Related products

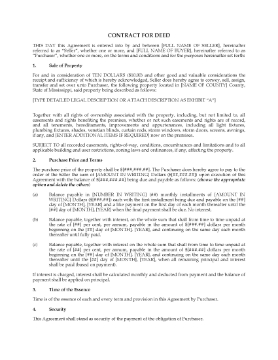

Mississippi Contract for Deed

Sell a real estate property to a buyer over time under the terms of this Mississippi Contract for Deed.

- Under the terms of this Contract (also known as a land contract), the seller in essence becomes the mortgage lender by allowing the purchaser to pay off the purchase price over time.

- Once the purchaser has paid all of the remaining balance, plus interest, the seller will transfer ownership of the property to the purchaser.

- If the purchaser fails to make the payments, the seller has the right to take back the property and keep all of the money that the purchaser has paid, as liquidated damages.

- By using a Contract for Deed, a property owner can secure the outstanding balance owing under the contract.

- Available in MS Word format.

- Intended to be used only in the State of Mississippi.

$17.99

Mississippi Special Warranty Deed

Transfer ownership of a MS commercial real estate property from a seller to a buyer with this Mississippi Commercial Special Warranty Deed.

The grantor (seller) and the grantee (buyer) agree that taxes are prorated to a specified date, and will be adjusted when the actual taxes are assessed.This Mississippi Commercial Special Warranty Deed form is provided in MS Word format, and can be easily edited on your computer, or filled in by hand.

$6.29

Mississippi Warranty Deed for Joint Ownership

Transfer ownership of a MS real estate property from two sellers to two buyers with this Mississippi Warranty Deed for Joint Ownership.

- This is the type of Warranty Deed that is used to convey a property from one couple (spouses or partners) to another couple, who will live in the property.

- The buyers will own the property as joint tenants with rights of survivorship. That means when one joint tenant dies, the title will pass to the surviving joint tenant.

- The sellers (grantors) covenant to the buyers (grantees) that they have good and marketable title to the property, they have the legal right and power to transfer the title, and they will defend the grantees' right to possess the property.

$6.29