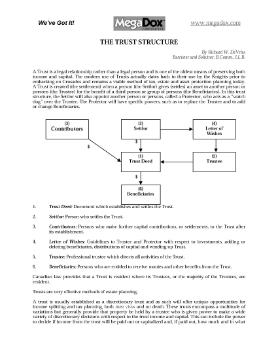

The Trust Structure in Canada

Learn about the trust structure in Canada in this free expert guide.

The guide provides an overview of the structure of a trust, the advantages of a tax structure as a vehicle for income splitting and tax planning for residents of Canada, and the characteristics of specific types of discretionary trusts, such as:

- spousal (family) trusts;

- trusts for minor children;

- trusts for adult children;

- trusts for long-term maintenance of a handicapped child;

- spendthrift trusts.

The Trust Structure in Canada is information for Canadian residents and is copyright by the author.

Trusts and Tax Planning in Canada

Learn about the various trust structures available to Canadians, and their tax benefits to the individual or business.

- This guide contains information on:

- family trusts (bearer, inter vivo or "living" trusts and testamentary),

- real estate investment trusts (REITs),

- royalty trusts,

- income trusts.

- The guide contains information relevant to Canadian residents and is available in Adobe PDF format.

Personal Net Worth Statement

If you need a client to provide a Net Worth Statement before you provide financial services, then this digital template form is ideal for you.

What information is gathered by the form?

When filling out the form, the client is asked to provide information concerning all present assets, liabilities and financial details (bank accounts, investment funds, mortgages, etc.)

What else is included in the template?

The Net Worth Statement form includes a Disclosure and Release Statement, which authorizes the financial advisor to use the information for certain specific purposes.

Format and Use

This Personal Net Worth Statement template is available in MS Word format and can be used anywhere. It's downloadable and fully customizable so you can tailor it to your unique needs.