Establishing an Offshore Structure for Canadians

This in-depth article describes a variety of offshore structures available to residents of Canada, for the purpose of asset protection. In particular, opportunities in the Bahamas are discussed.

The article provides a variety of information, including:

- a summary of how each structure is established,

- the purposes, advantages and disadvantages of each type of structure,

- international business corporations,

- settlement trusts,

- international foundations,

- universal life insurance,

- international deferred compensation programs,

- income stabilization plans,

- individual and corporate funding methods.

Establishing an Offshore Structure for Canadians is intended for residents of Canada, and is provided in Adobe PDF format.

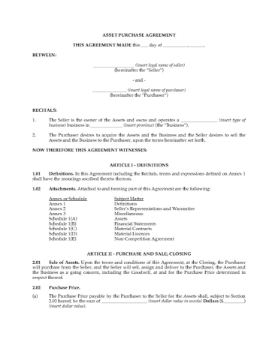

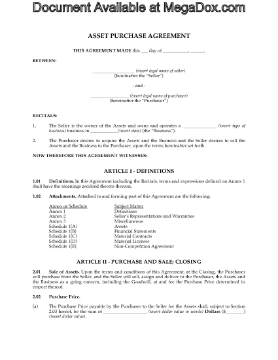

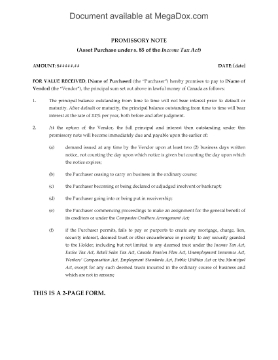

Asset Purchase Agreement | Canada

Draw up the terms for purchase of the assets of a Canadian business with this comprehensive Asset Purchase Agreement.

The business is sold as a "going concern", including assets, inventory and goodwill.

Purchase Price of Inventory

The amount of the purchase price allocated to inventory will be adjusted prior to closing based on the actual physical inventory at that time.

Conditional Transaction

The transaction is conditional in part upon the parties completing all of their covenants that must be performed prior to closing.

Schedules Included

Schedules include Definitions, Representations and Warranties of Seller, and a Non-Competition Agreement.

Format and Governing Law

The Asset Purchase Agreement package is available in MS Word format and is fully editable to fit your specific needs. It is governed by Canadian law and is intended for use only in Canada.

Letter of Intent to Purchase Assets and Shares but Not Debt

Write a letter of intent to purchase the assets and shares of a business, but not its debt, with this downloadable and customizable template.

- Negotiations Legally Binding. The LOI is only legally binding insofar as it relates to the negotiations being conducted between the parties with respect to the purchase.

- No Assumption. The buyer will not assume the liabilities or obligations of the business.

- Pre-Closing Debts. All pre-closing debts are to be paid by the seller.

- Tax Returns. The seller will be responsible for preparing and filing the closing income tax return and for terminating all employees.

- Employees. The buyer will make employment offers to the employees after the closing.

- Format of Template. The document is available in MS Word format and can be easily customized to fit your particular circumstances. This is a generic document template which can be used anywhere.