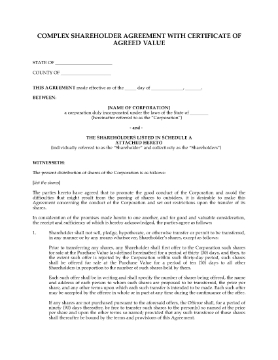

Shareholder Agreement with Certificate of Agreed Value | USA

Set restrictions on transfers of shares in a U.S. corporation with this Shareholder Agreement, with a Certificate of Agreed Value.

- Before offering shares to any other party, a shareholder must first offer them to the corporation.

- The corporation is obligated to purchase a shareholder's shares if the holder dies or becomes incapacitated, bankrupt, makes an assignment for the benefit of creditors, or if the shares are attached.

- The purchase value of the shares is determined by a certificate of agreed value signed by all of the shareholders and filed with the corporation.

- If the certificate of agreed value is older than 2 years, the book value of the shares will be used, as determined by the corporation's accountants.

- The USA Shareholder Agreement with Certificate of Agreed Value is a digital download that you can easily customize to fit your exact requirements.

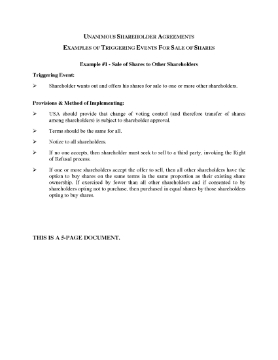

Triggering Events for Share Sales in Shareholder Agreements

Learn about the types of events which trigger a sale of shares under a Unanimous Shareholder Agreement, and the methods used to implement the sale.

- Triggering events include:

- right of first refusal;

- default buy-sell;

- shotgun or forced sale;

- transfer on death.

- Available as a PDF download.

Shotgun Clauses and Owner Managers

Should your company shareholder agreement include a shotgun clause? This article discusses these types of provisions from an owner-manager's perspective.

What is a "shotgun clause"?

A 'shotgun clause' or 'buy-sell clause' is a clause in a shareholder agreement which provides that if a shareholder wants to pull their investment out of the company, they can force the other shareholders to buy their shares.

Benefits and risks of a shotgun provision

The selling shareholder sets the price and the terms of sale, and the remaining shareholder(s) decide whether to accept the sale on that basis. In theory, a shotgun clause provides a fair mechanism for shareholder departure, due to the fact that the seller does not know whether or not the price and terms will be accepted. Therefore they must be reasonable in setting the price and terms.

In practice, however, a selling shareholder often tries to use the shotgun clause to their advantage, which can result in the receiving shareholder(s) turning to arbitration or the courts to settle the matter.

Practical limitations of shotgun clauses

The article discusses the limitations on shotgun clauses, and how to use them properly in your shareholder agreement.

Alternative methods of shareholder breakups

The writer discusses other methods of no-fault corporate divorce that can be used instead of a shotgun provision, such as drag-along, tag-along clauses, right of first refusal options, and auction or bidding processes.

Author Credit

This article was written by Phil Thompson, business lawyer and corporate counsel in Ontario, Canada.

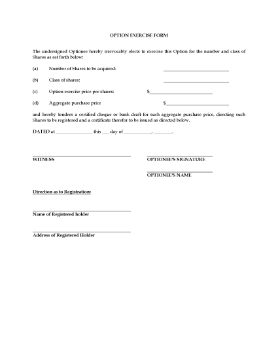

Right of First Refusal Clause for Shareholder Agreement

This Right of First Refusal clause can be inserted into a Shareholder Agreement to govern how a shareholder disposes of its shares.

- If a shareholder receives an arm's length offer from a third party to purchase its shares, the selling shareholder must give the other shareholders a right of first refusal to buy the shares before selling them to the third party.

- The clauses are downloadable and customizable.

- These generic clauses can be used in any common law country.

- Available in MS Word format.

Share Repurchase / Buy-Back Agreement

Use this downloadable Share Repurchase (or Buy-Back) Agreement to transfer shares from a shareholder back to the corporation.

- The Agreement is secured by a promissory note, and the template includes a sample form of promissory note.

- The corporation will cancel the shares after buying them back.

- The vendor represents that the shares are free of encumbrances and security interests against them.

- Both parties agree to take all actions necessary to complete the transaction.

- The Share Repurchase Agreement allows the corporation to reduce the number of outstanding shares and retain share value.

- This is a generic legal form which can be used in many jurisdictions. Available in MS Word format.