Customers who bought this item also bought

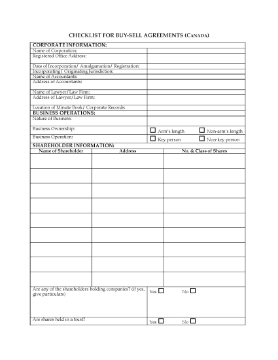

Checklist for Shareholder Buy-Sell Agreement | Canada

Learn how to prepare a Shareholder Buy-Sell Agreement with this checklist for Canadian companies.

- What would happen to your business if one of the owners dies or is no longer able to work? A Shareholder Buy-Sell Agreement provides for continuity of the business in those events.

- Topics included in the Checklist are:

- qualification of shares for capital gains exemption;

- provisions of any existing formal shareholder agreement;

- terms of purchase or redemption (or both) of a deceased shareholder's shares using proceeds of life insurance policies on the life of the deceased;

- whether life insurance policies will be held by the corporation, by the other shareholders or by a trustee.

- This is a fully editable legal form in MS Word format which can be customized to fit your circumstances.

- Governed by Canadian tax laws and ntended to be used only in Canada.

$12.49

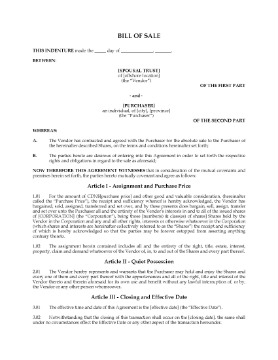

Bills of Sale for Spousal Trust Asset Transfer | Canada

Prepare four Bills of Sale for an asset transfer into a spousal trust, for use only in Canada.

This package contains bill of sale templates for the following:

- a transfer of assets from the spousal trust to an individual,

- a transfer of assets from the individual to a holding company,

- a transfer of assets from the holding company to an international investment corporation,

- a transfer of assets from the investment corporation to the trust.

The forms are available in MS Word format and are fully editable. Governed by Canadian laws and intended to be used only in Canada.

$29.99

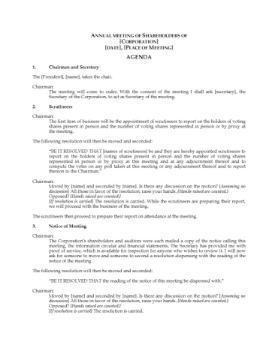

Agenda for Annual Shareholders Meeting | Canada

Set the agenda for an annual shareholders meeting of a Canadian corporation with this template form and procedural guide.

- The agenda form covers:

- the items of business that are required to be dealt with in the meeting (such as the annual election of the directors),

- a set of guidelines for conducting the meeting, and

- the procedure for taking a poll if any shareholder requests a poll to be taken.

- This is a reusable and fully editable form in MS Word format.

- Intended for use only for companies incorporated in Canada under a provincial or federal Business Corporations Act.

$11.99

Board of Directors Resolution to Approve Share Transfer | UK

Download a sample Directors Resolution for the Board of a UK company to approve a share transfer.

- The Resolution is to be used by a private company limited by shares, in accordance with the provisions of the Companies Act 2006.

- The template includes notes with respect to approval or disapproval of share transfers by the Board.

- The Board of Directors Resolution is a reusable form that you can customise with your company information. See how easy it can be to keep your corporate records up to date.

- Prepared in accordance with English law and intended for use only in the United Kingdom.

$2.50

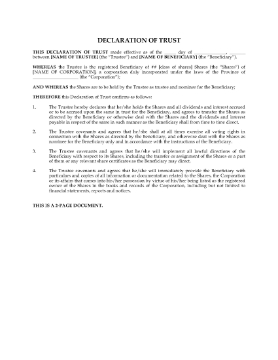

Trust Declaration by Nominee Trustee | Canada

Prepare a Trust Declaration by a nominee trustee who is the registered owner of shares with this template form for Canadian corporations.

- The nominee trustee declares that the shares are held in trust for a beneficiary.

- The trustee will exercise the voting rights of the shares as the beneficiary directs.

- The trustee will deal with the shares as nominee only and in accordance with the beneficiary's instructions.

- Available in MS Word format and fully editable.

- Intended to be used only in Canada.

$6.49 $4.99