Right of First Refusal Agreement to Acquire Shares

Grant a right of first refusal to another shareholder with this Right of First Refusal Agreement to Acquire Shares template.

- The Agreement grants one shareholder a first right of refusal to acquire shares owned by another shareholder ('granting shareholder').

- The right is granted pursuant to the winding up of a third shareholder (a company solely owned by the granting shareholder) and the transfer of the third shareholder's share interest to the granting shareholder.

- This is a generic legal form which is not specific to any country or region.

- The Right of First Refusal Agreement to Acquire Shares is available in MS Word format and is fully editable to fit your needs.

Stock Buy-Sell / Redemption Agreement | USA

Set out the provisions for dealing with the shares of a departing or deceased shareholder in this Stock Buy-Sell / Redemption Agreement for USA corporations.

- The Agreement clarifies the procedure the corporation must follow for repurchasing or redeeming a departing or deceased shareholder's stock holdings.

- Payment is secured by a promissory note and may be made over time.

- The corporation may not declare or pay dividends, reorganize, merge, consolidate, sell any of its material assets, or increase the salary of any key employee or officer while any portion of the redemption price remains unpaid.

- The departing shareholder must resign as a director and/or officer upon closing of the share purchase.

- This template is available as a MS Word download and is fully editable to fit your specific circumstances.

- Intended to be used by companies incorporated in the United States.

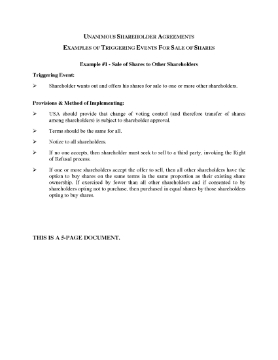

Triggering Events for Share Sales in Shareholder Agreements

Learn about the types of events which trigger a sale of shares under a Unanimous Shareholder Agreement, and the methods used to implement the sale.

- Triggering events include:

- right of first refusal;

- default buy-sell;

- shotgun or forced sale;

- transfer on death.

- Available as a PDF download.

Right of First Refusal Clause for Shareholder Agreement

This Right of First Refusal clause can be inserted into a Shareholder Agreement to govern how a shareholder disposes of its shares.

- If a shareholder receives an arm's length offer from a third party to purchase its shares, the selling shareholder must give the other shareholders a right of first refusal to buy the shares before selling them to the third party.

- The clauses are downloadable and customizable.

- These generic clauses can be used in any common law country.

- Available in MS Word format.

Shotgun Clauses and Owner Managers

Should your company shareholder agreement include a shotgun clause? This article discusses these types of provisions from an owner-manager's perspective.

What is a "shotgun clause"?

A 'shotgun clause' or 'buy-sell clause' is a clause in a shareholder agreement which provides that if a shareholder wants to pull their investment out of the company, they can force the other shareholders to buy their shares.

Benefits and risks of a shotgun provision

The selling shareholder sets the price and the terms of sale, and the remaining shareholder(s) decide whether to accept the sale on that basis. In theory, a shotgun clause provides a fair mechanism for shareholder departure, due to the fact that the seller does not know whether or not the price and terms will be accepted. Therefore they must be reasonable in setting the price and terms.

In practice, however, a selling shareholder often tries to use the shotgun clause to their advantage, which can result in the receiving shareholder(s) turning to arbitration or the courts to settle the matter.

Practical limitations of shotgun clauses

The article discusses the limitations on shotgun clauses, and how to use them properly in your shareholder agreement.

Alternative methods of shareholder breakups

The writer discusses other methods of no-fault corporate divorce that can be used instead of a shotgun provision, such as drag-along, tag-along clauses, right of first refusal options, and auction or bidding processes.

Author Credit

This article was written by Phil Thompson, business lawyer and corporate counsel in Ontario, Canada.