Ontario

Take the misery out of selling your home with these downloadable Ontario Real Estate Forms.

- Legal form templates for buying and selling residential real estate or commercial properties.

- FSBO purchase and sale contracts for condominiums as well as single family homes.

- Conveyancing and tax forms consistent with Ontario laws.

- if you are making a mortgage loan to the buyer, jump to our Mortgage Forms section.

Sort by

Display per page

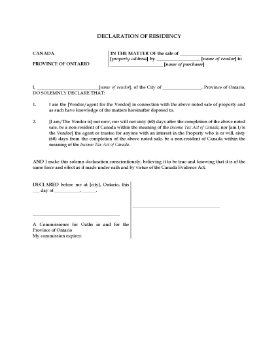

Ontario Declaration of Residency

Download this free Ontario Declaration of Residency forms for real estate sales in Ontario.

- If you are the vendor of the real estate property, you will need to provide the purchaser with the Declaration of Residency in order to fulfill the residency requirement of the Income Tax Act (Canada).

- This is a free form provided in MS Word format.

- Intended for use only in the Province of Ontario, Canada.

$0.00

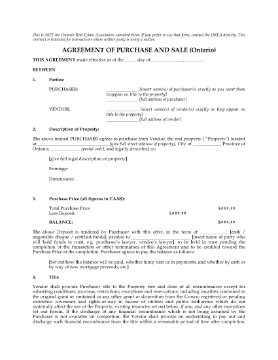

Ontario FSBO Real Estate Purchase and Sale Contract

Buy or sell a home in Ontario without a realtor with this For Sale by Owner (FSBO) Real Estate Purchase and Sale Contract.

- This contract is only for use in transactions where neither party is using a realtor.

- If HST is payable on the transaction, the purchaser will be responsible for paying it.

- If the sale is not subject to HST, the vendor agrees to certify that there is no HST payable.

- The vendor pays the costs of preparing the transfer documents. The purchaser pays for the preparation of the mortgage (if any).

- This is not the OREA standard form of contract. OREA forms must be obtained from a member of the Ontario Real Estate Association.

- This legal contract template is provided in MS Word format and is fully editable.

- Intended to be used only in the Province of Ontario, Canada.

$17.99

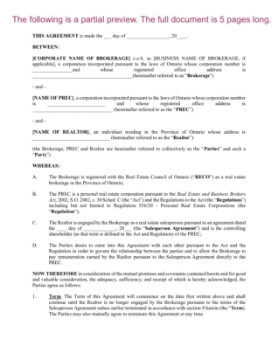

Ontario PREC Remuneration Agreement

Ontario realtors, take advantage of corporate tax rates on the commissions you earn by setting up a personal real estate corporation (PREC) and running your revenues through it.

- This Remuneration Agreement between the realtor, the PREC and the realtor’s brokerage establishes the relationship between the parties and sets out how revenues earned by the realtor will be paid.

- The realtor is engaged by the brokerage as a real estate salesperson and is the incorporator and shareholder of the PREC.

- Remuneration earned by the realtor is paid by the brokerage to the PREC instead of directly to the realtor.

- The Agreement does not create an employment, agency, partnership, joint venture or similar relationship between the brokerage and either of the other parties.

- The PREC and the realtor are responsible for withholding and remitting all required taxes and EI and other contributions.

- The PREC personnel are not eligible to participate in any benefit or compensation programs offered by the brokerage to its own employees.

- The PREC does not carry on business as a real estate brokerage.

- This document complies with the laws of the Province of Ontario, Canada.

$24.99

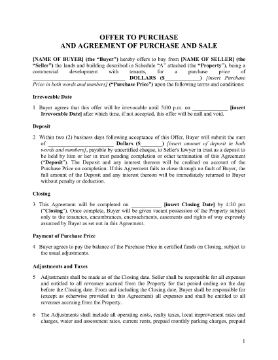

Ontario Purchase and Sale Agreement for Commercial Property

Buy and sell commercial real estate property in Ontario with this Offer to Purchase and Agreement of Purchase and Sale for Commercial Property.

- The seller is responsible for all expenses and taxes on the property up to the closing date. The buyer is responsible for those costs from and including the closing date.

- The seller is entitled to all rental revenues up to the closing date. From and including the closing date, the buyer will receive all rents from the property.

- The seller will make available to the buyer all documents, authorizations, records, etc. to allow the buyer to perform its due diligence and complete its inspection and any environmental or structural audits required.

- The buyer agrees to assume the existing tenants and leases, but is not obligated to assume any contracts for supply of products or services to the property.

- The seller agrees not to enter into any new leases prior to closing, and will notify all utility and other services of the change of ownership.

- This legal form is available as a Microsoft Word file and is fully editable to fit your circumstances.

- Intended for use only in the Province of Ontario, Canada.

$34.99