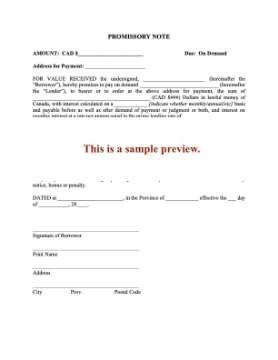

Promissory Note with Monthly Payments, Compound Interest | Canada

Set up a monthly payment schedule for a borrower with this Promissory Note form for Canadian loan transactions.

Monthly Payment Structure

The Promissory Note sets up a schedule of regular monthly payments for the borrower. These payments consist of both principal and interest amounts, which are to be repaid in equal installments each month throughout the loan term.

Calculation and Compounding of Interest

Interest on the outstanding loan balance is calculated and compounded on a monthly basis. This means that interest accrues on both the principal and any previously accumulated interest, resulting in a compounding effect over time.

Late Payment Provisions

If any portion of the principal or interest is not paid by the due date, the overdue amount will continue to bear interest at the same rate as the remaining loan balance. This ensures that late payments are subject to the same terms as regular payments.

Jurisdiction and Use

This Promissory Note template is suitable for use throughout Canada, with the possible exception of Quebec where a different French-language form may be required.

The form is available as a downloadable, editable, and reusable legal template to accommodate various lending arrangements. Prepared by legal professionals, not by AI.

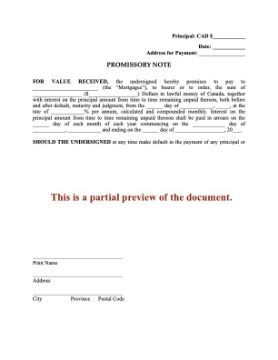

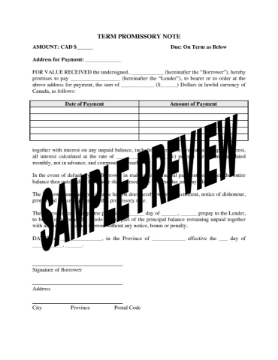

Term Promissory Note | Canada

Secure the repayment of a loan over time with this Term Promissory Note template for Canada.

This Term Promissory Note template is designed specifically for use within Canada. It provides a secure method for documenting the repayment of a loan over time.

Repayment Structure

The Note permits the borrower to repay the loan amount through regular payments. Each payment consists of a blended portion of principal and interest, ensuring a consistent payment schedule throughout the loan period.

Interest Calculation

Interest on the outstanding loan balance is calculated monthly, and the total interest is compounded annually. This approach offers clarity in how interest accrues over the duration of the loan.

Format and Reusability

This template is a reusable legal form available in Microsoft Word format, allowing for easy editing and customization to meet specific needs. Once purchased, it can be downloaded and utilised as often as required, making it a convenient option for ongoing or future loan agreements.

Jurisdiction

This template is intended for use only in Canada and should not be used for loans outside Canadian jurisdiction.

Annual Corporate Resolutions | Canada

Prepare the Annual Resolutions of the shareholders and directors of a Canadian business corporation with this package of forms.

- In small privately held corporations, it is common to pass Resolutions instead of holding a formal annual meeting, to deal with all the business that must be covered in the corporation's annual meeting.

- This package is a convenient time-saver for corporate lawyers and paralegals. It contains the following template forms:

- Resolution of the directors appointing the corporate officers and approving the financial statements.

- Resolution of the voting shareholders approving the financials and electing the directors.

- Resolution of all of the shareholders appointing auditors or waiving the audit requirement.

- Cover letter to be sent by a law firm to its corporate clients, enclosing the forms and giving instructions to the client.

- This package of Canada Annual Resolutions Forms can be used for federal companies and in Alberta, British Columbia, Saskatchewan, Ontario, New Brunswick, Nunavut, Yukon and Northwest Territories. French language translation required for Quebec.

Loan and Charging Agreement | Canada

Canadian lenders can use this downloadable Loan and Charging Agreement to prepare loan documents for a borrower.

- The template includes both the Loan Agreement and a promissory note for the principal amount of the loan plus interest.

- The borrower agrees to register an encumbrance against title to real estate owned by the borrower, as collateral security for the loan.

- If the borrower defaults in repaying the loan, title to the property will be transferred to the lender.

- Available in MS Word format.

- Intended to be used only in Canada.

Directors Resolution to Change Registered Office | Canada

The directors of a Canadian corporation can change its registered office by passing this Directors Resolution.

- The corporation's Board of Directors resolves to change the registered office from its current location to a new location.

- The corporate secretary is authorized to file the appropriate form of Notice with the applicable registry.

- The template can be used by any Canadian corporation formed under a Business Corporations Act, either federally or provincially. English version not valid in Quebec.

- Available as a fully editable download in MS Word format.

- Intended to be used only within Canada.