Product tags

- merger form (3)

- ,

- amalgamation agreement (3)

- ,

- australia (5)

Related products

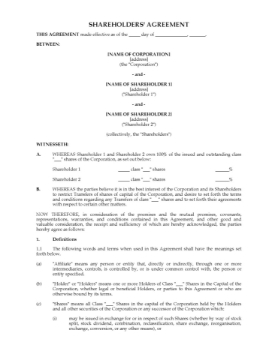

Shareholder Agreement | Australia

Set out how the shares of an Australian corporation are to be transferred or sold under this customizable Australia Shareholder Agreement.

Why does my company need a shareholder agreement?

Every corporation with more than one shareholder should have a shareholder agreement in place. A shareholder agreement sets out the rights, responsibilities and obligations of the shareholders to each other and to the company.

Key Provisions

- Transfers of shares.

- Procedure for avoiding deadlock in votes.

- Non-competition and confidentiality clauses.

- Matters requiring majority vote.

Right of First Refusal Provisions

- Each shareholder has a right of first refusal to purchase any shares being disposed of by the other shareholder(s) before the shares can be offered to third parties.

- Shareholders not wishing to exercise their right of first refusal can transfer a pro rata share of the offered securities to the other remaining shareholders.

- The shareholders also have a right of first refusal to purchase new securities being issued by the corporation.

Call Option

If a shareholder is in default (as defined in the agreement), the other shareholders have a call option. In other words, they have the option to purchase the defaulting shareholder's shares at fair market value.

Format and Jurisdiction

This Shareholder Agreement template is provided in MS Word format and is fully customizable. It is governed by Australian law and is intended to be used only within Australia.

$34.99