- promissory note form (26)

- ,

- loan security form (61)

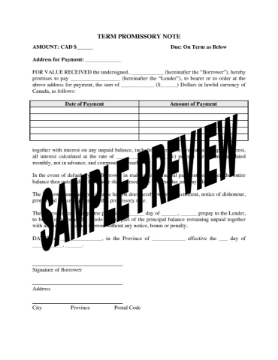

Term Promissory Note | Canada

Secure the repayment of a loan over time with this Term Promissory Note template for Canada.

This Term Promissory Note template is designed specifically for use within Canada. It provides a secure method for documenting the repayment of a loan over time.

Repayment Structure

The Note permits the borrower to repay the loan amount through regular payments. Each payment consists of a blended portion of principal and interest, ensuring a consistent payment schedule throughout the loan period.

Interest Calculation

Interest on the outstanding loan balance is calculated monthly, and the total interest is compounded annually. This approach offers clarity in how interest accrues over the duration of the loan.

Format and Reusability

This template is a reusable legal form available in Microsoft Word format, allowing for easy editing and customization to meet specific needs. Once purchased, it can be downloaded and utilised as often as required, making it a convenient option for ongoing or future loan agreements.

Jurisdiction

This template is intended for use only in Canada and should not be used for loans outside Canadian jurisdiction.

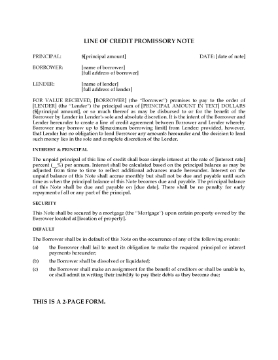

Line of Credit Promissory Note

If you are offering a line of credit to a customer, secure your interest with this Line of Credit Promissory Note form.

- The Note allows for multiple advances, up to a specified maximum amount.

- Interest on the secured amount is simple interest, accruing monthly.

- The Note is secured by a mortgage on the Borrower's property.

- There is no prepayment penalty.

- This is a generic legal template which is not specifically written for any country, state or province.

- This form is provided in MS Word format and is easy to customize.

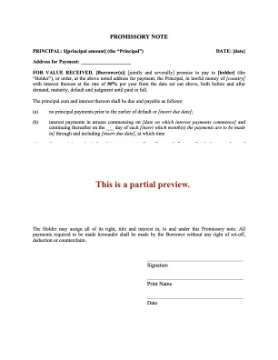

Promissory Note for Interest Only

Secure the repayment of a loan with this Promissory Note form for interest payments only.

- The Note allows the borrower to make payments against interest only, with no payment to be made against the principal amount until a date set out in the Note.

- Interest payments are made in arrears, on regularly scheduled payment dates.

- The borrower can repay the principal amount of the loan at any time without having to pay a prepayment penalty.

- This Promissory Note for Interest Only template is generic (not country specific) and is easy to fill in with all the specifics of your transaction.