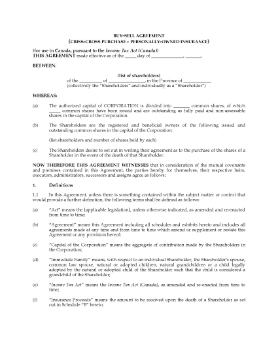

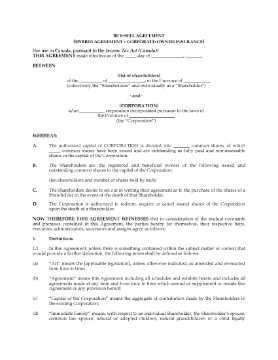

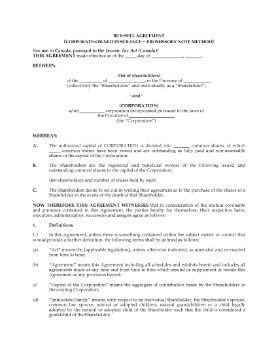

Shareholder Buy-Sell Agreement - Hybrid Method | Canada

The Canada Shareholder Buy-Sell Agreement (Hybrid Method) is an option that Canadians can consider to put a succession plan in place for the continuity of their small business.

- This type of buy-sell agreement is known as a 'hybrid' buy-sell.

- Under this Agreement, the corporation holds life insurance policies on each of the shareholders.

- Upon a shareholder's death, the corporation will collect the insurance proceeds, and use the proceeds to fund the purchase of the deceased shareholder's shares by any of the surviving shareholders who are interested, on a pro rata basis (proportional to their existing shareholdings).

- Any unpurchased shares will be redeemed by the corporation.

- The corporation will make an election for a deemed dividend to be paid from the capital dividend account if possible.

- The Agreement is governed by Canadian income tax laws.

- This legal contract form is available in MS word format and is fully editable.

Retirement Planning Strategies for Canadians

Worried about saving enough for your retirement? Learn how to identify and take advantage of the best ways to save for your retirement with this guide for Canadians.

Topics include:

- dynamics of financial planning,

- determining personal goals,

- sources of retirement income,

- tax consequences,

- preparation and implementation of a specific plan of action,

- alternative strategies in the event of a shortfall.

Retirement Planning Strategies for Canadians is provided by Chimo Financial Services. This guide is intended for Canadian citizens, whether they live in or outside of Canada.

Vital Knowledge for Canadian Retirement Planning

Do you know the 10 most common errors of retirement planning among Canadians? This e-book by Lyle Manery, BA, CLU, CHFC, will help you avoid the pitfalls.

- Gain knowledge of the many issues which affect your financial future so you can make wise decisions.

- Estate creation, conservation and distribution are all integral parts of the retirement planning process. These are all covered in this book.

- Learn about the concepts and programs available in Canada that should be considered when making these important decisions.

- This guide reflects Canadian tax laws and is intended for Canadian residents.

- This is a 65-page e-book available in PDF format.

Succession Planning and the Family Business

Every family business should have a succession plan in place.

This article will help you identify the issues to consider when planning your succession plan / exit strategy so that you can retire and pass on your business to the next generation.

Why does a family business need a succession plan?

This article by the Harvard Business Review discusses the reasons why family business owners need to design a transition plan to avoid tension, discord and disruption to business operations.

Topics Discussed

The topics covered in "Succession Planning and the Family Business" include:

- Examining the reasons for leaving the business to a specific family member.

- The most common mistakes in crafting a family-based succession plan.

- Determining what is best for succeeding generations.

- Tips for creating a successful succession plan.

Author Credit

This expert guide was written by Phil Thompson, business lawyer and corporate counsel in Ontario, Canada.

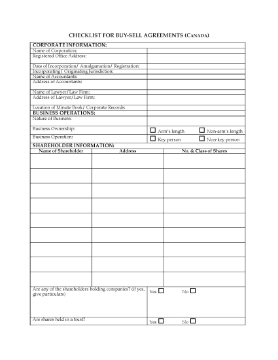

Directors Resolution to Issue New Shares | Canada

Prepare a Directors Resolution to authorize the issuance of new shares in a Canadian business corporation with this easy-to-use template.

Every time shares are issued in a corporation, the directors must approve the issuance. You can re-use this Directors Resolution template every time, by inserting the details in the spaces provided.

Purpose of Directors Resolution

The directors accept the subscriptions for new shares and authorize the corporation to issue share certificates to the subscribers upon payment of the share price.

Format and Jurisdiction

This is a downloadable MS Word template. The form can be used by any privately owned corporation incorporated under a Business Corporations Act within Canada.