Customers who bought this item also bought

Contractor Services Agreement

Retain an independent contractor for specific projects with this Contractor Services Agreement.

- Compensation. The contractor will be paid an hourly rate and will be reimbursed for pre-approved expenses.

- Contract Not Exclusive. The agreement is not an exclusive contract and the contractor is not required to devote all of his/her time and efforts to the company's projects.

- Confidentiality. The document includes a confidentiality agreement and a non-competition covenant.

- Scope of Law. This is a generic legal form which does not specifically reference the laws of any country or jurisdiction.

- How to Get a Copy. You can download the Contractor Services Agreement in MS Word format immediately after you purchase it.

$29.99

Independent Contractor Agreement | USA

Cut your employer remittances by staffing your business with independent contractors instead of employees under this Independent Contractor Agreement for US employers.

- The independent contractor is responsible for remitting his or her own taxes and other required deductions.

- The contractor will not be entitled to vacation pay, health insurance, social security, workers' compensation, or any employee benefits.

- The contractor will invoice the company for services on a regular basis (monthly, twice monthly, etc).

- The contractor will be reimbursed for reasonable approved expenses incurred in the performance of his or her employment duties.

- The agreement contains non-competition and non-solicitation provisions to protect the employer's business and customer base.

- Any inventions or discoveries by the contractor during his/her engagement by the company will be the exclusive property of the employer.

- The template includes a Confidentiality Agreement to be signed by the contractor.

- This USA Independent Contractor Agreement template can be used in many U.S. jurisdictions. Local laws may restrict or prohibit hiring staff on a contractor basis in certain circumstances.

- Available in MS Word format.

$29.99

Ontario Share Purchase Agreement Between Equal Partners

Sell all your shares to your business partner with this Share Purchase Agreement for an Ontario corporation.

- This template is for a company that has two shareholders who are equal partners.

- One partner sells all of its shares to the other partner for cash.

- The buyer will secure a release of any guarantees provided by the seller with respect to the business.

- The seller will release the buyer from all claims and agrees to sign a non-competition agreement.

- This downloadable Share Purchase Agreement is an easy exit strategy for an equal partner to transfer its interest while allowing the business to continue operations.

- This legal document was prepared to be used within the Province of Ontario, Canada.

$17.99

Ontario Share Purchase Agreement and Assignment of Shareholder Loans

Sell the shares of an Ontario corporation and transfer any existing shareholder loans with this Share Purchase and Assignment Agreement.

- The seller sells its shares and assigns the balance of shareholder loans still outstanding over to the buyer, who is taking over the business of the company.

- The purchase price will be allocated between the shares and the shareholder loans, at fair market value.

- The buyer is at liberty to contact customers, suppliers and employees to notify them of the change of control. The seller will operate the business until closing.

- The parties will each file any required tax elections with respect to the transaction.

- This template is available as a downloadable and fully customizable MS Word document.

- Intended for use only in the Province of Ontario, Canada.

$46.99

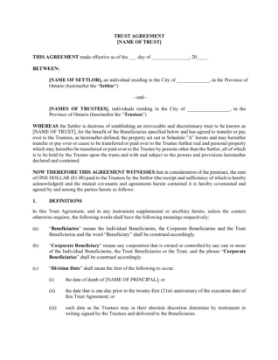

Ontario Forms to Establish Family Trust

Set up a family trust as part of your tax planning strategy with this package of forms for Ontario.

- The package contains the following forms:

- Irrevocable Trust Agreement,

- Consent of Proposed Trustee, which must be signed by each of the designated trustees,

- Resolutions of the Trustees establishing the trust,

- Receipt for the initial trust property,

- Promissory Note,

- Register of Trustees.

- The trust will be an irrevocable discretionary trust.

- The division date will be the first to occur of (i) the date of the principal or (ii) the day before the 21st anniversary of the execution date of the trust agreement.

- The agreement provides for the incapacity of a trustee or a beneficiary.

- The settlor will derive no income or capital or other benefit from the trust.

- The settlor cannot act as a trustee.

- The settlor cannot revoke the trust.

- For the purposes of the Income Tax Act, the trust can only be resident in Canada.

- The trustees will be indemnified and held harmless against claims, losses and damages in connection with their acting as trustees. The indemnities and protections afforded to any trustee under the agreement will continue to run even if the trustee ceases to hold the position of trustee.

- No distributions of capital or income shall be made at any time that there are less than two trustees in office.

- Available in MS Word format, fully editable.

- Intended to be used only in the Province of Ontario, Canada.

$59.99