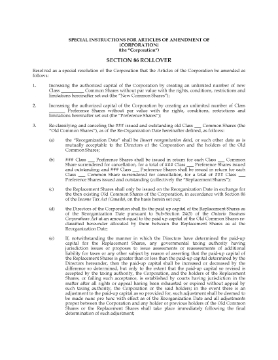

Ontario Section 85 Asset Rollover (Investments)

Roll over certain investments under Section 85 of the Income Tax Act (Canada) with this Ontario Section 85 Asset Rollover template.

- The vendor sells the investment assets to the purchaser, with part of the purchase price to be paid by way of preference shares in the capital of the purchaser, and the balance secured by a promissory note (included).

- The parties agree to file joint elections under Section 85(1) of the ITA and as required under the Ontario Corporations Tax Act.

- The file includes a Section 116 Affidavit of Residency to be sworn by a corporate officer of the vendor (if applicable).

- This Section 85 Asset Rollover of Investments is provided in MS Word format, and is fully editable to fit your specific circumstances.

- Intended for use only in the Province of Ontario, Canada.

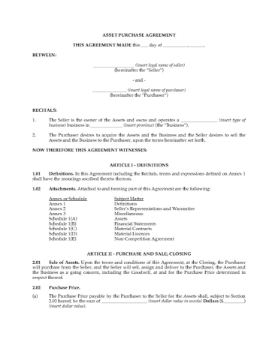

Asset Purchase Agreement | Canada

Draw up the terms for purchase of the assets of a Canadian business with this comprehensive Asset Purchase Agreement.

The business is sold as a "going concern", including assets, inventory and goodwill.

Purchase Price of Inventory

The amount of the purchase price allocated to inventory will be adjusted prior to closing based on the actual physical inventory at that time.

Conditional Transaction

The transaction is conditional in part upon the parties completing all of their covenants that must be performed prior to closing.

Schedules Included

Schedules include Definitions, Representations and Warranties of Seller, and a Non-Competition Agreement.

Format and Governing Law

The Asset Purchase Agreement package is available in MS Word format and is fully editable to fit your specific needs. It is governed by Canadian law and is intended for use only in Canada.

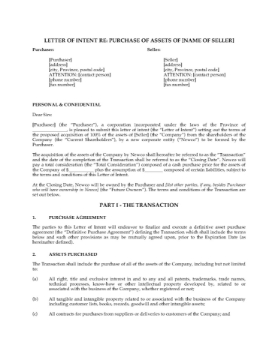

Letter of Intent to Purchase Business Assets | Canada

Negotiate the purchase of a Canadian business with this Letter of Intent to Purchase Assets of Business template for Canada.

A letter of intent (LOI) is not a legal contract, except for certain provisions such as confidentiality clauses which prohibit either party from disclosing any confidential information belonging to the other party. A signed letter of intent signals to other interested parties that you are already in negotiations to buy the business.

Purpose of this Letter of Intent

This Letter of Intent sets out the negotiations between the parties related to the buyer's offer to purchase all of the assets and goodwill of the business from the seller.

Expiration of LOI

If the parties fail to execute a formal Purchase & Sale Agreement within a specified number of days, the letter of intent will expire.

Failure to Complete Transaction

If the seller fails to go through with the transaction for no reason, the seller agrees to pay the buyer's costs and a specified amount as liquidated damages.

Format and Scope of Use

The Letter of Intent form is available in MS Word format and is fully editable and reusable. This LOI can be used in any Canadian province or territory.

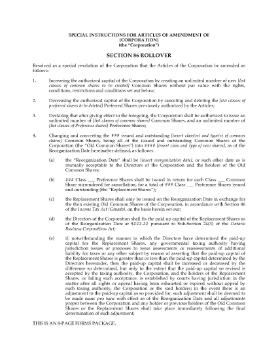

Section 85 Rollover Agreement for Land | Canada

Use this Section 85 rollover agreement to transfer real property to a corporation in exchange for shares while avoiding capital gains tax.

- A rollover allows you to transfer the asset under Section 85 of the Income Tax Act (Canada) without attracting capital gains tax on the transaction.

- In exchange for the land, the corporation purchasing the land issues shares to the vendor in an amount equal to the fair market value of the land.

- The purchaser and vendor agree to jointly file an election under subsection 85(1) of the Income Tax Act.

- A section 85 rollover agreement gives you a means to preserve your assets and reduce your tax liability.

- This document is governed by Canadian tax laws and is intended for use in Canada only.

Ontario Offer to Purchase Business Assets and Shares

Have you decided to buy an established business in Ontario? You can write up your offer to purchase the assets and shares of the company with this downloadable template.

- The offer is for the assets (excluding cash on hand and receivables) and the shares, but not the debt obligations of the company.

- Upon being accepted, the offer automatically becomes a legally binding purchase and sale agreement.

- The buyer will not assume any of the business liabilities except for the premises lease, maintenance contracts and salaries of employees that will be kept on after the closing.

- The parties agree to review and make any adjustments to the purchase price six months after closing.

- It is the seller's responsibility to terminate employees, prepare financial statements, file the final income tax return and pay corporate taxes as of the closing date.

- This is a downloadable fully editable template in MS Word format.

- Intended for use in the Province of Ontario, Canada.