Products tagged with 'canada gst form'

Purchaser's GST Warranty and Indemnity | Canada

Prepare a GST Warranty and Indemnity for the purchase of real estate or a bulk sale of goods in Canada with this downloadable template.

- The Warranty and Indemnity is supplied by the purchaser to the vendor as part of the documentation required for the transaction.

- The purchaser warrants that it is a GST registrant and indemnifies the vendor against any liability incurred by the vendor with respect to the collection and remittance of Goods and Services Tax in connection with the purchase and sale transaction.

- The form is a downloadable MS Word document.

- For use only in Canada.

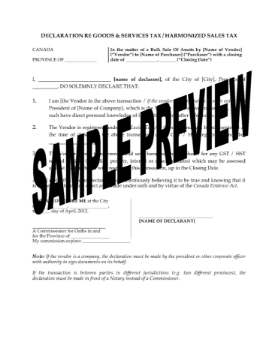

GST Declaration for Real Estate Purchase | Canada

Use this easy template to prepare a GST Declaration and Acknowledgement for a real estate transaction in Canada.

- The Declaration would be provided by the purchaser to the vendor.

- The purchaser declares:

- that Goods and Services Tax is payable on the real estate purchase, and

- that the purchaser will remit the tax following the closing of the transaction.

- This form is a free MS Word template.

- Intended for use only in Canada.

GST Agency Agreement | Canada

Prepare a GST Agency Agreement between a client and a lawyer with this free template form for Canada.

- The client appoints the lawyer as its agent to pay fees for certain federal and provincial government services on its behalf.

- This form makes it unnecessary for the lawyer to charge the client GST on those services.

- The client also indemnifies the lawyer against any claims or costs.

- The form can be downloaded for free in MS Word format.

- Intended to be used only in Canada.

Assignment of GST New Home Rebate | Canada

Assign a GST rebate on a new home purchase to the builder with this free Assignment Form for Canadian real estate properties.

- The assignment is made under Section 254 or Section 266 of the Excise Tax Act.

- This form is used when a purchaser of a new home assigns their GST rebate to the builder.

- Downloadable and easy to use.

- Available in MS Word format.

- Only for use in Canada.

Vendor's GST / HST Warranty and Indemnity | Canada

Use this downloadable template to get a GST / HST Warranty and Indemnity from the vendor of real estate or bulk goods in Canada.

Vendor’s Warranty

The vendor, also referred to as the seller, provides a warranty affirming that they are registered for GST (Goods and Services Tax) or HST (Harmonized Sales Tax), as required under Canadian tax laws. This declaration is crucial for maintaining compliance with federal and provincial tax regulations.

Indemnity Provision

In addition to the warranty of tax registration, the vendor agrees to indemnify the purchaser. This indemnification protects the purchaser from any liability that may arise in relation to the collection and remittance of GST and/or HST, in the Province of Ontario. The protection offered by the indemnity is effective up to the closing date of the purchase and sale transaction.

Applicability

This template is suitable for use in transactions occurring anywhere in Canada. It provides a standardized approach to handling GST/HST warranty and indemnity matters for both real estate and bulk goods purchases.

Form Features

The template is presented as a printable, blank legal form. It is designed for ease of use, allowing parties to quickly and efficiently document the required warranty and indemnity provisions for their transaction.