CANADA

Canadian lenders, secure repayment of a loan from a borrower with these Loan Transaction Forms for Canada.

Why should I document a loan to a family member or close friend?

In order to be classified as a secured creditor you must document the loan and get some collateral from the borrower, such as a mortgage on their home or an encumbrance on a vehicle or other asset. This will ensure that the debt is treated as a secured debt.

Secured debts are not automatically wiped out if the borrower declares bankruptcy. Secured debts take priority over unsecured debts, and you will have the legal right to foreclose or repossess and sell any items pledged as collateral if the borrower fails to honour its payment obligations.

What rate of interest can I charge?

If you live in a province or territory which does not have laws governing how interest will be charged on a loan or mortgage, the Canada Interest Act will apply.

If you have not stated whether the interest rate is simple or compound interest, a court would probably rule that only simple interest will be charged.

Cost-Effective Reusable Forms

When you purchase forms from MegaDox.com, you buy only what you need, when you need it. No subscription required, no additional fees attached. Use the forms as often as your business requires.

AI Disclaimer

These forms were not generated using AI tools. Each of the documents has been written and reviewed by legal professionals.

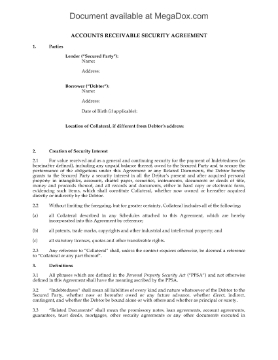

Accounts Receivable Security Agreement | Canada

Document your security interest in a borrower's property with this Accounts Receivable Security Agreement template for Canadian lenders.

- The Agreement is part of the documentation that the borrower must provide to the lender, to secure a loan or line of credit.

- The Agreement grants the lender a security interest in all of the borrower's present and future personal property including inventory, equipment, accounts receivable and book debts.

- The form is governed by Canadian laws and can be used in any province or territory which has Personal Property Security Act legislation.

- Buy and download the template in MS Word format. Other formats available on request.

Assignment of Rents Agreement | Canada

Secure the repayment of a mortgage loan by having the borrower execute this Assignment of Rents Agreement for Canadian lenders.

- The borrower assigns to the lender all rent revenues from tenants in the property being mortgaged.

- The assignment is given as security for repayment of the mortgage and performance of the borrower's obligations to the lender.

- The rentals continue to be paid to the borrower / assignor until such time as the lender / assignee gives a demand in writing to the tenants to pay the rents to the assignee.

- The agreement stays in effective until all of the monies due under the mortgage have been paid in full.

- An Assignment of Rents Agreement is a good means of obtaining additional security for performance under a loan agreement. You can download it immediately following purchase.

- This form is governed by the laws of Canada.

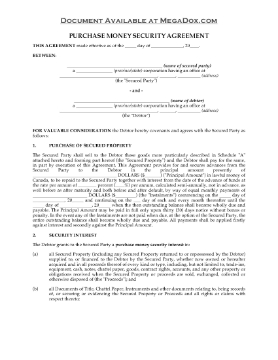

British Columbia Purchase Money Security Agreement

When you sell inventory on credit to a distributor, make sure you protect your security interest in those goods until you're paid in full under this Purchase Money Security Agreement for BC.

- The contract attaches a purchase money security interest (PMSI) to the goods being sold, which then become collateral under the Agreement.

- The supplier (secured party) extends credit to the customer (debtor) for the purchase of the inventory, and the debtor agrees to pay the purchase amount in a series of instalment payments.

- In return for being allowed to pay over time, the debtor grants the secured party a PMSI over the goods and over the proceeds that will be realized from the goods.

- This is a downloadable legal form intended for use in the Province of British Columbia, Canada.

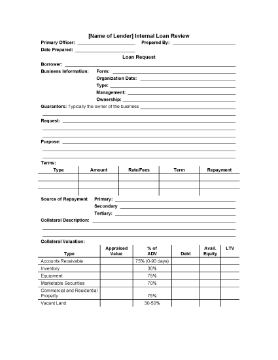

Business Loan Application | Canada

Use this customizable Business Loan Application for clients that are applying for loan funding for an existing or start-up business in Canada.The applicant must provide information about:

- the corporate structure and history of the business;

- the guarantors of the loan;

- the purpose of the loan and terms of repayment;

- what is being used as collateral;

- the financial status of borrower, assets, income, debts and liabilities, including copies of financial statements;

- the business experience of the owners.

You can download a copy of the Canada Business Loan Application immediately after you purchase it.

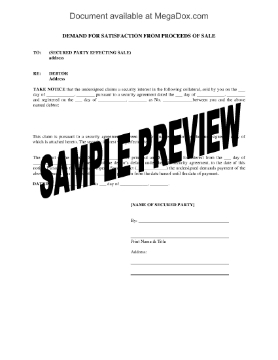

Demand for Satisfaction from Proceeds of Sale | Canada

Recoup money owed to you by a debtor from a sale of assets by serving this Canada Demand for Satisfaction from Proceeds of Sale on the party selling the collateral.

- The demand is given by a secured party to another secured party who is undertaking a sale of a debtor's assets.

- The party making the demand has no security interest in the items being sold, but is owed money under a loan agreement, mortgage, etc. by the debtor whose assets are being sold.

- This legal form can be used in any Canadian province or territory.

- This form is available as a downloadable MS Word document.

General Assignment of Book Debts | Canada

Have a borrower sign over their book debts to secure the loan funding with this General Assignment of Book Debts template for Canada.

- The borrower assigns its book debts and accounts to the lender as general continuing collateral security for a commercial loan or credit facilities provided by the lender.

- The assignment gives the lender the right to collect, demand payment, sue, enforce, receive and recover the borrower's book debts.

- Available in MS Word format.

- Intended to be used only in Canada.

General Assignment of Rents and Leases | Canada

Before loaning money to a borrower, obtain an assignment of rental and lease income from their rental properties with this downloadable template for Canadian lenders.

- The borrower assigns to the lender the amount of all rents and leases payable by the tenants in any rental property owned by the borrower.

- The assignment is given as security for a mortgage loan or other monies being advanced to the borrower by the lender.

- The tenants will continue to pay the rent to the borrower unless and until the lender gives a written demand for it. This would only happen if the borrower defaults.

- The lender does not have any liability or obligation under the lease.

- The Assignment of Rents and Leases can be used in any Canadian province or territory except Quebec.

- Every commercial loan in Canada should include a General Assignment of Rents and Leases as part of its paperwork. Download the form today.

General Security Agreement | Canada

Secure a loan or line of credit with this General Security Agreement for Canadian lenders.

- The borrower grants the lender a security interest in all of the borrower's personal property (inventory, equipment, accounts and book debts), and all income and proceeds from that personal property.

- The General Security Agreement secures payment and performance of all of the borrower's present and future indebtedness to the lender, including the lender's costs of enforcing the Agreement.

- The borrower agrees to protect and preserve the collateral property, to keep it in good condition and repair, to pay all taxes and charges levied against it, and to keep it fully insured.

- So long as the borrower is not in breach of its obligations, the borrower retains possession of the collateral and can use it in the ordinary course of its business.

- This legal document template is intended for use only in Canada.

Inventory Security Agreement | Canada

Extend credit to your customers and secure payment of your accounts with this customizable Inventory Security Agreement for Canadian suppliers.

- The Agreement covers the customer's purchase of inventory, parts and accessories from the supplier.

- The supplier is given a security interest over all of the customer's present and future inventory, accounts, assets and property.

- Title to all inventory supplied remains with the supplier until the customer has paid in full.

- The customer may only sell the goods in the ordinary course of its business.

- This legal contract template is downloadable and editable to fit your business needs.

- Governed by Canadian laws and intended for use only in Canada.

Loan and Charging Agreement | Canada

Canadian lenders can use this downloadable Loan and Charging Agreement to prepare loan documents for a borrower.

- The template includes both the Loan Agreement and a promissory note for the principal amount of the loan plus interest.

- The borrower agrees to register an encumbrance against title to real estate owned by the borrower, as collateral security for the loan.

- If the borrower defaults in repaying the loan, title to the property will be transferred to the lender.

- Available in MS Word format.

- Intended to be used only in Canada.