Trust Agreements

Set up a living trust to avoid probate, hold property, reduce taxes or manage your assets with these easy-to-use Trust Agreements and related forms.

Q. What is a living trust?

A. A living trust is one that is formed while you're alive (unlike a testamentary trust, which is created by your Will and does not exist until after your death). There are many different kinds of living trusts, and each has a specific purpose. Some are revocable (meaning they can be revoked after coming into effect) and some are irrevocable, meaning the terms of the trust cannot be changed once it becomes effective.

Q. Should I make my trust a revocable trust or an irrevocable trust?

A. That depends on what the underlying purpose of the trust is to be. Any property you place in a revocable trust can be transferred out of the trust whenever you want, but property placed in an irrevocable trust cannot. That property now belongs to the beneficiaries of the trust. This is the most effective means of earmarking assets for the benefit of minor children. Once they're part of the trust estate, they cannot be used in any manner or for any purpose except those stated in the Trust Declaration. It's also a widely used method of avoiding US federal estate taxes and protecting assets from attachment by creditors.

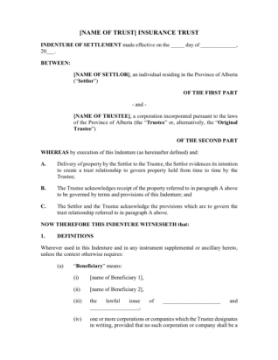

Alberta Insurance Trust Deed

Establish an insurance trust to direct how and when your life insurance proceeds are distributed with this template Insurance Trust Deed for Alberta residents.

- Irrevocable Trust. The trust being formed under the indenture is an irrevocable trust.

- Trust Indenture to Govern. It is the intention of the settlor of the trust that the provisions of the trust indenture, and not the provisions of s. 34 or s. 35 of the Trustee Act (Alberta) govern the manner in which the trustee will administer and dispose of the trust property.

- Income of Trust. The trustee may designate that income of the trust will include life insurance benefits, cash surrender value of life insurance policies, life insurance premium refunds, proceeds from life insurance policy loans, capital gains, any other receipts considered income under the Income Tax Act, but will exclude non-taxable dividends.

- Trustee's Discretion. The trustee has full discretion as to the division and distribution of the trust property.

- Trust Property Not Family Property.The trust property will not form part of the family property for purposes of the Matrimonial Property Act (Alberta).

- Restrictions on Settlor.

- The settlor cannot be added as a beneficiary and cannot be appointed as a trustee.

- The settlor has no authority or power under the indenture and will not receive any benefits of any kind from the trust.

- The settlor cannot direct that any trust property be transferred to any person or persons.

- Income Tax Act Not to Apply to Conveyance. The settlor conveys the trust property to the trustee on the express understanding that ss. 75(2) and 107(4.1) of the Income Tax Act do not apply to the conveyance.

- Designated Persons. No beneficiary who is a "designated person" under s. 74.5(5) of the Income Tax Act may receive or use income or capital of the trust while being a designated person.

- Format. The Insurance Trust Deed template is available in MS Word format and is fully editable.

- Governing Law. The document is governed by the laws of the Province of Alberta, Canada and by Canadian tax laws.

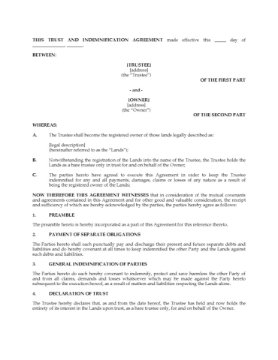

Alberta Land Trust and Indemnification Agreement

Draw up a Trust Agreement for land in Alberta with this downloadable template.

- The Agreement is made in respect of land which will be registered in the name of the trustee as bare trustee, to be held in trust on behalf of another party who is the beneficial owner.

- The parties will each pay their separate debts, except for expenses already incurred, which will be paid by the owner.

- The parties will keep each other indemnified against claims arising with respect to the land.

- The trustee has the power to lease or mortgage the land, with the consent of the owner.

- Available in MS Word format.

- Intended for use only in the Province of Alberta, Canada.

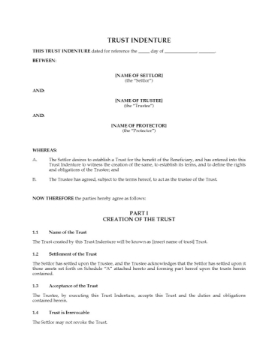

Alter Ego Trust Deed | Canada

Prepare an Alter Ego Trust Deed with this easy-to-use template, pursuant to the provisions of the Income Tax Act (Canada).

- Who Can Use This Form. An alter ego trust can only be created by an individual aged 65 or older, who will have the exclusive right to receive all income from the trust.

- Trust Income. During the settlor's lifetime no person other than the settlor may receive or otherwise obtain the use of any part of the trust's income or capital.

- Distribution of Trust AssetsUpon the settlor's death, the trust will hold any remaining assets for the benefit of other beneficiaries named in the Trust Deed. The trust will be able to distribute those assets to the other beneficiaries without the assets having to go through the probate process.

- Legal Jurisdiction. This Alter Ego Trust Deed template is governed by Canadian tax laws and is intended to be used only within Canada.

- Format. The template is available in MS Word format and is fully editable.

Amendment to Living Trust for Charitable Gift | USA

Amend your Revocable Living Trust to make a charitable gift with this downloadable template form for USA trusts.

- This Amendment lets you gift some of the trust property to a charity or non-profit organization.

- You can change the original Trust Agreement giving the trustee instructions to make the charitable gift.

- This template is only for trust agreements made in the United States.

- The form is provided in MS Word format and is easy to fill in and print.

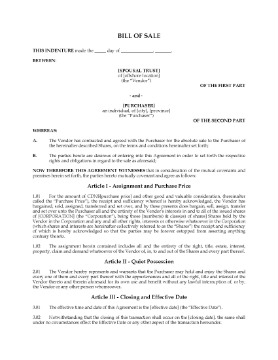

Bills of Sale for Spousal Trust Asset Transfer | Canada

Prepare four Bills of Sale for an asset transfer into a spousal trust, for use only in Canada.

This package contains bill of sale templates for the following:

- a transfer of assets from the spousal trust to an individual,

- a transfer of assets from the individual to a holding company,

- a transfer of assets from the holding company to an international investment corporation,

- a transfer of assets from the investment corporation to the trust.

The forms are available in MS Word format and are fully editable. Governed by Canadian laws and intended to be used only in Canada.

Business Trust Declaration and Agreement | USA

Use this template Business Trust Declaration and Agreement to set up a U.S. business trust to protect your assets and reduce taxes.

- The trustees will hold all property, income and profit of the business in trust for the beneficial shareholders.

- The trustees are authorized to sign documents, hold title to property, buy and sell property, conduct business, commence or defend litigation, adopt and enforce bylaws and regulations, and carry out other actions in the name of the Trust.

- Shareholders are not liable, and every obligation entered into by the trustees must stipulate in writing that the shareholders are not liable for any debt or liability incurred in connection with such obligation.

- Trustees are only liable for their own actions, and not for the actions of the other trustees. No trustee shall be personally liable for any act or duty carried out on behalf of the Trust.

- Available in MS Word format.

- Intended to be used only within the United States.

California Revocable Living Trust Agreement

Protect your assets and avoid probate proceedings by placing your estate property into trust with this Revocable Living Trust Agreement for California residents.

- The trustee will pay the trust income to the settlor (maker of the trust), and such portion of the principal of the trust as the trustee sees fit for the medical care, maintenance and welfare of the settlor.

- If the settlor becomes unable to manage his/her affairs, the trustee may pay the trust income and principal to the settlor's spouse and/or children.

- The settlor may make changes to or revoke the Trust Agreement by written notice to the trustee.

- Upon the settlor's death, the remaining trust property is to be distributed to the beneficiaries in a manner set out in a schedule to the Agreement.

Charitable Remainder Trust | Canada

Prepare a charitable remainder trust with this downloadable template for Canadian residents.

How a Charitable Remainder Trust works

A charitable remainder trust allows the donor to retain a life interest in property transferred into the trust but makes an irrevocable gift of the residual interest to a registered charity.

The charity then issues a donation receipt for the fair market value of the residual interest in the property at the time that the residual interest vests in the charity.

Key Provisions

- Tax Credit. The tax credit can be carried forward in whole or in part for up to five years.

- Capital Gains. All capital gains are allocated to the capital beneficiary, i.e. the charity, which is tax-exempt.

- Trust Income. The net income of the trust is paid to the income beneficiary (the settlor and their spouse, and/or whoever else the settlor may designate in the trust).

- Expenses. Trust expenses are paid from the trust income.

- Irrevocable Trust. This is an irrevocable trust.

Format and Legal Jurisdiction

The template is available in MS Word format and is fully customizable. This trust deed is governed by Canadian tax laws and is intended to be used only in Canada.

Charitable Trust Deed | USA

Set up an IRS-approved charitable trust with this template Charitable Trust Deed for US residents.

- The trust will be administered by a corporate trustee and one or more individual trustees.

- The trust property and income are to be used only for the charitable purposes stated in the Trust Deed and not to benefit any person or company.

- The trustees must make distributions in such a manner as not to subject the trust to any tax, and shall not engage in any self dealing as described in Section 4941 of the Internal Revenue Code.

- The trustees shall not retain any excess business holdings as defined in Section 4943 of the Code and shall not make any investments as defined in Section 4944 of the Code.

- The trustees must not make any taxable expenditure which would subject the Trust or any corporate trustee to tax under Section 4945 of the Code.

- This template is provided in MS Word format and is easy to use.

- Governed by American tax laws and intended for use only in the United States.

Family Trust Annual Resolutions | Canada

Prepare annual resolutions for a family trust in Canada with this easy-to-use forms package which contains:

- Trustee resolutions naming the records office, appointing the accountants, and confirming the acts of the trustees.

- Trustee resolutions resolving that all income allocations and expense payments required to be made have been or will be made for the year, and that the trust will not be liable for income tax under Part 1 of the Income Tax Act (Canada).

- This forms package is a downloadable MS Word file containing all of the resolutions. Fully editable and easy to use.

- Intended to be used only in Canada.