Customers who bought this item also bought

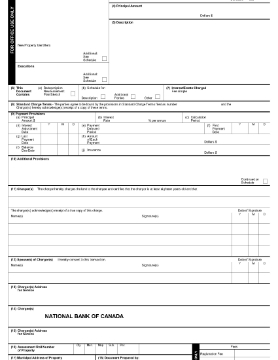

Ontario PREC Remuneration Agreement

Ontario realtors, take advantage of corporate tax rates on the commissions you earn by setting up a personal real estate corporation (PREC) and running your revenues through it.

- This Remuneration Agreement between the realtor, the PREC and the realtor’s brokerage establishes the relationship between the parties and sets out how revenues earned by the realtor will be paid.

- The realtor is engaged by the brokerage as a real estate salesperson and is the incorporator and shareholder of the PREC.

- Remuneration earned by the realtor is paid by the brokerage to the PREC instead of directly to the realtor.

- The Agreement does not create an employment, agency, partnership, joint venture or similar relationship between the brokerage and either of the other parties.

- The PREC and the realtor are responsible for withholding and remitting all required taxes and EI and other contributions.

- The PREC personnel are not eligible to participate in any benefit or compensation programs offered by the brokerage to its own employees.

- The PREC does not carry on business as a real estate brokerage.

- This document complies with the laws of the Province of Ontario, Canada.

$24.99