Product tags

Related products

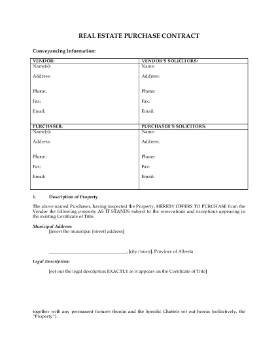

Alberta As-Is Real Estate Purchase Contract

Sell a property in Alberta on an as-is basis with this Alberta As-It-Stands Real Estate Purchase Contract

- Purpose of Agreement. This type of contract is often used to buy land with no buildings (vacant lots, parking lots, etc.), or to buy a lot on which the building will be demolished.

- For Sale by Owner. This is an FSBO (for sale by owner) contract. Since the property is being sold by the vendor (seller) without being listed through a realtor, there are no commissions payable on the sale.

- Acknowledgement of Inspection. The purchaser acknowledges having inspected the property and is offering to buy the property as it stands (as is).

- No Representations. The purchaser agrees that the vendor has not made any representations or warranties regarding the property or any lands in close proximity which might directly or indirectly affect the property, other than what is set out in the contract.

This Alberta As-It-Stands Real Estate Purchase Contract is in MS Word format, and is fully editable to fit your circumstances.

$17.99

Colorado Food Truck Vendor Agreement

Prepare a license agreement that allows a food truck operator to operate the food truck on city-owned property with this easy downloadable template for Colorado.

- The agreement is between a municipal corporation (City) and a food truck vendor, allowing the operation of a food truck within a designated area throughout the contract period.

- In return for a monthly fee, the Licensor grants a nonexclusive, revocable license to the vendor to sell specified permitted food products from an approved food truck within a designated license area.

- The food truck vendor must operate within specified hours, and must comply with all of City's standards for operation of food trucks.

- In return for the grant of license, the food truck operator will pay a monthly license fee, subject to annual adjustments.

- The Licensee must obtain and maintain certain types of insurance and all necessary permits and licenses for operation.

- The food truck operator indemnifies the city against any claims arising from the operation of the food truck.

- Available in MS Word format.

- Governed by the laws of the State of Colorado.

$39.99

Alberta Dower Act Forms

When selling a real estate property in Alberta, you must provide Dower Act Forms with your transfer documents.

This package contains the following items:

- a Dower Affidavit,

- Consent of Spouse and Certificate of Acknowledgement by Spouse, and

- Affidavit of Executor or Administrator.

How to use the forms

These forms must be signed in front of a Notary or Commissioner for Oaths and attached to any instrument (such as a transfer of land) disposing of a principal residence (i.e. the home in which you live).

The Affidavits and Consent form fulfill the requirements of the Alberta Dower Act with respect to spousal consent to the disposition of the matrimonial homestead.

Format and legal jurisdiction

The Dower Act Forms are available in MS Word format. They are intended to be used only in the Province of Alberta, Canada.

$0.00