Product tags

Related products

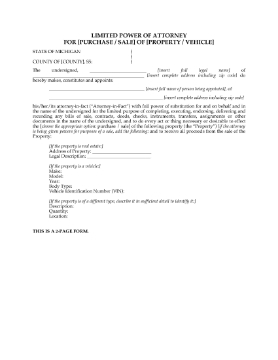

Michigan Power of Attorney for Purchase or Sale of Asset

You can name a friend or family member as your agent to buy or sell real estate, vehicles or other assets with this Michigan Limited Power of Attorney for Purchase or Sale of Asset.

- This is a legal document that gives your agent (attorney-in-fact) the power to execute the necessary paperwork to complete the transaction and transfer ownership of the real estate, personal property or vehicle.

- You can also authorize your attorney to receive and deposit the sale proceeds for you.

- The power of attorney only remains in effect until the transaction has been completed, after which it is automatically terminated.

Don't let the fact that you can't be present stop you from buying or selling property. Download the Michigan Limited Power of Attorney for Purchase or Sale of Asset form and appoint someone to do it for you.

$6.29

North Carolina Limited Power of Attorney for Real Property

Name someone as your attorney to handle the purchase or sale of real estate in North Carolina with this Limited Power of Attorney for Real Property form.

- This Power of Attorney becomes effective immediately and will remain in effect until the date you specify. If no date is specified, the power of attorney expires after one year.

- The attorney is given the authority required to take all actions, sign documents and do whatever else is necessary in order to complete the purchase or sale of the real property. The authority is limited to this transaction only.

- The form is available in MS Word format.

- Intended to be used only in the State of North Carolina.

$4.99

Texas Power of Attorney for Taxes

Appoint an agent (attorney) to obtain a tax refund on your behalf with this Limited Power of Attorney for Taxes for Texas residents.

With this legal document, you can grant your attorney the power, on your behalf, to:- request and receive the required documentation,

- amend and sign your tax returns, and

- receive any other information required with respect to the matter.

You may want to consider naming your accountant as your agent in this Texas Limited Power of Attorney for Taxes. Download the form, fill it in, and sign it - give your attorney a copy and make one for the IRS as well.

$2.29