UNITED KINGDOM

Secure repayment of a loan from a borrower with these Loan Transaction Forms for lenders in the UK.

- All forms are prepared to comply with the laws of England and Wales.

- Available as downloadable MS Word templates.

- Easy to customise to fit your exact circumstances.

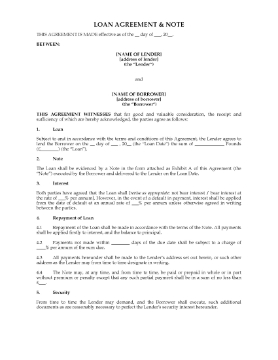

Loan Agreement and Note | UK

Document a loan transaction in the United Kingdom with this Loan Agreement and Note template.

Interest and Penalty

The Agreement contains alternative interest clauses, for either a fixed interest rate or for an interest-free loan, depending on the terms you have agreed upon with the borrower.

The Note can be paid in whole or in part without interest or penalty, except that any partial payments must be for at least a specified minimum amount.

Default

The loan becomes immediately due and payable upon any default by the borrower. The lender has the right to demand full repayment at any time upon proper written notice.

Format and Legal Jurisdiction

The Loan Agreement and Note template is available in MS Word format. It is fully customisable and can be re-used as often as required.

This legal document is governed by English law and is intended to be used only in the United Kingdom.

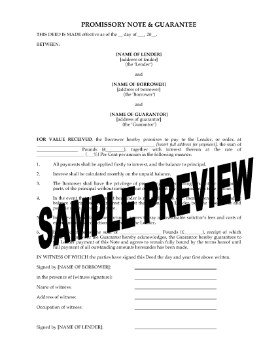

Promissory Note with Guarantee | UK

If you are loaning money to a person or company in the UK, secure repayment of the loan with this Promissory Note and Guarantee.

- The borrower agrees to repay the loan with interest calculated monthly on the unpaid balance.

- The borrower may prepay the balance at any time without penalty.

- The Note includes a guarantee of payment of the Note by a guarantor.

- Available in MS Word format.

- Intended to be used only in the United Kingdom.

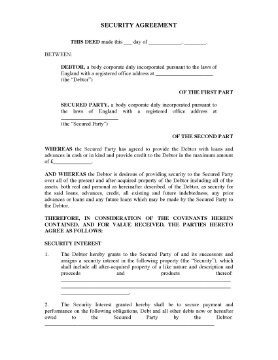

Security Agreement | UK

UK lenders, prepare a Security Agreement for a borrower to sign by using this downloadable and easy-to-use template.

- The borrower grants the lender a security interest in all of the borrower's present and after-acquired property to secure repayment of a loan, operating line, or other credit facilities advanced by the lender to the borrower.

- The collateral is to be kept at the borrower's address within the United Kingdom and not moved or relocated without the lender's consent.

- The borrower must keep the collateral insured, and the lender is to be a named beneficiary on the insurance policy.

- The agreement is in default if there is any material decrease in the value of the security or an adverse change in the borrower's financial situation.

- Available in MS Word format.

- Governed by English law and intended to be used only in the United Kingdom.

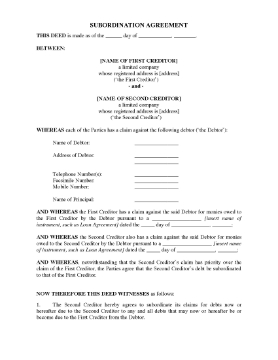

Subordination Agreement | UK

This simple short-form Subordination Agreement can be used by lenders anywhere in the United Kingdom.

- The Agreement is between two creditors who have both provided lending or credit facilities to the debtor.

- The second creditor agrees to subordinate its claims against the debtor to the claims of the first creditor.

- The subordination covers the whole amount of the creditor's secured and unsecured claims, and is for an unlimited duration.

- This form is provided in MS Word format. It is customisable and easy to use.

- Intended to be used only in the United Kingdom.

UK Agreement to Assume Debt

Transfer a debt obligation from one debtor to another with this Agreement to Assume Debt form for the UK.

- The new debtor agrees to assume the debt from the current debtor and to pay the debt to the creditor on the terms set out in the contract.

- If the new debtor defaults in payment, the creditor will have full rights to bring action jointly and severally against both debtors for payment of the outstanding balance.

- The form is governed by English law and can be used throughout the United Kingdom.

An Agreement to Assume Debt is often used when a business is being sold or taken over. Buy and download the form, customise it to suit your needs.

UK Agreement to Compromise Debt

If a customer owes you money and you are willing to accept payment of a lesser sum in order to settle the debt, you can sign this Agreement to Compromise Debt with the customer.

- The creditor agrees to accept the lesser sum from the debtor as payment in full.

- The agreement is conditioned upon the provision that the sum must be paid within a specified time period.

- If the customer fails to do so, the creditor will have the right to sue the debtor for the full amount of the debt.

- The agreement is governed by English law and can be used throughout the United Kingdom.