USA Real Estate Forms

Buy, sell and transfer title to residential and commercial real estate properties in the United States with these easy-to-use USA Real Estate Forms. Choose forms for your particular State.

Alabama Special Warranty Deed

Transfer ownership of an Alabama real estate property with this easy-to-use Alabama Special Warranty Deed form.

Under a Special Warranty Deed, the seller (grantor) warrants or guarantees the title only against defects arising during his/her ownership of the property but not against title defects existing before that time.This Alabama Special Warranty Deed form is a downloadable legal document in MS Word format.

Alabama Warranty Deed for Joint Ownership

Transfer title of an Alabama real estate property from two sellers to two buyers with this Alabama Warranty Deed for Joint Ownership.

- This is the type of Warranty Deed that is used to convey a property from one couple (spouses or partners) to another couple, who will live in the property.

- The buyers will own the property as joint tenants with rights of survivorship. That means when one joint tenant dies, the title will pass to the survivor.

- The sellers (grantors) covenant to the buyers (grantees) that they have good and marketable title to the property, they have the legal right and power to transfer the title, and they will defend the grantees' right to possess the property.

Alaska General Warranty Deed Form

Transfer a real estate property in Alaska from a seller to a buyer with this easy-to-use Alaska Warranty Deed form.

The seller (the grantor) gives the buyer (the grantee) the following covenants:

- that the grantor has good and marketable title to the property,

- that the grantor has the legal right and authority to transfer the title to the buyer, and

- that the grantor will forever defend the right of the grantee to possess the property.

This Alaska Warranty Deed form is a downloadable legal document in MS Word format.

Alaska Quitclaim Deed

Transfer title to a real estate property from one person to another with this downloadable Quitclaim Deed for Alaska.

- Under the Quitclaim Deed, the transferor conveys all of its interest in the property to the transferee but does not provide any warranties regarding the property.

- This form of Deed is often used to remove one spouse's name from title following divorce proceedings.

- The form is provided in MS Word format and is easy to download, fill in and print.

- Intended for use only in the State of Alaska.

Alaska Quitclaim Deed from Two Persons to One Person

Transfer title to a real estate property in Alaska from two persons to one person with this easy-to-use Quitclaim Deed form.

What Is a Quitclaim Deed?

A Quitclaim Deed is a legal instrument through which the property owner (transferor) conveys their ownership of a property to a different owner (transferee). The transferor does not offer any warranties regarding the property’s title, condition, or any other aspect. A Quitclaim Deed simply transfers whatever interest the transferor holds at the time of execution.

Common Uses

This type of deed is frequently used in situations where a straightforward transfer of ownership is needed, such as removing one spouse’s name from the title following divorce proceedings. It is particularly useful when the parties do not require extensive guarantees.

Form Features

The Alaska Quitclaim Deed form is available in Microsoft Word format. It can be easily downloaded, filled in with the required information, and printed for use, making the process simple and convenient for users.

Jurisdiction

This Quitclaim Deed is governed by the laws of Alaska and should only be used for properties located in that State.

Alaska Seller Property Disclosure Statement

Alaska law requires the seller of a real estate property to make full disclosure of the property's condition by providing a potential buyer with a completed Residential Real Property Transfer Disclosure Statement.

- The Disclosure Statement must be completed by the seller in order to comply with Alaska Statute (AS) 34.70.010 - 34.70.200.

- The seller must disclose all known defects, health and safety risks, and other conditions in the property.

- After receiving the report, the buyer has 3 - 6 days (depending on the method of delivery of the report) to terminate the offer based on the information contained in the Disclosure Statement.

- Residential Real Property includes single family dwellings, two single-family dwelling units under the same roof, or any individual unit in a multi-unit structure or common interest ownership housing community.

- Failure to disclose as required by the law could result in the seller being liable for damages, costs and attorney fees.

- This disclosure form is available as a free PDF download. Click the link provided to download your copy.

Alaska Special Warranty Deed

Transfer title for an Alaska real estate property to a new owner with this easy-to-use Alaska Special Warranty Deed form.

- Under a Special Warranty Deed, the seller (grantor) warrants or guarantees the title only against defects arising during his/her ownership of the property but not against title defects existing before that time.

- Title is transferred subject to current taxes and assessments, easements, encumbrances, liens and liabilities.

- Special warranty deeds are often used by executors and trustees to transfer estate property to a beneficiary.

- This form is a downloadable legal document in MS Word format.

- Intended for use only in the State of Alaska.

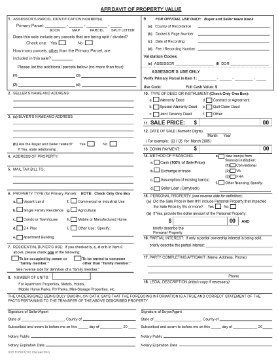

Arizona Affidavit of Property Value

Download a free Affidavit of Property Value form for the purchase and sale of real estate property in Arizona.

- This form is used to record the selling price, date of sale and other required information about the sale of property.

- The form includes definitions, information and a list of exemptions under the Arizona Revised Statutes.

- Available as a fillable PDF form.

- Form 82162, published by the Arizona Department of Revenue.

Arizona Beneficiary Deed Forms

Pass your real estate property on to a beneficiary when you die, without putting it through probate, with these Beneficiary Deed forms for Arizona.

- The Beneficiary Deed (also called a Transfer on Death Deed or a TOD) is signed and filed with the Recorder's Office before the original owner passes away.

- Although the deed is re-titled in the beneficiary's name at this time, the original owner still has rights to the property and can do whatever he or she pleases with the property until the time of his or her death, without the permission of the beneficiary.

- The package also includes a Revocation of Beneficiary Deed, in the event you want to cancel the Beneficiary Deed after it has been filed.

- These legal forms are easy to use. All forms are contained in a single downloadable file.

- Intended for use only in the State of Arizona.

Arizona Contract for Deed

If you are selling a real estate property in Arizona, you can assist the buyer by carrying part or all of the purchase price with this Contract for Deed (or purchase money mortgage).

- Under the terms of this Contract, the seller effectively becomes the mortgage lender for the balance of the purchase money.

- Title will transfer to the buyer once payment in full of all principal and interest has been received by the seller.

- The seller has the right to take back the property if the buyer defaults in payment.

- At the seller's option, the balance can be repaid by monthly payments with or without interest until paid, or monthly payments with interest for a fixed number of payments with a balloon payment at the end to pay out the balance.

- Available in MS Word format, fully editable to fit your exact circumstances.

- Intended to be used only in the State of Arizona.