- termination of lease form (129)

- ,

- ohio commercial leasing (6)

Ohio Commercial Lease Agreement

Lease office or retail space to a business tenant with this fully editable Ohio Commercial Lease Agreement.

- Renewal. Option for the tenant to renew for an additional term at the end of the lease.

- Property Taxes. Alternate provisions for taxes to be paid by either the landlord or the tenant, as applicable.

- Insurance. The tenant is responsible for carrying comprehensive public liability, fire and extended coverage insurance.

- Structural Repairs. Alternate provisions depending on whether the landlord is responsible for mechanical and structural repairs, or if the tenant is responsible for all repairs.

- Parking. Parking areas are to be shared by all tenants and their employees and customers.

- Damage or Destruction.Provisions for termination or for abatement of rent in the event of damage, destruction, or condemnation of the building.

- This lease agreement template is fully editable to fit your needs.

- Intended for use only in the State of Ohio.

Ohio Commercial Triple Net Lease Agreement

Lease office, retail or other business premises to a tenant with this Ohio Commercial Triple Net Lease Agreement.

This Commercial Triple Net Lease Agreement is designed for leasing office, retail, or other business premises in the state of Ohio. The agreement sets forth the responsibilities and obligations of both the lessor and the lessee, with particular emphasis on the triple net nature of the lease.

Triple Net Lease

Under this agreement, the tenant (lessee) is responsible for paying all costs and expenses associated with the leased premises. This includes covering structural repairs, ensuring that the property is maintained in good condition, and handling all financial obligations tied to the property.

Renewal Option

The lease provides the lessee with the option to renew the agreement for an additional term upon the expiration of the initial lease period.

Taxes and Charges

The lessee is obligated to pay all expenses, taxes, levies, and charges related to the premises. This also encompasses all utilities, services, and operating expenses necessary for the conduct of the lessee’s business.

Insurance Requirements

The lessee must carry appropriate insurance coverage, including fire, extended coverage, and liability insurance, to protect both the property and the interests of the parties involved in the lease.

Alterations, Improvements, and Repairs

All alterations, improvements, maintenance, and repairs to the premises are the responsibility of the lessee. The lessee must ensure that any changes or enhancements comply with applicable regulations and maintain the integrity of the property.

Damage or Destruction

The agreement contains provisions addressing situations involving damage, destruction, or condemnation of the building. These clauses outline potential abatement of rent or termination of the lease if such events occur.

Subordination

The lessee agrees to execute a subordination agreement or any other necessary documents to subordinate the lease to a mortgage or other charge, should the lessor require it.

Additional Rent

The lease may include an optional clause requiring the lessee to pay percentage rent in addition to the base rent, if applicable.

Template Format and Jurisdiction

This template is available in MS Word format and can be fully edited to suit your specific needs. The document is intended to be used only in the State of Ohio.

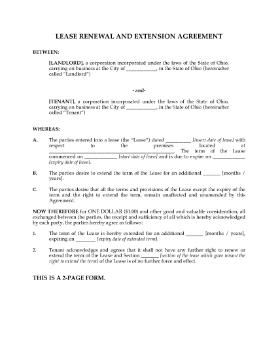

Ohio Renewal and Extension of Commercial Lease

Renew a business tenant's lease with this affordable Ohio Renewal and Extension of Commercial Lease.

- The tenant has no further right to extend or renew the lease.

- The renewal contract sets out the new expiry date and the rental payments for the renewal term.

- All other terms and provisions of the original lease remain in full force and effect.

- This Agreement is for commercial properties. For residential tenancies, a Residential Lease Extension form is required.

- Easy to use, fully editable so you can customize it to your exact needs.

- Intended to be used only in the State of Ohio.