Product tags

Related products

Multistate Biweekly Payment Rider | USA

Attach the Multistate Biweekly Payment Rider (Fixed Rate) to the mortgage document when a borrower wants to make the mortgage payments every two weeks instead of monthly.

- The Rider will become part of the mortgage or deed of trust and supplements the provisions of the loan document.

- The form sets out the amount of the biweekly payment, and the late charge that will be paid if a payment is not made in full when it is due.

- This Rider is for fixed rate mortgages on single-family homes in the United States.

- Download a free copy of the Fannie Mae/Freddie Mac Form 3177 Multistate Biweekly Payment Rider (Fixed Rate).

$0.00

Multistate Condominium Mortgage Rider | USA

The USA Multistate Condominium Mortgage Rider should be attached to mortgage documents for single family condominiums.

- The Rider will become part of the mortgage or deed of trust and supplements the provisions of the loan document.

- The borrower agrees to perform all of the obligations under the Declaration, bylaws, and other documents governing the condominium property.

- The owners' association must maintain blanket property insurance and public liability insurance on the condominium project.

- Free downloadable Form 3140 from FreddieMac.com.

$0.00

Multistate PUD Mortgage Rider | USA

Attach this PUD Mortgage Rider to mortgages for single family residences that are part of a planned unit development (PUD).

- The Rider will become part of the mortgage or deed of trust and supplements the provisions of the loan document.

- The borrower agrees to perform all of its obligations under the Declaration, bylaws, and other documents governing the PUD property, and to pay all dues and assessments when they become due.

- The PUD owners' association must maintain blanket property insurance and public liability insurance on the condominium project.

- If the borrower fails to pay dues and assessments when they become due, the lender may pay them, and they will form part of the debt owed by the borrower.

- Form 3150 USA Multistate Planned Unit Development (PUD) Mortgage Rider is a free download from FreddieMac.com.

$0.00

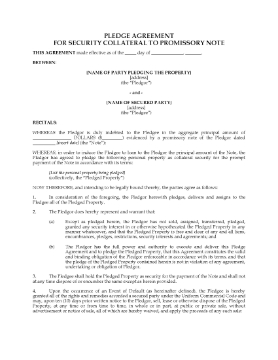

USA Pledge of Security Collateral to Promissory Note

USA lenders who require additional collateral security can have their customers sign this Pledge of Security form as part of the loan documentation package.

- The borrower agrees to pledge personal property for the lender to hold as collateral security to ensure repayment of a loan under a promissory note.

- If the borrower defaults in payment, the lender has all the rights and remedies of a secured party under the Uniform Commercial Code, and has the right to sell, lease or dispose of the property as it sees fit.

- Once you have purchased the form, you can customize it for your business and use it over and over. There are no additional licensing or restocking fees.

If you lend money, you should have this Pledge of Security form on hand for your loans officers. Purchase, download, fill in, print and get a signature - it's easy.

$12.49