UNITED STATES

Start up a partnership or joint venture with these customizable template agreements and forms.

Under U.S. tax laws, partnerships do not pay their own income tax (unlike a corporation). Instead, the partners each pay tax on their distributive share of the partnership's taxable income. Joint ventures are treated like partnerships for income tax purposes.

Domestic partnerships and joint ventures are governed by the laws of the State in which they originated. Foreign joint ventures which include US partners are subject to international trade laws and the laws of the country in which they will be operating.

Business Alliance Agreement | USA

Collaborate with another business to develop new markets to your mutual benefit under this Business Alliance Agreement for U.S. companies.

- The parties agree to cooperate in identifying prospective customers, representing products and providing technical support to customers.

- Each party will be treated as the general contractor for projects in which it proposes the goods and services of the other party.

- Each party shall be liable only to the extent of its respective interest.

- Each party shall treat all information received from the other party as confidential.

- The template can be used anywhere in the United States.

- Available in MS Word format.

- Expand your markets, grow your business and capitalize on opportunities through strategic relationships.

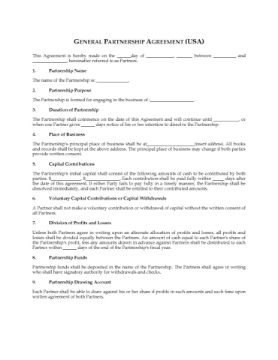

General Partnership Agreement | USA

Establish a general partnership with this comprehensive document template for USA partnerships.

This document serves as a comprehensive template for establishing a general partnership in the United States. It is designed to address key aspects of partnership formation, management, and dissolution, ensuring that all partners are aware of their rights and responsibilities under U.S. law.

Capital Contributions and Withdrawals

Any voluntary contributions or withdrawals of capital by a partner require the unanimous consent of all partners. This provision ensures that financial decisions impacting the partnership are agreed upon collectively, maintaining transparency and trust among the partners.

Division of Profits and Losses

All profits and losses generated by the partnership will be divided equally among the partners. This approach promotes fairness and equality, recognizing the shared efforts and contributions of each partner within the business.

Admission of New Partners

A new partner may only be admitted into the partnership if they match the initial capital contributions made by the existing partners. This requirement ensures that all partners have an equal financial stake in the business from the outset.

Dissolution of Partnership

The partnership will be dissolved under any of the following circumstances:

- upon the death, disability, or voluntary withdrawal of a partner; or

- if a partner fails to make a required capital contribution.

These conditions are set to protect the interests of the remaining partners and to provide clear guidelines for ending the partnership.

Non-Competition Agreement for Withdrawing Partners

Any partner who chooses to withdraw from the partnership must agree not to compete with the partnership. This non-competition clause is intended to safeguard the business and prevent conflicts of interest after a partner's departure.

Format and Jurisdiction

The template is available in Microsoft Word format for ease of editing and customization. It is governed by U.S. laws and is intended solely for use within the United States.

Joint Venture Agreement | USA

Set up a joint venture between two or more companies in the United States with this Joint Venture Agreement template.

- The Agreement does not set up a partnership between the parties.

- The template contains provisions for management by a managing co-venturer, or joint management by all the parties.

- The co-venturers may have interests in other businesses outside of the joint venture. The template includes an optional non-competition provision.

- The co-venturers indemnify each other against liability.

- This template is a downloadable and customizable MS Word template.

- Intended for use only in the United States.

Joint Venture Agreement to Purchase Mortgages | USA

Prepare a Joint Venture Agreement for a U.S. venture being set up to purchase mortgages using this digital template.

Overview of the Agreement

The parties (venturers or co-venturers) will jointly purchase a promissory note secured by a mortgage or deed of trust.

Each party will contribute a specified amount of capital and agrees to make additional contributions as required. Each party is entitled to receive revenues in proportion to their respective interests.

Other Key Points

- Decisions affecting the operation of the joint venture require the approval of all venturers.

- The joint venture will not maintain a bank account in its own name, but will use a mortgage servicing company to collect payments and make distributions.

- The venturers will jointly appoint an attorney-in-fact to purchase the purchase of a suitable mortgage.

Format and Jurisdiction

This Joint Venture Agreement template is available in MS Word format and is fully customizable and reusable, making it both flexible and cost-effective.

This legal document template is intended to be used only in the United States.

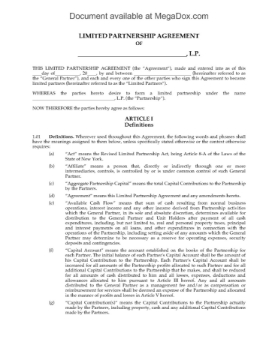

Limited Partnership Agreement | USA

Set up a USA limited partnership between a general partner and several limited partners with this Limited Partnership Agreement template.

What are the advantages of a limited partnership structure?

A limited partnership gives the operating partner (the general partner) the opportunity to bring investors onboard as limited partners, without giving up control of the business.

The general partner manages the business and makes most decisions without needing the consent of the limited partners. In return for this autonomy, the limited partners' liability extends only to the amount they have invested in the business.

Financial Obligations of Parties

Under the terms of this Partnership Agreement, the general partner will not be required to contribute any cash to the capital of the Partnership. The limited partners must each purchase a minimum number of partnership units.

The limited partners will not be liable for the debts or liabilities of the Partnership and are not required to make additional capital contributions after their initial purchase of units.

The liability exposure of the limited partners is limited to the amount of the subscription paid by each of them for their partnership units.

Withdrawal and Assignment of Interest

The Agreement template includes provisions for withdrawal of the general partner and assignment of a partner's interest. The Partnership would have a right of first refusal to purchase the withdrawing partner's units.

Format and Jurisdiction

This Limited Partnership Agreement template is provided in MS Word format and is fully customizable to meet your specific requirements.

The legal contract is governed by U.S. laws and is intended to be used only within the United States.

New York Limited Partnership Agreement

Set up a limited partnership between a general partner and several limited partners with this Limited Partnership Agreement template for the State of New York.

- Limited partners must purchase a minimum number of partnership units in accordance with a private placement offering. Limited partners will not be obligated to make additional capital contributions.

- Capital contributions not used for operations within a specified number of years will be returned, with deductions for offering expenses.

- Capital contributions cannot be withdrawn or reduced except as a result of the dissolution of the partnership.

- Partnership units may be transferred or assigned with the consent of the general partner.

- Additional general partners may be admitted, provided they have substantial means to protect the federal tax status of the partnership. Any additional general partners will not be entitled to share in the distributions allocable to the limited partners.

- Available in MS Word format.

- Intended for use only in the State of New York.

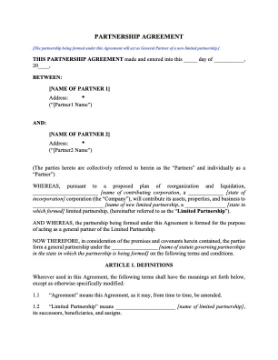

Partnership Agreement (general partner entity) | USA

Set up a partnership which will in turn act as general partner of a limited partnership with this customizable template for the USA.

- The partnership being formed by the agreement will be managed by a managing partner.

- The managing partner will have control of the day-to-day business operations, and will be responsible for all tax matters. All matters outside of the day-to-day business will be decided by a majority vote of all partners.

- The partners will devote a necessary amount of time and attention to the partnership business, but are not restricted from involvement in other businesses, whether they compete with the partnership business or not.

- Admission to the partnership is limited to the managing partner, its CEO and the other officers and directors of the managing partner.

- This template is available as a MS Word download, and is fully editable to meet your needs.

- Intended to be used only in the United States.

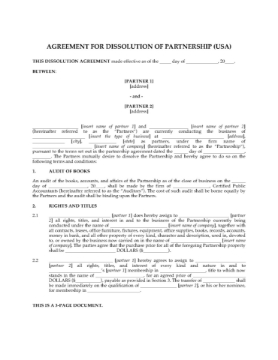

Partnership Dissolution Agreement | USA

Wind up a general partnership in the United States with this USA Partnership Dissolution Agreement.

- The partnership's books will be audited and a dissolution bank account set up, into which the capital account will be transferred, along with any additional sums necessary to pay the partnership debts and liabilities.

- One partner transfers all title and interest in the partnership's assets to the other partner, who will pay an agreed purchase price for the departing partner's interest and take over the business.

- Available in MS Word format and fully customizable.

- Intended to be used only in the United States.

Real Estate General Partnership Agreement | USA

Set up a general partnership for buying, developing and leasing real estate properties with this USA Real Estate General Partnership Agreement template.

- Cash flow of the partnership will be distributed among the partners in the same proportion as profits and losses are allocated.

- If the income produced by the partnership properties is not sufficient to pay operating costs, the partners will contribute additional funds in proportion to their capital interests.

- If a partner fails to make his/her contribution, the other partners may contribute additional funds, which may be treated either as additional capital or as a loan to the defaulting partner.

- A partner may transfer all or part of his interest to or for the benefit of a spouse or descendant(s).

- If a partner wants to transfer all or part of his interest to someone other than a family member, the other partners have a first right of refusal to purchase the interest.

- The partnership can be terminated by a majority vote (based on interests). Upon termination the partnership assets will be sold and any net proceeds will be distributed to the partners in proportion to their capital interests.

- The USA Real Estate General Partnership Agreement template is available as a downloadable Microsoft Word file, which is fully customizable to meet your needs.

Real Estate Limited Partnership Agreement | USA

Create a limited partnership for purchasing investment real estate properties in the USA under this Real Estate Limited Partnership Agreement.

- In addition to cash contributions to capital, the general partners will contribute to the partnership certain real estate property under a contract for purchase and sale.

- The partnership assumes all of the purchaser's obligations under this contract, except for the payment of costs associated with the purchase transaction, which will be paid by the general partners.

- Partnership profits and losses will be distributed among or borne by the partners in proportion to their capital contributions.

- Proceeds from the sale of any property or asset held by the partnership will be allocated among the partners in amounts equal to their cash contributions, and a portion of the balance allocated proportionately among the partners in proportion to their capital contributions.

- None of the partners will receive a salary or be entitled to draws for services rendered on behalf of the partnership.

- No Limited Partner shall have the right to substitute an assignee as contributor in his place.

- This template is provided in MS Word format, and is easy to download, edit with your specific details, and print.

- This legal form is governed by the laws of the United States.

- 1

- 2