Personal Guarantee Forms

Before you lend money to a business, get a written guarantee of repayment from the business owners with these downloadable and customizable Personal Guarantee Forms.

Most commercial lenders will require a personal guarantee (guaranty) from the principals of a business before they extend credit facilities to that business. Lenders look at a personal guarantee as a sign that the principals have faith in their business and in its ability to pay its debts, and that they intend to honor the company's commitments. A lender may not want to risk a bad loan if a business owner is not willing to take the risk of having to repay it if the business goes under.

A personal guarantee gives the lender the means to go after the personal assets of the guarantor if the company defaults on its obligations. That is why lenders and lessors generally require them, and as the percentage of businesses going under increases, the requirement for personal guarantees from directors and business owners will increase as well.

Alberta Corporate Mortgage Guarantee Forms

Obtain a guarantee to ensure repayment of a mortgage loan to a corporation with this package of mortgage guarantee forms for Alberta.

- The guarantee is an unconditional guarantee from a principal of the corporation who agrees to repay the principal, interest and all other sums owing under the mortgage if the corporate mortgagor defaults.

- The guarantor's liability will be to the same extent as if the guarantor was primarily liable under the mortgage security, and not just as a surety.

- The package also includes a set of corporate resolutions to be passed by the shareholders and directors of the corporate guarantor, authorizing the corporation to give the guarantee.

- This package of Mortgage Guarantee forms is intended to be used in the Province of Alberta, Canada.

Alberta Guarantee and Postponement of Claim

Obtain a personal guarantee from the principals of a corporate borrower with this Guarantee and Postponement of Claim for Alberta, Canada.

Purpose of Guarantee and Postponement

The Guarantee would be given by a director, shareholder, or sole proprietor of the corporation as security to guarantee repayment of the corporate borrower's indebtedness to a lender if the borrower defaults in paying back the debt.

The guarantor also agrees that any debts owed by the borrower to the guarantor will be postponed to the debts owed to the lender, and the lender's claims would take priority.

Who Can Use this Guarantee Template

The Guarantee and Postponement of Claim can be used by any company that lends money or extends credit to customers in Alberta.

What is Included in the Template Form

The template includes the form of acknowledgement required by the Guarantees Acknowledgement Act (Alberta). It also includes an affidavit of execution.

Format and Jurisdiction

The Guarantee and Postponement of Claim form is available in MS Word format. It is customizable and reusable.

This document is intended for use only in the Province of Alberta, Canada.

Alberta Guarantee of Commercial Lease

Don't wait for a business tenant to default on its lease obligations. Get a personal guarantee from the owners with this Guarantee of Commercial Lease form for Alberta landlords.

- The guarantee is given by a principal of the company, such as a shareholder, partner, sole proprietor or other person with a financial interest in the tenant.

- The guarantee is unconditional and continuing.

- A guarantee of this type is typically required by the landlord prior to signing the lease.

- The guarantor agrees to pay all rent and other amounts due under the lease if the lessee defaults, including the payment of legal fees incurred by the landlord in enforcing the terms of the lease.

- This is a downloadable form in MS Word format.

- This legal document is solely for use in the Province of Alberta, Canada.

Alberta Guarantees Acknowledgement Act Certificate

Prepare a Guarantees Acknowledgement Act Certificate with this free form for the Province of Alberta.

- The Certificate must be attached to a Personal Guarantee.

- The lawyer/notary public certifies that the guarantor appeared in person before them, has read the guarantee and understands it, and has acknowledged executing the guarantee.

- This Certificate is required by Alberta law and must be attached to any personal guarantee signed in the province.

- This form can only be used in Alberta, Canada.

Arizona Guarantee of Commercial Lease

When leasing commercial space to a tenant, always get a guarantee of the lease from one of the owners of the business.

Legal Jurisdiction

This Guarantee of Commercial Lease form is for the State of Arizona.

The Guarantee of Lease document should be signed by a director, shareholder, partner, sole proprietor or other person with a financial interest in the tenant's business.

Terms of Guarantee

The person executing the Guarantee (guarantor) agrees to pay the rent and perform all of the tenant's obligations under the lease, if the tenant is unable to do so.

The guarantee being given is absolute, unconditional and continuing.

Format

The Arizona Guarantee of Lease form is available in MS Word format. Pay for the form once, use it as often as required.

British Columbia Guarantee and Postponement

Overview of Guarantee and Postponement

When a corporate borrower seeks a loan, lenders often require an additional level of security to ensure repayment. One effective approach is to obtain a personal guarantee, using a Guarantee and Postponement form such as this template for the Province of British Columbia.

Who Should Provide the Guarantee?

The guarantee must be supplied by an individual who has a significant stake in the company, such as a director, shareholder, or sole proprietor. By providing this guarantee, the individual commits to repaying the borrower's indebtedness to the lender if the corporate borrower defaults on the loan.

Priority of Debts

Under the terms of the Guarantee and Postponement, the guarantor also agrees that any debts the borrower owes to them will be deferred in favor of debts owed to the lender. This means the lender's claims take priority over any other claims the guarantor may have against the borrower.

Form Usage and Availability

Once purchased, the Guarantee and Postponement form can be used multiple times without incurring additional fees. It is available for immediate download following purchase, allowing lenders in British Columbia to quickly integrate it into their loan documentation. Every lender in the province is encouraged to include this form as a standard part of their lending process.

California Guaranty of Debt Obligation

If you loan money to businesses in California, have the principals of the borrower sign this Guaranty of Debt Obligation form to accompany the loan documents.

- The owners of the borrower company agree to guarantee repayment of the borrower's indebtedness.

- The Guaranty is given unconditionally. The guarantors waive the benefit of any statute of limitations affecting their liability.

- The guarantors will repay the debt upon the dissolution, insolvency, bankruptcy, receivership or business failure of the debtor.

- The guarantors have no right of subrogation until the debt is paid in full.

- This form is a digital template. Buy the form, download it, use it as often you require.

- Intended to be used only in the State of California.

Colorado Guaranty of Commercial Lease

Secure the obligations of a corporate lessee (tenant) with this Colorado Guaranty of Commercial Lease.

Purpose of Guaranty

The Guaranty of Commercial Lease is given to the landlord by someone with a financial interest in the tenant's business, such as a shareholder, partner, or sole proprietor (the guarantor). It is intended to be an inducement to the landlord (lessor) to sign the lease.

Key Provisions

- The guaranty is absolute, unconditional and continuing. This means that the guarantor unconditionally promises to be responsible for the tenant's obligations under the lease, regardless of the circumstances, without any conditions or exceptions.

- The guaranty ensures payment of all rent and other amounts due under the lease, including the payment of legal fees incurred by the lessor in enforcing the terms of the lease.

Format and Jurisdiction

The Guaranty of Commercial Lease form is available in MS Word format and is fully editable and reusable. It is intended to be used only in the State of Colorado.

Demand Letter to Guarantor

Lenders, demand payment from a guarantor under a loan document with this Demand Letter to Guarantor.

- The letter informs the guarantor that the debtor whose indebtedness was guaranteed by the guarantor has defaulted in making payments towards the loan.

- The lender demands that the guarantor pay the outstanding amount by a certain date.

- This template is available in MS Word format and is easy to download, fill in with your details, and print.

- The form can be used almost anywhere that does not have a statutory form.

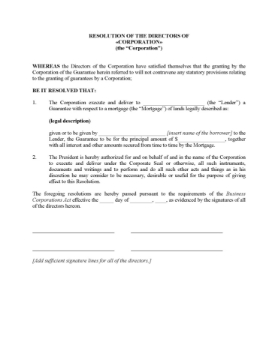

Directors Resolution to Guarantee Mortgage | Canada

Use this ready-made Directors' Resolution template to authorize a Canadian corporation to guarantee a mortgage.

- The Board of Directors resolve to have the corporation guarantee the repayment of a mortgage loan taken out by an affiliate or subsidiary, and to sign the necessary legal documents.

- This template can be used for federal corporations or for business corporations incorporated under any provincial Business Corporations Act.

- Available in MS Word format.

- Intended to be used only in Canada.