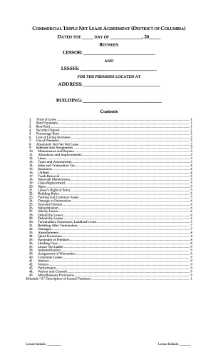

DC Commercial Triple Net Lease Agreement

Lease office, retail or other business premises in the District of Columbia to a tenant with this template Commercial Triple Net Lease Agreement.

This template provides a comprehensive agreement for leasing office, retail, or other business premises within the District of Columbia. The agreement is designed to clearly outline the responsibilities and obligations of both the landlord (lessor) and tenant (lessee).

Triple Net Lease

Under a triple net lease, the lessee is responsible for covering all costs and expenses associated with the leased premises. This includes not only routine expenses but also structural repairs, ensuring the property is maintained to a high standard throughout the term of the lease.

Renewal Option

The agreement grants the lessee the option to renew the lease for an additional term. This provides flexibility and security for tenants wishing to continue their business operations beyond the initial lease period.

Taxes, Charges, and Operating Expenses

The lessee is obligated to pay all expenses, taxes, levies, and charges related to the premises. This responsibility extends to all utilities, services, and operating expenses incurred as part of running their business.

Insurance Requirements

It is the lessee’s duty to maintain appropriate insurance coverage, including fire, extended coverage, and liability insurance, to protect the premises and their business activities.

Alterations, Improvements, and Repairs

All alterations, improvements, maintenance, and repairs to the premises fall under the lessee’s responsibility. This ensures that the property remains in good condition and any necessary updates or repairs are promptly addressed.

Damage, Destruction, or Condemnation

The agreement contains clauses detailing the procedures for rent abatement or lease termination in the event the building is damaged, destroyed, or condemned. These provisions provide guidance and protection for both parties should unforeseen circumstances arise.

Subordination

The lessee agrees to sign a subordination agreement or any other necessary documents, if required by the lessor, to subordinate the lease to a mortgage or other charge. This ensures that the lease remains subordinate to the lessor’s financing arrangements.

Additional Rent

An optional clause may be included for percentage rent, requiring the lessee to pay an additional amount based on the performance of their business, on top of the base rent. This can be tailored to suit the specific needs of the parties involved.

Template Features

This District of Columbia Commercial Triple Net Lease Agreement template is provided in MS Word format and is fully editable, allowing users to customize it to fit their particular requirements.

Jurisdiction

This lease template is meant to be used only in the District of Columbia.

DC Guaranty of Commercial Lease

Before executing a lease with a new corporate tenant, have one of the owners guarantee the business' obligations under this Guaranty of Commercial Lease.

- The Guaranty form is only for leases in the District of Columbia.

- This is a continuing and unconditional guarantee.

- A principal of the company, such as a shareholder, partner, or sole proprietor must execute the form.

- A guarantee of this type is typically required as an inducement to the lessor â„ landlord to sign the lease.

- The guarantor personally guarantees payment of all rent and other amounts due under the lease, including the payment of legal fees incurred by the landlord in enforcing the terms of the lease.