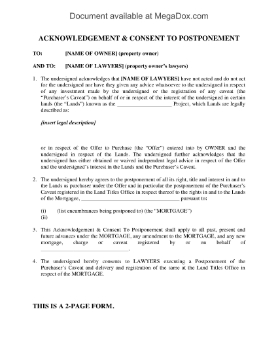

Customers who bought this item also bought

Alberta Vendor Take-Back Mortgage

Have you found a buyer for your property who can't qualify for a mortgage? Lend them the amount they need with this Vendor Take-Back Mortgage for Alberta real estate properties.

- A vendor take-back mortgage (also known as a 'purchase money mortgage') is often used for real estate transactions between family members.

- The seller (vendor) agrees to carry all or part of the purchase price for the real estate and the buyer will make regular payments to the seller, just as with a regular mortgage.

- The seller has the right to take back the property if the buyer fails to make the payments or meet its other obligations under the mortgage.

- A Vendor Take-back Mortgage is an alternative method of financing a real estate purchase that allows buyers who cannot get a conventional mortgage a chance to own a home.

- This legal document is intended solely for use in the Province of Alberta, Canada.

$17.99

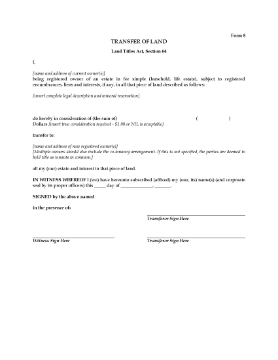

Alberta Transfer of Land Form 8

When selling real estate in Alberta, you must convey the title to the new owner by registering this Transfer of Land form with an Alberta Registry Office.

- The form must be completed and signed where indicated by the seller and the buyer, and submitted for filing with the appropriate fees.

- The form includes an Affidavit of Execution, Dower Act requirements, and Affidavit of Value.

- This form is in MS Word format and can be completed either by hand or on a computer.

- Alberta Land Titles Form 8, Transfer of Land.

$0.00

Alberta Dower Act Forms

When selling a real estate property in Alberta, you must provide Dower Act Forms with your transfer documents.

This package contains the following items:

- a Dower Affidavit,

- Consent of Spouse and Certificate of Acknowledgement by Spouse, and

- Affidavit of Executor or Administrator.

How to use the forms

These forms must be signed in front of a Notary or Commissioner for Oaths and attached to any instrument (such as a transfer of land) disposing of a principal residence (i.e. the home in which you live).

The Affidavits and Consent form fulfill the requirements of the Alberta Dower Act with respect to spousal consent to the disposition of the matrimonial homestead.

Format and legal jurisdiction

The Dower Act Forms are available in MS Word format. They are intended to be used only in the Province of Alberta, Canada.

$0.00

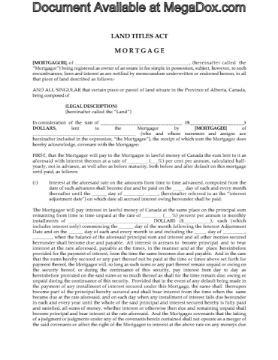

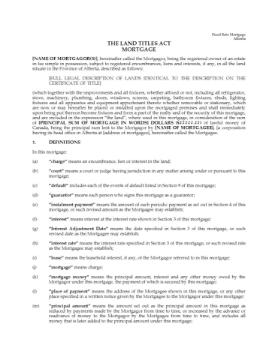

Alberta Standard Charge Fixed Rate Mortgage

Secure a loan with real estate under the terms of this Standard Charge Fixed Rate Closed Term Mortgage for Alberta.

- Renewal. Early renewal privileges, i.e. the mortgage may be renewed on any installment payment date.

- Interest. Interest will be calculated half-yearly, not in advance.

- Property Taxes. The mortgage lender may elect to pay the property taxes when they come due, or elect to have the borrower (mortgagor) pay the taxes.

- Application of Payments. All payments will be applied first to taxes and life insurance (if applicable), then to interest, then to principal, and then to any other moneys owing.

- Leasehold. Optional provisions for a leasehold mortgage.

- Available in MS Word format.

- Intended to be used only in the Province of Alberta, Canada.

$29.99

Alberta Caveat Forbidding Registration

File a caveat to protect your interest under a purchase agreement for Alberta land with this free Form 26.

- As the purchaser of a property, you have an interest in the property and can file a caveat under the Alberta Land Titles Act.

- The form includes the required Form 27 Affidavit in support.

- This template includes the appropriate wording for registering a purchaser's interest pursuant to a purchase agreement between the caveator and the owner of the property.

- You can access the fillable PDF directly from Service Alberta by using the link provided.

$0.00