Only registered users can write reviews

Related products

Alberta Section 85 Purchase Agreement for Common Shares

Prepare a section 85 Share Purchase Agreement (value stated) with this rollover document package for the Province of Alberta.

- The vendor sells the subject shares to the purchaser in exchange for shares in the capital stock of the purchaser, pursuant to Section 85 of the Income Tax Act (Canada).

- The shares being issued have an aggregate redemption value equal to the fair market value of the vendor shares, with any shortfall in value covered by a promissory note for the balance.

- The parties agree to make such amendments as may be required by any CRA determination that the amounts or values differ from those stated in the agreement, amendments to be retroactive to the effective date.

- The package includes:

- Share Purchase Agreement,

- Schedule of Assets with breakdown of elected amount limits and consideration received,

- Demand Promissory Note form.

- Intended for use in the Province of Alberta, Canada.

$17.99

Alberta Section 85 Rollover Agreement for Newco Shares

Exchange common shares held by a shareholder for shares in a new company with this easy Section 85 Rollover Agreement for Alberta corporations.

- The parties will file a joint election under s. 85 of the Income Tax Act (Canada).

- The purchase price for the existing common shares will be equal to the fair market value of the shares at the effective date of the agreement.

- The amounts will be adjusted accordingly if any taxing authority determines that the FMV is different from that determined by the agreement, retroactive to the effective date.

- The agreement includes a Schedule of Assets with breakdown of elected amount limits and consideration received.

- This legal form is available as a downloadable MS Word document.

- Intended for use in the Province of Alberta, Canada.

$11.99

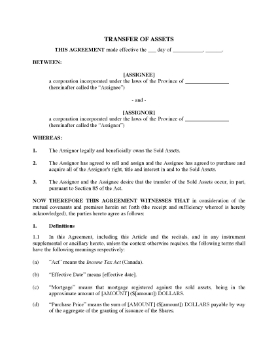

Asset Transfer Agreement (Land for Shares) | Canada

Make an exchange of land for shares under section 85 of the Income Tax Act (Canada) with this Asset Transfer Agreement.

- The parties are both Canadian corporate entities.

- The seller transfers the land to the buyer. In exchange the buyer assumes the mortgage on the land and issues shares of its capital to the seller.

- The parties agree to jointly file an election under Section 85.

- The Asset Transfer Agreement is part of an asset exchange (rollover) transaction.

- This document complies with Canadian tax laws and is only for use in Canada.

$11.99