Purchase Money Promissory Note for Real Estate Purchase

If you are selling a real estate property and allowing the buyer to pay the purchase price over time, make sure the buyer signs this Purchase Money Promissory Note.

- Having a signed promissory note in place makes you a secured creditor if the buyer becomes bankrupt or insolvent.

- The buyer will pay off the balance of the purchase price in regular installments, rather than having to come up with all of the purchase money in order to close the sale.

- The Note contains an acceleration clause, meaning if the maker defaults in a payment, the entire balance together with interest becomes immediately due and payable.

- Get the Purchase Money Promissory Note signed at the same time that the other documents for the real estate purchase are executed by the buyer.

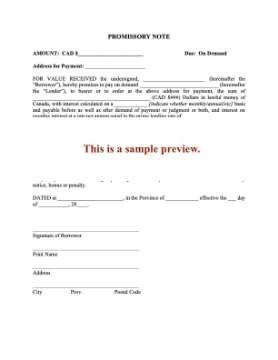

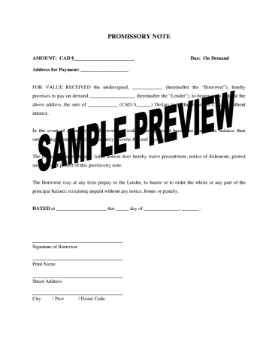

Demand Note with Floating Interest Rate | Canada

This Demand Promissory Note form is designed to help creditors in Canada document loans and safeguard their rights effectively.

The Demand Note template offers an easy-to-use format that includes a floating interest rate, ensuring flexibility for both parties.

Interest Rate Calculation

The interest on the loan is calculated based on the current prime lending rate of the lender’s bank. This method ensures that the interest remains competitive and reflects prevailing market conditions.

Prepayment Terms

Borrowers have the option to prepay the loan at any time. Importantly, there are no penalties or premiums associated with early repayment, providing added flexibility for the borrower.

Form Accessibility and Reusability

The form is straightforward to fill out and can be printed for signature, making the documentation process simple and efficient. Users may utilize the form multiple times as needed for different loan arrangements.

Jurisdiction

This template is recognized as a legal form throughout Canada and can be used in any province or territory. For transactions in the Province of Quebec, a French language version of the form may be necessary to comply with local requirements.

How to Obtain the Form

To access the Demand Note form, simply add it to your cart and complete the checkout process. Upon successful transaction, your document will automatically download.

Promissory Note for Interest-Free Loan | Canada

Are you making an interest-free loan to a friend or family member in Canada? Have them sign this Demand Promissory Note.

When would I need to use this Promissory Note form?

If you lend money to a family member or close friend, you may decide not to charge them interest on the loan balance. Even so, it is important to secure a formal commitment from the borrower to repay the loaned amount.

Getting a Promissory Note signed ensures that the borrower is legally obligated to repay the principal.

When and Where to Use the Form

- This type of Promissory Note is most frequently used when the lender and borrower share a close relationship, such as family members.

- This Demand Promissory Note is intended for use within Canada. It is suitable for all provinces and territories except Québec, where a different French-language form may be needed.

Repayment Terms

Because the loan is interest-free, the borrower is required only to return the principal amount borrowed. No interest will accrue on the loan.

Format of the Template

The Promissory Note for Interest-Free Loan form is available as a digital download in MS Word format and is easy to fill in with your details.

Promissory Note for Interest Only | Canada

Secure the repayment of a loan made in Canada with this Promissory Note (for interest only).

This Promissory Note template is designed to help secure the repayment of interest on a loan made within Canada. It provides a clear framework for both lenders and borrowers regarding the repayment terms and expectations.

Deferred Repayment of Principal

Under this Note, the borrower is required to make payments that cover only the accrued interest on the loan. No payments toward the principal amount are necessary until the specific date outlined in the Note. This allows the borrower to manage cash flow by deferring principal repayments until a later time.

Schedule of Interest Payments

Interest payments are to be made in arrears, following a regular payment schedule as defined in the terms of the Note. This ensures that the lender receives compensation for the use of their funds over the period of the loan.

Principal Repayment and Prepayment

The principal sum of the loan may be repaid at any time chosen by the borrower, without incurring any penalty or additional fee. This flexibility benefits the borrower, allowing for early repayment if desired.

Format and Availability

This template is provided in Microsoft Word format, making it easy to edit and customize to suit the specific details of your transaction.

Jurisdiction

This Promissory Note is intended exclusively for use in Canada.