CANADA

Set up a trust to protect your personal and business assets with a customizable Trust Agreement.

- Province-specific forms as well as documents that can be used anywhere within Canada.

- These legal documents were prepared pursuant to Canadian tax laws and should only be used within their intended jurisdiction.

- All documents can be easily edited to fit your unique needs.

Alberta Insurance Trust Deed

Establish an insurance trust to direct how and when your life insurance proceeds are distributed with this template Insurance Trust Deed for Alberta residents.

- Irrevocable Trust. The trust being formed under the indenture is an irrevocable trust.

- Trust Indenture to Govern. It is the intention of the settlor of the trust that the provisions of the trust indenture, and not the provisions of s. 34 or s. 35 of the Trustee Act (Alberta) govern the manner in which the trustee will administer and dispose of the trust property.

- Income of Trust. The trustee may designate that income of the trust will include life insurance benefits, cash surrender value of life insurance policies, life insurance premium refunds, proceeds from life insurance policy loans, capital gains, any other receipts considered income under the Income Tax Act, but will exclude non-taxable dividends.

- Trustee's Discretion. The trustee has full discretion as to the division and distribution of the trust property.

- Trust Property Not Family Property.The trust property will not form part of the family property for purposes of the Matrimonial Property Act (Alberta).

- Restrictions on Settlor.

- The settlor cannot be added as a beneficiary and cannot be appointed as a trustee.

- The settlor has no authority or power under the indenture and will not receive any benefits of any kind from the trust.

- The settlor cannot direct that any trust property be transferred to any person or persons.

- Income Tax Act Not to Apply to Conveyance. The settlor conveys the trust property to the trustee on the express understanding that ss. 75(2) and 107(4.1) of the Income Tax Act do not apply to the conveyance.

- Designated Persons. No beneficiary who is a "designated person" under s. 74.5(5) of the Income Tax Act may receive or use income or capital of the trust while being a designated person.

- Format. The Insurance Trust Deed template is available in MS Word format and is fully editable.

- Governing Law. The document is governed by the laws of the Province of Alberta, Canada and by Canadian tax laws.

Alberta Land Trust and Indemnification Agreement

Draw up a Trust Agreement for land in Alberta with this downloadable template.

- The Agreement is made in respect of land which will be registered in the name of the trustee as bare trustee, to be held in trust on behalf of another party who is the beneficial owner.

- The parties will each pay their separate debts, except for expenses already incurred, which will be paid by the owner.

- The parties will keep each other indemnified against claims arising with respect to the land.

- The trustee has the power to lease or mortgage the land, with the consent of the owner.

- Available in MS Word format.

- Intended for use only in the Province of Alberta, Canada.

Alter Ego Trust Deed | Canada

Prepare an Alter Ego Trust Deed with this easy-to-use template, pursuant to the provisions of the Income Tax Act (Canada).

- Who Can Use This Form. An alter ego trust can only be created by an individual aged 65 or older, who will have the exclusive right to receive all income from the trust.

- Trust Income. During the settlor's lifetime no person other than the settlor may receive or otherwise obtain the use of any part of the trust's income or capital.

- Distribution of Trust AssetsUpon the settlor's death, the trust will hold any remaining assets for the benefit of other beneficiaries named in the Trust Deed. The trust will be able to distribute those assets to the other beneficiaries without the assets having to go through the probate process.

- Legal Jurisdiction. This Alter Ego Trust Deed template is governed by Canadian tax laws and is intended to be used only within Canada.

- Format. The template is available in MS Word format and is fully editable.

Bills of Sale for Spousal Trust Asset Transfer | Canada

Prepare four Bills of Sale for an asset transfer into a spousal trust, for use only in Canada.

This package contains bill of sale templates for the following:

- a transfer of assets from the spousal trust to an individual,

- a transfer of assets from the individual to a holding company,

- a transfer of assets from the holding company to an international investment corporation,

- a transfer of assets from the investment corporation to the trust.

The forms are available in MS Word format and are fully editable. Governed by Canadian laws and intended to be used only in Canada.

Charitable Remainder Trust | Canada

Prepare a charitable remainder trust with this downloadable template for Canadian residents.

How a Charitable Remainder Trust works

A charitable remainder trust allows the donor to retain a life interest in property transferred into the trust but makes an irrevocable gift of the residual interest to a registered charity.

The charity then issues a donation receipt for the fair market value of the residual interest in the property at the time that the residual interest vests in the charity.

Key Provisions

- Tax Credit. The tax credit can be carried forward in whole or in part for up to five years.

- Capital Gains. All capital gains are allocated to the capital beneficiary, i.e. the charity, which is tax-exempt.

- Trust Income. The net income of the trust is paid to the income beneficiary (the settlor and their spouse, and/or whoever else the settlor may designate in the trust).

- Expenses. Trust expenses are paid from the trust income.

- Irrevocable Trust. This is an irrevocable trust.

Format and Legal Jurisdiction

The template is available in MS Word format and is fully customizable. This trust deed is governed by Canadian tax laws and is intended to be used only in Canada.

Family Trust Annual Resolutions | Canada

Prepare annual resolutions for a family trust in Canada with this easy-to-use forms package which contains:

- Trustee resolutions naming the records office, appointing the accountants, and confirming the acts of the trustees.

- Trustee resolutions resolving that all income allocations and expense payments required to be made have been or will be made for the year, and that the trust will not be liable for income tax under Part 1 of the Income Tax Act (Canada).

- This forms package is a downloadable MS Word file containing all of the resolutions. Fully editable and easy to use.

- Intended to be used only in Canada.

Family Trust Forms Package to Replace Trustee | Canada

Appoint a replacement trustee for a family trust with this package of forms for Canada.

- The package contains the following:

- Appointment and Replacement of Trustee form.

- Consent to Act as Trustee.

- Resignation of Departing Trustee.

- Trustee Resolutions to be signed by the new trustee and the remaining trustees.

- This forms package is a downloadable digital product. All forms are contained in one file.

- Intended to be used only in Canada.

Family Trust Forms to Set Up Trust | Canada

Establish a trust fund and appoint trustees for a family trust with this package of forms for Canada.

- The Family Trust package contains the following documents:

- Discretionary Trust Deed.

- Resolutions of the original trustee accepting the trust, acknowledging the settlement and providing for execution of documents and banking authority.

- Receipt for the settlement from the settlor.

- Consent to Act as Trustee form.

- Appointment of additional trustees.

- Trustee resolutions to be signed by the additional trustees.

- Available in MS Word format.

- Governed by Canadian tax laws and intended to be used only in Canada.

Irrevocable Discretionary Trust Deed | Canada

Set up an Irrevocable Discretionary Trust with this template trust deed for Canada.

- A discretionary trust is also called a blind trust because the beneficiary has no information about the assets in the trust or how the trust is administered.

- The settlor (the person setting up the trust) is the sole beneficiary of the trust and cannot act as a trustee.

- The division date will occur either upon the death of the beneficiary or on the 21-year anniversary of the establishment of the trust, whichever is earlier.

- The settlor reserves no powers or rights, and shall receive no benefits, income or capital of the trust fund in his/her capacity as settlor.

- This trust cannot be revoked.

- During the lifetime of the settlor, no income or capital of the trust shall be distributed to the settlor's spouse or a minor child of the settlor unless the distribution does not result in attribution of income or gain to the settlor under the Income Tax Act (Canada).

- This Irrevocable Discretionary Trust Deed is a good strategy to use when it's important that the beneficiary not be aware of what assets are held in the trust so as to avoid any claims of conflict of interest.

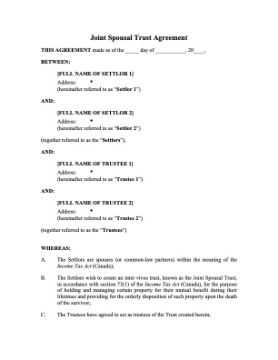

Joint Spousal Trust Deed | Canada

Prepare a Joint Spousal Trust Deed with this downloadable and customizable template for Canadians.

What is a joint spousal trust?

A joint spousal trust is an inter vivos trust established to benefit both spouses during their lifetimes and includes provisions for the remaining spouse after one passes away.

What is the purpose of a joint spousal trust?

When both spouses die, the trust property passes to the remainder beneficiaries named in the trust agreement, without the necessity of probate.

Format and Legal Jurisdiction

The Joint Spousal Trust Deed is governed by Canadian tax laws and is intended to be used only within Canada. This downloadable template is available in MS Word format. It is fully editable and reusable.

- 1

- 2