When you're starting up a business, cost drives every decision you make. And when it comes to business equipment, you need to determine whether it is most cost-effective and advantageous to lease or purchase the equipment necessary to your business.

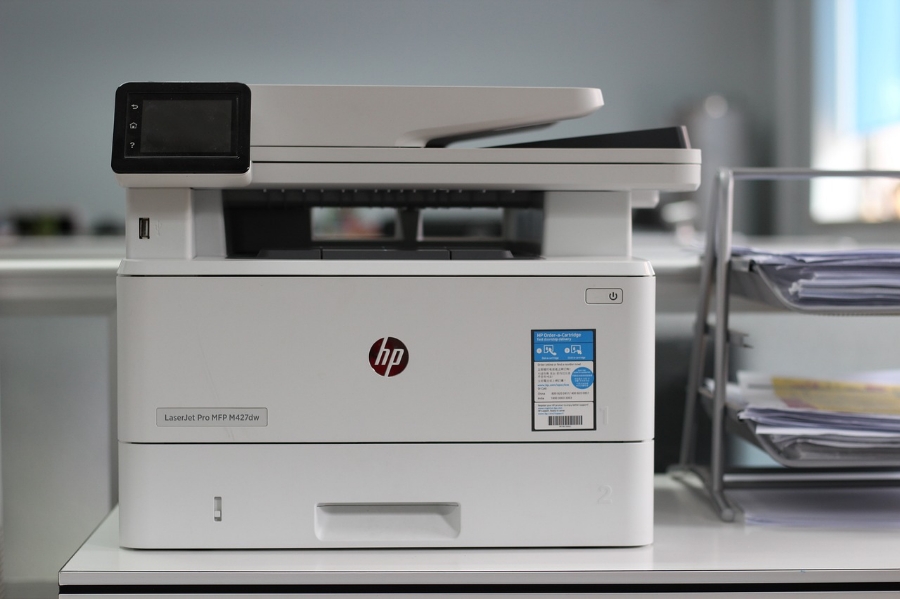

There are essentially three options available for acquiring the equipment you need: (1) a straight lease, (2) lease-to-own (also called a finance lease), or (3) outright purchase. The term "business equipment" can apply to anything you need for your operations, including computers, printers, and other electronics; office furniture; communications systems (smartphones, pagers, etc.); alarms and security systems; shelving and storage; specialized machinery; warehouse forklifts and loaders; and vehicles.

The Pros of Leasing

The upside of leasing is that it requires less of an initial outlay than purchasing, so you're not tying up so much money right off the bat. And for computer equipment, it can be the best option.

Your lease costs can be deducted as an operating expense, and they don't depreciate. Since the average equipment lease runs for 3 years, your lease will be expiring right about the same time that your computer equipment is obsolete, and you can upgrade to a new system under a new lease. (Review the lease terms to make sure they provide for maintenance, updates and support.)

The Cons of Leasing

Your overall costs are almost always higher because of interest and fees, you don't own the assets, and you build no equity in the equipment.

In addition, the lease agreement will contain restrictions on how you use the equipment: such as whether, and how much, you can customize the equipment for your business.

Comparison of Pros and Cons

LEASING | BUYING |

Lower upfront costs have less impact on cash flow | Higher initial investment required |

Higher total costs overall, interest rates much higher on lease than financed purchase | Lower total investment over the life of the equipment |

No ownership or equity until end of term | Ownership of and equity in assets upon purchase, with option for resale |

Easy upgrade options during and at end of term | Full control over use and customization of equipment |

Maintenance and insurance can be added as option to lease | Maintenance and insurance costs must be fully covered by owner |

Lease costs can be deducted as operating expenses | Equipment can be depreciated over a period of years which can be a tax benefit, but can mean loss of value |

Fixed monthly payments which can end up costing more than the value of the equipment over the term of the lease | Large upfront cost, but fewer ongoing expenses |

Penalties for early termination |

|

Should I Buy Instead?

When you buy it, you own it. And you can probably deduct a good portion of those asset purchases on your business income tax return. You also get the benefit of the depreciation deduction. If the equipment you need has a lifespan of more than 3-5 years and you've got the capital to do it, you probably should purchase instead of leasing it.

Office furniture is a good example of equipment with a long lifespan. While you may replace the chairs every few years, it's likely that the desks, shelving and filing cabinets will be around for a long time. These items are readily available from second-hand office suppliers, which can save you money. Buying second hand can be a great way to save money and still get what you need. Look for classified ads, listings on Craig's List and Kijiji, and shops that specialize in used office equipment and supplies.

Check out the local and online auctions as well. You have more recourse when buying from a dealer since you can usually take the item back, although there will probably be no warranty. The price might be higher than if you bought it from an individual, but the ability to return the item is worth paying more for. The risk you run when buying from an auction is that you can't actually test the equipment beforehand. Many auctions sell goods as seen, which means if the goods do not work, you have almost no chance of getting your money back, except for online auctions such as eBay. Find out what the restrictions are - and what your rights are - before bidding on any auction items.

Determining the Actual Costs

Many start-up companies will need to finance any equipment purchases. There are some questions that you will have to get answered in order to determine what the actual cost of leasing versus purchasing will be.

- What is the required down payment for the equipment?

- What is the term of the lease or loan?

- What are the monthly payments?

- What is the interest rate?

- Is there a final balloon payment at the end of the term? If so, what is the amount?

- What is the cost of an extended warranty (if applicable)?

- If lease-to-own, can you buy out early? At what cost?

- What is the total cost of the lease or loan (including maintenance and warranties) over its lifetime?

- If leasing to own, how much more are you paying to lease the equipment over and above its actual value?

- What are the tax deductions available if you purchase?

- What would the resale value of the purchased equipment be?

Can You Afford It?

Now that you know what the costs will be, ask yourself whether the business can afford it? Do you have sufficient cash flow at present to support your monthly lease or loan payments? If your business is seasonal, you'll need enough cash to support those payments during your off-season. And what about the maintenance costs? Are they included in your lease? Did you provide for them in the loan calculations? Do you know what they are? Then there's insurance. How much is the annual insurance cost to cover the equipment? Is it included in the lease?

If the answer to any of the above questions is "No", you should determine which equipment is absolutely essential for your business, and which items can wait until your cash flow improves. If you have to have it and the cash isn't there to buy it, then talk to several leasing companies and negotiate the best lease you can.

Image by xuefei wang from Pixabay