Product tags

- estate planning form (107)

- ,

- canadian tax planning form (22)

- ,

- canada trust form (9)

- ,

- living trust form (5)

- ,

- irrevocable trust form (3)

Only registered users can write reviews

Related products

Irrevocable Discretionary Trust Deed | Canada

Set up an Irrevocable Discretionary Trust with this template trust deed for Canada.

- A discretionary trust is also called a blind trust because the beneficiary has no information about the assets in the trust or how the trust is administered.

- The settlor (the person setting up the trust) is the sole beneficiary of the trust and cannot act as a trustee.

- The division date will occur either upon the death of the beneficiary or on the 21-year anniversary of the establishment of the trust, whichever is earlier.

- The settlor reserves no powers or rights, and shall receive no benefits, income or capital of the trust fund in his/her capacity as settlor.

- This trust cannot be revoked.

- During the lifetime of the settlor, no income or capital of the trust shall be distributed to the settlor's spouse or a minor child of the settlor unless the distribution does not result in attribution of income or gain to the settlor under the Income Tax Act (Canada).

- This Irrevocable Discretionary Trust Deed is a good strategy to use when it's important that the beneficiary not be aware of what assets are held in the trust so as to avoid any claims of conflict of interest.

$34.99

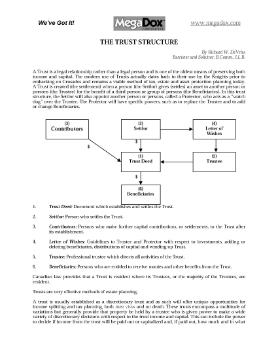

The Trust Structure in Canada

Learn about the trust structure in Canada in this free expert guide.

The guide provides an overview of the structure of a trust, the advantages of a tax structure as a vehicle for income splitting and tax planning for residents of Canada, and the characteristics of specific types of discretionary trusts, such as:

- spousal (family) trusts;

- trusts for minor children;

- trusts for adult children;

- trusts for long-term maintenance of a handicapped child;

- spendthrift trusts.

The Trust Structure in Canada is information for Canadian residents and is copyright by the author.

$0.00

Trusts and Tax Planning in Canada

Learn about the various trust structures available to Canadians, and their tax benefits to the individual or business.

- This guide contains information on:

- family trusts (bearer, inter vivo or "living" trusts and testamentary),

- real estate investment trusts (REITs),

- royalty trusts,

- income trusts.

- The guide contains information relevant to Canadian residents and is available in Adobe PDF format.

$4.99

Alter Ego Trust Deed | Canada

Prepare an Alter Ego Trust Deed with this easy-to-use template, pursuant to the provisions of the Income Tax Act (Canada).

- Who Can Use This Form. An alter ego trust can only be created by an individual aged 65 or older, who will have the exclusive right to receive all income from the trust.

- Trust Income. During the settlor's lifetime no person other than the settlor may receive or otherwise obtain the use of any part of the trust's income or capital.

- Distribution of Trust AssetsUpon the settlor's death, the trust will hold any remaining assets for the benefit of other beneficiaries named in the Trust Deed. The trust will be able to distribute those assets to the other beneficiaries without the assets having to go through the probate process.

- Legal Jurisdiction. This Alter Ego Trust Deed template is governed by Canadian tax laws and is intended to be used only within Canada.

- Format. The template is available in MS Word format and is fully editable.

$29.99