Succession Planning

Protect the future of your small business after your retirement, disability or death by putting a Business Succession Plan in place.

- Have you given any thought to what will happen to your small business when you are no longer able - or willing - to run it?

- Do you plan to hand it your business over to your kids? Or sell it to a partner or an employee?

- If you have partners, how will a partner's share be disposed of if he/she was to die suddenly?

Succession planning is essential for ensuring continuity for the business, creating a buffer zone to help deal with unexpected events, and providing financial security for the owners.

Business Succession Planning in Canada

Plan for the future of your small business - learn what you need to know about Business Succession Planning in Canada with this 8-page expert guide.

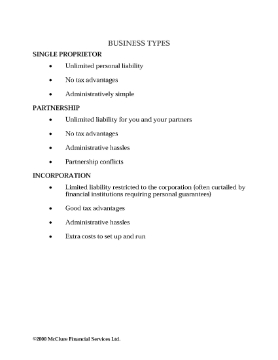

The guide describes the different types of business structures under Canadian laws, the pros and cons of each type of corporate entity. In addition, it discusses:

- how to extract value from your business,

- corporate investing,

- exit strategies,

- family businesses,

- tax planning and estate freezes.

Business Succession Planning in Canada is intended for Canadian businesses and is provided in PDF format.

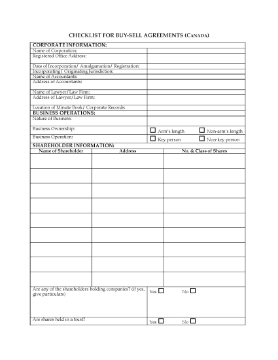

Checklist for Shareholder Buy-Sell Agreement | Canada

Learn how to prepare a Shareholder Buy-Sell Agreement with this checklist for Canadian companies.

- What would happen to your business if one of the owners dies or is no longer able to work? A Shareholder Buy-Sell Agreement provides for continuity of the business in those events.

- Topics included in the Checklist are:

- qualification of shares for capital gains exemption;

- provisions of any existing formal shareholder agreement;

- terms of purchase or redemption (or both) of a deceased shareholder's shares using proceeds of life insurance policies on the life of the deceased;

- whether life insurance policies will be held by the corporation, by the other shareholders or by a trustee.

- This is a fully editable legal form in MS Word format which can be customized to fit your circumstances.

- Governed by Canadian tax laws and ntended to be used only in Canada.

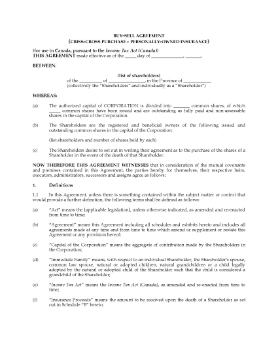

Criss-cross Shareholder Buy-Sell Agreement | Canada

Have you started succession planning for your business? Ensure continuity of ownership and management with this Criss-Cross Shareholder Buy-Sell Agreement for Canada.

- The Buy-Sell Agreement provides for the purchase of one shareholder's interest by the other shareholder upon the death of the first shareholder.

- The purchase is made by a method called the 'criss cross' method. That means that each shareholder holds a life insurance policy on the other shareholder, and the deceased shareholder's shares are purchased using the proceeds of the life insurance.

- This is a fully editable legal form in MS Word format which can be customized to fit your circumstances.

- Governed by Canadian tax laws and ntended to be used only in Canada.

Criss-Cross Shareholder Buy-Sell Agreement with Trustee | Canada

Ensure the continuity of ownership and management of your company, even if one of the owners dies, with this Shareholder Buy-Sell Agreement for Canadian businesses.

- The shareholders have appointed a trustee for the purpose of holding life insurance policies on each shareholder in trust to the benefit of the other shareholders.

- If a shareholder dies, the trustee, on behalf of the surviving shareholders, will purchase the deceased's shares in the company using the proceeds of the life insurance.

- This is a fully editable legal form in MS Word format which can be customized to fit your circumstances.

- Governed by Canadian tax laws and ntended to be used only in Canada.

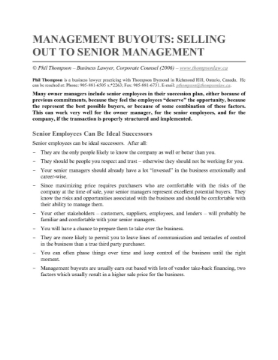

Management Buyouts - Selling Out to Senior Management

This guide for small business owner managers explains how you can include senior employees in your business succession plan.

Why You Should Include Employees in Succession Planning

There are a number of good reasons to include your long-time employees in your business continuity planning:

- It is a way to give deserving employees an opportunity to acquire the business.

- This is a viable alternative if your family members have no interest in taking over the business.

- Senior employees often represent the best possible buyers for the business, as they are already actively involved in its operation.

Contents of the Guide

This guide sets out the pros and cons of this exit strategy, the issues you need to consider, and how to structure the deal in the best interests of all parties.

Author Credit

This expert guide was written by Phil Thompson, business lawyer and corporate counsel in Ontario, Canada.

Ownership Succession Plan for Family Business

Make sure that your small business continues on after you retire with this sample Ownership Succession Plan for Family Business.

- This sample Succession Plan is designed to assist the owners of a family operation or other small business in planning for the future of the business following the retirement, disability or death of the principal owner(s), through:

- training other members of the family or company team in management roles,

- granting stock options as incentives,

- setting up a board of advisers with expertise in financial, legal and other areas,

- developing business plans and initiatives to grow the business and protect the owners' interests.

- If you run a family business and you haven't put together a succession plan yet, don't put it off any longer. Download and complete this template.

Shareholder Buy-Sell Agreement - Hybrid Method | Canada

The Canada Shareholder Buy-Sell Agreement (Hybrid Method) is an option that Canadians can consider to put a succession plan in place for the continuity of their small business.

- This type of buy-sell agreement is known as a 'hybrid' buy-sell.

- Under this Agreement, the corporation holds life insurance policies on each of the shareholders.

- Upon a shareholder's death, the corporation will collect the insurance proceeds, and use the proceeds to fund the purchase of the deceased shareholder's shares by any of the surviving shareholders who are interested, on a pro rata basis (proportional to their existing shareholdings).

- Any unpurchased shares will be redeemed by the corporation.

- The corporation will make an election for a deemed dividend to be paid from the capital dividend account if possible.

- The Agreement is governed by Canadian income tax laws.

- This legal contract form is available in MS word format and is fully editable.

Shareholder Buy-Sell Agreement (Corporate Redemption Method) | Canada

Would your business survive the death or retirement of one of the owners? Provide for the continued existence of the business with this Canada Shareholder Buy-Sell Agreement (Corporate Redemption Method).

- The corporation obtains life insurance policies on each of the shareholders and uses the proceeds to fund the redemption, acquisition or cancellation of the corporation's shares.

- Upon the death of a shareholder, the corporation redeems the deceased shareholder's shares and makes an election that the deemed dividend is to be paid from the capital dividend account to the extent possible.

- The Agreement contains several different options for methods of valuating the shares.

- The Agreement is made pursuant to the Income Tax Act (Canada).

- This Shareholder Buy-Sell Agreement (Corporate Redemption Method) is available as a downloadable and fully editable MS Word template.

Shareholder Buy-Sell Agreement (Promissory Note Method) | Canada

Plan ahead for the continuation of your business upon the death or retirement of an owner with this Shareholder Buy-Sell Agreement (Promissory Note Method) for Canadian companies.

- The corporation will hold life insurance policies on each of the shareholders and use the proceeds to redeem and acquire its own shares from a deceased shareholder's estate.

- If a shareholder dies, the surviving shareholders can purchase the deceased's shares on a pro rata basis (proportionate to their current shareholdings) by issuing the corporation a promissory note for the purchase price.

- The corporation will loan the purchaser the amount of the purchase price from the insurance proceeds, and then makes an election for a deemed dividend to be paid from the capital dividend account if possible.

- This is a fully editable legal form in MS Word format which can be customized to fit your circumstances.

- Governed by Canadian tax laws and ntended to be used only in Canada.

Sole Proprietorship Buy-Sell Agreement

Succession planning is vital to the survival of small businesses. This Sole Proprietorship Buy-Sell Agreement can help ensure the continuity of yours.

What is succession planning?

Succession planning is a strategy to determine what will happen to your business when you retire, die, or become incapacitated. A succession plan sets out who will take over operating and managing the business, and how and when that transfer will take place.

Scope of the Buy-Sell Agreement

This is a simple form of buy-sell agreement between the owner of a sole proprietorship and an employee who wants to purchase the business when the owner dies. Both parties want the business to continue to exist.

Key Points of the Agreement

- On the death of the proprietor, the executor or administrator of the estate will formalize the sale of the business to the employee.

- The employee will finance the purchase through proceeds of a life insurance policy on the life of the proprietor.

- The purchase transaction will include all real property, accounts receivable and other assets owned by the business.

- The parties will jointly determine the value of the business at the end of each fiscal year.

Format and Jurisdiction

This is a downloadable MS Word template from MegaDox.com. It is fully editable and can be customized to fit your specific requirements.

The form is generic legal contract and does not contain specific references to the laws of any country. It can be used in most common law jurisdictions.

- 1

- 2