Product tags

Related products

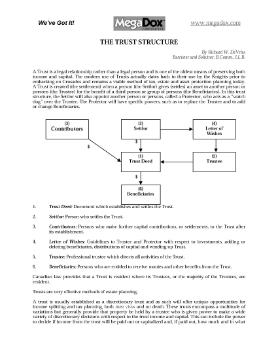

The Trust Structure in Canada

Learn about the trust structure in Canada in this free expert guide.

The guide provides an overview of the structure of a trust, the advantages of a tax structure as a vehicle for income splitting and tax planning for residents of Canada, and the characteristics of specific types of discretionary trusts, such as:

- spousal (family) trusts;

- trusts for minor children;

- trusts for adult children;

- trusts for long-term maintenance of a handicapped child;

- spendthrift trusts.

The Trust Structure in Canada is information for Canadian residents and is copyright by the author.

$0.00

Trusts and Tax Planning in Canada

Learn about the various trust structures available to Canadians, and their tax benefits to the individual or business.

- This guide contains information on:

- family trusts (bearer, inter vivo or "living" trusts and testamentary),

- real estate investment trusts (REITs),

- royalty trusts,

- income trusts.

- The guide contains information relevant to Canadian residents and is available in Adobe PDF format.

$4.99

Cutting Through Life Insurance Chaos in Canada

Cutting Through Life Insurance Chaos in Canada is a 14-page information package for Canadians.

This package is provided to help you understand:

- the jargon of life insurance,

- the benefits of having good life insurance coverage,

- how to determine whether you need it and how much you need,

- types of personal and business life insurance available,

- term life, whole life, and universal life insurance,

- disability, buy-sell and key man policies.

Get your free copy of Cutting Through Life Insurance Chaos in Canada and find out how to make life insurance part of your financial planning.

$0.00