Customers who bought this item also bought

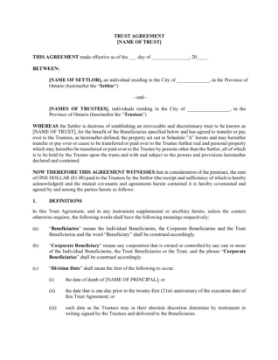

Ontario Forms to Establish Family Trust

Set up a family trust as part of your tax planning strategy with this package of forms for Ontario.

- The package contains the following forms:

- Irrevocable Trust Agreement,

- Consent of Proposed Trustee, which must be signed by each of the designated trustees,

- Resolutions of the Trustees establishing the trust,

- Receipt for the initial trust property,

- Promissory Note,

- Register of Trustees.

- The trust will be an irrevocable discretionary trust.

- The division date will be the first to occur of (i) the date of the principal or (ii) the day before the 21st anniversary of the execution date of the trust agreement.

- The agreement provides for the incapacity of a trustee or a beneficiary.

- The settlor will derive no income or capital or other benefit from the trust.

- The settlor cannot act as a trustee.

- The settlor cannot revoke the trust.

- For the purposes of the Income Tax Act, the trust can only be resident in Canada.

- The trustees will be indemnified and held harmless against claims, losses and damages in connection with their acting as trustees. The indemnities and protections afforded to any trustee under the agreement will continue to run even if the trustee ceases to hold the position of trustee.

- No distributions of capital or income shall be made at any time that there are less than two trustees in office.

- Available in MS Word format, fully editable.

- Intended to be used only in the Province of Ontario, Canada.

$59.99