Related products

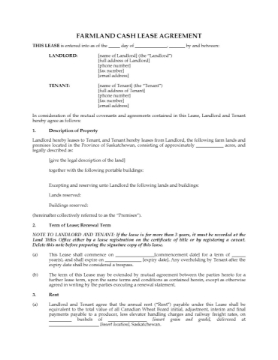

Saskatchewan Farm Land Cash Lease Agreement

Rent out Saskatchewan farm land to a tenant with this Saskatchewan Farm Land Cash Lease Agreement.

- This Lease allows the tenant to pay the annual rent in payments which are timed to coincide with the tenant's payments from the Canadian Wheat Board for the grain raised on the land.

- The tenant will use the farm land solely for agricultural purposes and will work the farm in accordance with normal farming practices.

- The tenant is responsible for control of weeds and soil erosion.

- The tenant cannot make major improvements without the landlord's consent. A Consent Form for this purpose is included.

- The tenant will seed all of the land except areas to be summerfallowed, and will summerfallow a specified number of acres each year.

- The landlord will provide grain storage facilities, but if they are not sufficient the tenant may remove excess grain to other locations for storage.

- If the landlord still has grain stored on the lands when the lease commences, the landlord will have the right to continue to store such grain on the land but only for a specified time period, after which it must be removed.

- Similarly, if market conditions at the end of the lease term prevent the tenant from delivering all of the grain grown during the term, the tenant may store the grain on the land in accordance with the Agricultural Leaseholds Act.

- The document also includes Surrender of Lease and Consent of Non-Owning Spouse forms.

- Intended to be used only in the Province of Saskatchewan, Canada.

$29.99

Saskatchewan Standard Form Commercial Lease

Rent out office or retail business premises in Saskatchewan to a tenant with this Standard Form Commercial Lease Agreement.

- The tenant has the option to renew the lease after the initial term expires.

- The lease template contains alternate paragraphs depending on whether the landlord is responsible for mechanical and structural repairs, or if the tenant is responsible for all repairs.

- The lease also contains alternate paragraphs for payment of the property taxes, depending on whether the landlord or the tenant will be paying the taxes.

- The tenant agrees not to register its leasehold interest against title to the property, but has the right to register a caveat so long as the tenant discharges the caveat at the end of the lease.

- The landlord is not responsible for death or injury to persons on the premises, or for any loss or damage of personal property. The tenant indemnifies the landlord against any claims or actions arising from the lease or the tenant's use of the premises.

- Available in MS Word format.

- Intended for use only in the Province of Saskatchewan, Canada.

$31.99