Customers who bought this item also bought

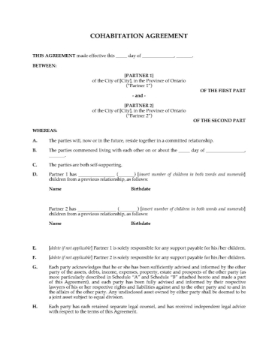

Ontario Cohabitation Agreement

Cohabiting couples in Ontario can establish their rights and obligations and the ownership of their separate and joint property in a Cohabitation Agreement.

- The Agreement allows you and your partner to specify which assets each of you owned prior to the relationship, and which are jointly owned by both of you.

- You can also set out how your joint assets will be distributed if you decide to end the relationship.

- You can also agree upon how household expenses will be split, and who is responsible for other debts. For instance, if your partner owes money on a student loan incurred before you met, he/she may be solely responsible for paying it off.

- If the two of you decide to get married, the Cohabitation Agreement becomes a prenuptial (pre-marriage) agreement.

- You will both need to get independent legal advice from a lawyer before you sign the Agreement. A Certificate of Independent Legal Advice is included for each of you, which the lawyer will sign after seeing you.

- Ontario law treats married and cohabiting couples differently with respect to property rights. Make sure yours are protected.

- Available in MS Word format, fully customizable.

$31.99

Family Trust Annual Resolutions | Canada

Prepare annual resolutions for a family trust in Canada with this easy-to-use forms package which contains:

- Trustee resolutions naming the records office, appointing the accountants, and confirming the acts of the trustees.

- Trustee resolutions resolving that all income allocations and expense payments required to be made have been or will be made for the year, and that the trust will not be liable for income tax under Part 1 of the Income Tax Act (Canada).

- This forms package is a downloadable MS Word file containing all of the resolutions. Fully editable and easy to use.

- Intended to be used only in Canada.

$9.99