Wisconsin

Get the forms you need to transfer ownership of real estate properties in the State of Wisconsin - purchase, download, fill in the blanks on PC, laptop or tablet, and print for signature.

In Wisconsin, if you sold a home that you owned and lived in for at least 2 years during the 5-year period prior to the date of the sale, you may be eligible to exclude your capital gain on the sale if it does not exceed $250,000 (or $500,000 for a jointly owned home, if you're filing a joint tax return). If you lost money on the sale of your personal residence, that is a nondeductible personal loss.

Sort by

Display per page

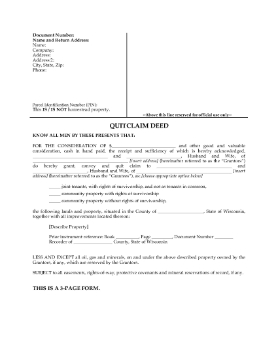

Wisconsin Quitclaim Deed for Joint Ownership

Transfer the interest in a real estate property in Wisconsin from a husband and wife to another husband and wife with this Quitclaim Deed for Joint Ownership.

The transferors convey their interest in the property to the transferees, but do not provide any warranties regarding the property. The transferees can take title either as:

This Wisconsin Quitclaim Deed for Joint Ownership form is provided in MS Word format and is easy to download, fill in and print.

The transferors convey their interest in the property to the transferees, but do not provide any warranties regarding the property. The transferees can take title either as:

- joint tenants, with rights of survivorship, which means that if one of them dies, title to the property passes to the surviving joint tenant, or

- community property with rights of survivorship, or

- community property without rights of survivorship.

This Wisconsin Quitclaim Deed for Joint Ownership form is provided in MS Word format and is easy to download, fill in and print.

$6.29

Wisconsin Quitclaim Deed from Husband and Wife to Individual

Transfer title to a real estate property in Wisconsin from two spouses to one person with this easy-to-use Quitclaim Deed from Husband and Wife to Individual.

Under the Quitclaim Deed, the transferors (grantors) convey all of their interest in the property to the transferee (grantee) but do not provide any warranties regarding the property. This form of Deed is often used following a divorce, to remove one spouse's name from title to the property.

This Wisconsin Quitclaim Deed from Husband and Wife to Individual form is available in MS Word format and is easy to use and fully customizable.

Under the Quitclaim Deed, the transferors (grantors) convey all of their interest in the property to the transferee (grantee) but do not provide any warranties regarding the property. This form of Deed is often used following a divorce, to remove one spouse's name from title to the property.

This Wisconsin Quitclaim Deed from Husband and Wife to Individual form is available in MS Word format and is easy to use and fully customizable.

$6.29

Wisconsin Special Warranty Deed

Transfer ownership of a Wisconsin real estate property with this easy-to-use Wisconsin Special Warranty Deed form.

Under a Special Warranty Deed, the seller (grantor) warrants or guarantees the title only against defects arising during his/her ownership of the property but not against title defects existing before that time.This Wisconsin Special Warranty Deed form is a downloadable legal document in MS Word format.

$6.29

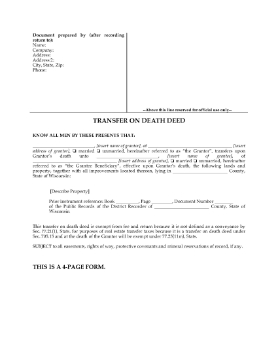

Wisconsin Transfer on Death Deed Forms

Pass your real estate property on to a beneficiary, without the need for probate when you die, with these Wisconsin Transfer on Death Deed Forms.

- The Transfer on Death Deed (also called a Beneficiary Deed or a TOD) is signed and filed with the Recorder's Office before the original owner passes away.

- Although the deed is re-titled in the beneficiary's name at this time, the original owner still has rights to the property and can do whatever he or she pleases with the property until the time of his or her death, without the permission of the beneficiary.

- The transfer is exempt from real estate transfer taxes under Wisconsin statute.

- This package also includes a Revocation of Transfer on Death Deed, so that you can cancel the TOD at any time after it has been filed, if you wish.

- These Wisconsin Transfer on Death Deed Forms are in MS Word format, and are easy to download and use.

$6.29

Wisconsin Warranty Deed for Joint Ownership

Transfer title of a real estate property in Wisconsin from two sellers to two buyers with this Wisconsin Warranty Deed for joint ownership with rights of survivorship.

This is the type of Warranty Deed that is used to convey a property from one couple (spouses or partners) to another couple, who will live in the property.The sellers (grantors) covenant to the buyers (grantees) that they have good and marketable title to the property, they have the legal right and power to transfer the title, and they will defend the grantees' right to possess the property.

The buyers can take title either as:

- joint tenants, with rights of survivorship, which means that if one of them dies, title to the property passes to the surviving joint tenant, or

- community property with rights of survivorship, or

- community property without rights of survivorship.

This Wisconsin Warranty Deed for Joint Ownership template is downloadable and easy to use.

$6.29

Wisconsin Warranty Deed Form

Transfer a Wisconsin real estate property from a seller to a buyer with this easy-to-use Wisconsin Warranty Deed form.

The seller (the grantor) gives the buyer (the grantee) the following covenants:- that the grantor has good and marketable title to the property,

- that the grantor has the legal right and authority to transfer the title to the buyer, and

- that the grantor will forever defend the right of the grantee to possess the property.

$6.29