Only registered users can write reviews

Customers who bought this item also bought

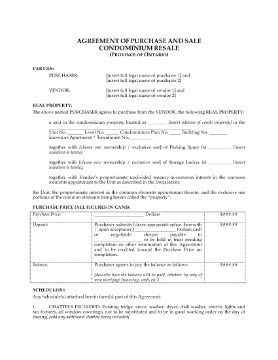

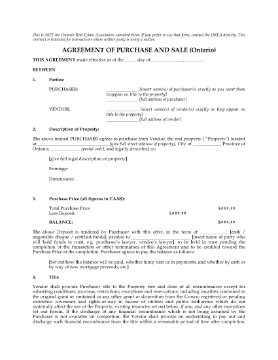

Ontario FSBO Real Estate Purchase and Sale Contract

Buy or sell a home in Ontario without a realtor with this For Sale by Owner (FSBO) Real Estate Purchase and Sale Contract.

- This contract is only for use in transactions where neither party is using a realtor.

- If HST is payable on the transaction, the purchaser will be responsible for paying it.

- If the sale is not subject to HST, the vendor agrees to certify that there is no HST payable.

- The vendor pays the costs of preparing the transfer documents. The purchaser pays for the preparation of the mortgage (if any).

- This is not the OREA standard form of contract. OREA forms must be obtained from a member of the Ontario Real Estate Association.

- This legal contract template is provided in MS Word format and is fully editable.

- Intended to be used only in the Province of Ontario, Canada.

$17.99