Customers who bought this item also bought

Ontario Offer to Purchase Restaurant Assets

You can easily write an offer to buy the assets and property of a restaurant with this downloadable template Offer to Purchase for the Province of Ontario.

- The offer becomes a legally binding agreement of purchase and sale once it has been accepted by the seller.

- On closing, the buyer will pay the seller the value of liquor, food and beverages on hand, valued at either cost or net realizable value, whichever is lower.

- The buyer is not required to purchase inventory older than two months or inventory which is unsaleable or unusable.

- The buyer is responsible for remitting the GST applicable to the sale. The buyer will also pay retail sales tax on the purchased assets.

- The seller will give the buyer reasonable access to the premises, books and records of the business to enable the buyer to conduct its due diligence investigation.

- The agreement contains the standard representations and warranties of each party.

- The seller agrees not to carry on or be involved with a competing business within an agreed proximity to the restaurant, and will not solicit customers or employees from the business.

- The Offer to Purchase form is intended for use within the Province of Ontario, Canada.

$29.99

Restaurant Lease | Canada

Lease a restaurant premises in Canada to a tenant with this Restaurant Lease template.

- This is a triple net lease, and the tenant pays all taxes, charges and assessments on the premises, all operating costs, all utilities and services to the premises.

- Parking.The restaurant shares the common parking lot with other businesses in the mall or building.

- Indemnification. The tenant indemnifies the landlord against any claims arising from the tenant's use and occupation of the space.

- Use of Premises. The premises are to be used for the purposes of a restaurant only. This lease can be used for a dine-in or take-out and delivery restaurant. The tenant will have the exclusive right during the lease term to sell specific food items in the building / mall.

- Insurance. The tenant is required to carry comprehensive general liability insurance, all risk insurance, boiler and machinery insurance (if applicable), and business interruption insurance.

- Events of Default. If the tenant becomes bankrupt or insolvent, or if a receiver is appointed, the current month's rent and the next 3 months' rent will become immediately payable, and the landlord has the right to recover possession of the premises.

- Dispute Resolution. The parties agree to binding arbitration in the event of a dispute.

- Available in MS Word format.

- Intended to be used only in Canada.

$29.99

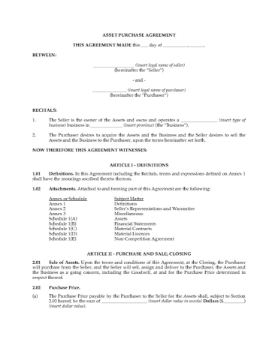

Asset Purchase Agreement | Canada

Draw up the terms for purchase of the assets of a Canadian business with this comprehensive Asset Purchase Agreement.

The business is sold as a "going concern", including assets, inventory and goodwill.

Purchase Price of Inventory

The amount of the purchase price allocated to inventory will be adjusted prior to closing based on the actual physical inventory at that time.

Conditional Transaction

The transaction is conditional in part upon the parties completing all of their covenants that must be performed prior to closing.

Schedules Included

Schedules include Definitions, Representations and Warranties of Seller, and a Non-Competition Agreement.

Format and Governing Law

The Asset Purchase Agreement package is available in MS Word format and is fully editable to fit your specific needs. It is governed by Canadian law and is intended for use only in Canada.

$49.99