the loan application, the borrower will be in default.

- Default. If the borrower breaches any provision of the agreement and fails to cure the breach, the entire amount of the indebtedness will become due and payable, and the lender may invoke its power to sell the property.

- Homestead. The borrower waives all homestead exemptions.

$17.99