Product tags

- incorporation form (10)

- ,

- forms for alberta companies (6)

- ,

- alberta business corporations act (3)

- ,

- share rights (4)

Related products

Alberta Share Classes - Preferred Redeemable Dividend Bearing

Incorporate an Alberta corporation with common and preferred share classes by attaching this Schedule to the Articles of Incorporation.

- Class A common voting shares;

- Class B common non-voting shares;

- dividends on common shares to be declared contemporaneously;

- Class C preferred non-voting dividend bearing redeemable shares with rights on dissolution in priority to other classes;

- Class D preferred non-voting shares, with rights on dissolution in priority to the common shares.

Alberta Articles of Incorporation Schedule for Share Classes A and B Common, C and D Preferred, available in MS Word format. Download, edit as necessary, print for filing with Corporate Registry.

$9.99

Alberta Share Classes - 2 Common, 3 Preferred Dividend Bearing

Establish the rights and privileges for common and preferred share classes of an Alberta corporation with this ready-made Schedule to the Articles of Incorporation.

- This Schedule is for the following classes of shares:

- Class A and B common voting shares;

- Class C non-voting dividend bearing shares;

- Preferred D and E non-voting redeemable retractable dividend bearing shares with rights on dissolution in priority to all other share classes.

- Available in MS Word format.

- Intended to be used in the Province of Alberta, Canada.

$12.49 $11.99

Alberta Share Classes - Voting, Nonvoting and Redeemable

Create voting, non-voting and redeemable share classes for an Alberta corporation with this Schedule to the Articles of Incorporation.

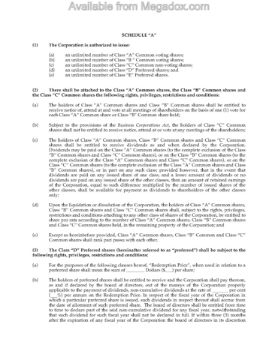

This Schedule forms an integral part of the Articles of Incorporation and outlines the rights and restrictions associated with various classes of shares issued by an Alberta corporation.

The document is prepared in accordance with the Business Corporations Act (Alberta) and must be attached to the Articles of Incorporation or Amendment for submission to the Corporate Registry. The document is available in Microsoft Word format.

Share Classes Overview

1. Voting Dividend Bearing Shares

- Class A Shares: Voting shares entitled to receive dividends.

- Class B Shares: Voting shares entitled to receive dividends.

2. Non-Voting Dividend Bearing Shares

- Class C Shares: Non-voting shares entitled to receive dividends.

- Class D Shares: Non-voting shares entitled to receive dividends.

3. Non-Voting Redeemable Retractable Dividend Bearing Shares

- Class E Shares: Non-voting shares that are redeemable and retractable, entitled to receive dividends. These shares have priority rights on dissolution over other classes of shares.

4. Voting Redeemable Retractable Non-Dividend Bearing Shares

- Class F Shares: Voting shares that are redeemable and retractable and do not bear dividends. These shares have priority rights on dissolution over all other classes except for Class E shares.

$15.99

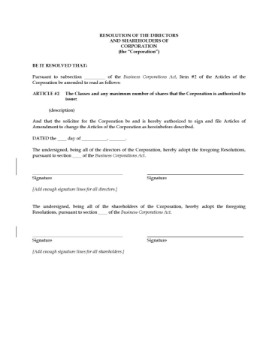

Corporate Resolution to Amend Share Structure | Canada

Authorize a change to the share structure of a Canadian business corporation with this free corporate resolution form.

- The Resolution will be signed by the corporation's directors and shareholders to authorize amendments to the Articles of Incorporation with respect to:

- the classes of shares that the corporation is authorized to issue,

- the rights and obligations attaching to each share class.

- Available in MS Word format.

- Intended to be used only by Canadian corporations.

$0.00