Mergers, Amalgamations and Takeovers

Prepare the corporate legal documents you need to merge two or more related companies with these ready-made Merger, Amalgamation and Takeover Forms.

What is an amalgamation?

An amalgamation is the combination of two or more related companies. The amalgamated entity typically takes on the identity of the larger and more financially stable of the amalgamating entities. The shareholders of each company become the shareholders of the amalgamated company, and the assets and liabilities of the merged companies are vested in the amalgamated company.

How is an amalgamation different from a merger?

A merger is the formation of a new company from two or more existing companies, through pooling of common stock, cash payment or a combination of both. The companies being merged cease to exist and the shareholders of those companies become the shareholders of the new company.

What is a takeover?

The term takeover is generally used to refer to an acquisition where the company being acquired is resisting the takeover, otherwise known as a 'hostile takeover'. This is accomplished by bypassing the board of directors and making a tender offer directly to the shareholders.

If the offer to purchase their shares is sufficient to influence them, a majority of the shareholders may decide to approve the takeover, notwithstanding that the directors and management oppose it.

Many companies have employed defenses against corporate takeover, such as instituting a shareholders' rights plan which allows shareholders to purchase additional stock at a reduced price, resulting in a higher number of shareholders. However, these strategies can have the negative effect of lowering the stock price and diluting the shares.

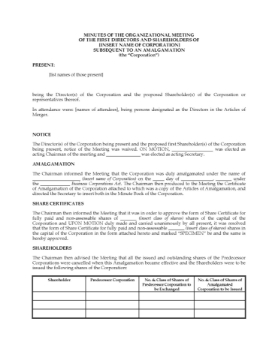

Minutes of Organizational Meeting Post-Amalgamation | Canada

Use this easy template to prepare the Minutes of the organization meeting of a Canadian corporation after an amalgamation.

Purpose of Minutes of Meeting

After an amalgamation of two companies in Canada, the amalgamated corporation must hold an initial meeting of directors and shareholders to address organizational matters.

These template Minutes include:

- appointment of directors to hold office until the next annual meeting,

- appointment of the corporate officers who will perform certain duties for the corporation,

- adopting by-laws for the new corporation,

- issuing shares of stock to the shareholders.

Format and Jurisdiction

The template is available in MS Word format and is fully customizable. These Minutes are prepared to comply with Canadian corporate laws and are intended to be used only in Canada.

North Carolina Agreement and Plan of Merger

Merge a North Carolina company with a wholly owned subsidiary under the terms of this Agreement and Plan of Merger.

- After the merger, the subsidiary will cease to exist and the company will continue in existence as the surviving corporation.

- The shares of the subsidiary will be canceled and the shares of the Company will be converted into stock in the surviving corporation.

- The company will not amend its articles or by-laws, reorganize its share capital, redeem or pay dividends on its stock, acquire or dispose of capital assets from the date of the agreement until the effective date of the merger.

- Employees of the company will become employees of the surviving corporation after the merger.

This template Agreement and Plan of Merger is prepared under North Carolina laws. Affordable and easy to use.

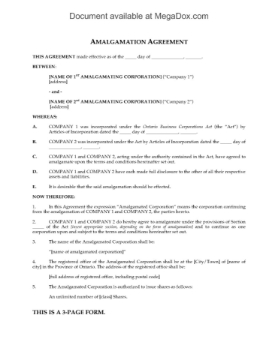

Ontario Amalgamation Agreement

Amalgamate two related corporations with this easy-to-use Amalgamation Agreement for Ontario companies.

- The shares of each amalgamating company are to be converted into shares of the new corporate entity formed by the amalgamation.

- Each of the amalgamating companies contributes all of its assets and property to the new company.

- The number of shareholders of the new company will be limited to no more than 50.

- This legal contract template is available as a downloadable, fully editable MS Word file.

- Intended for use only in the Province of Ontario, Canada.

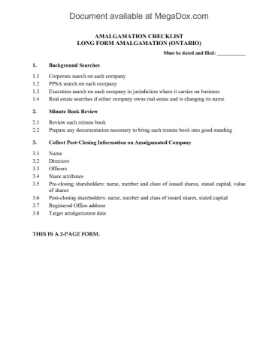

Ontario Checklist for Long Form Amalgamation

Track the steps required for a Long Form Amalgamation in the Province of Ontario with this ready-made checklist.

- If the amalgamation does not meet the requirements for a short form amalgamation, a long form amalgamation must be done.

- The checklist summarizes all the information, documents and actions that need to be compiled and completed in order to finalize the amalgamation.

- This checklist is a downloadable and fully editable MS Word template.

- Prepared for amalgamations in the Province of Ontario, Canada.

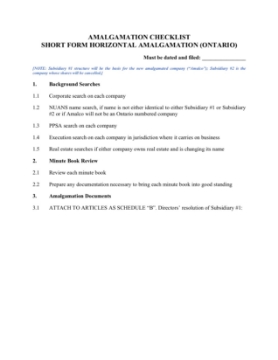

Ontario Checklist for Short Form Horizontal Amalgamation

Track the steps required for a Short Form Horizontal Amalgamation in the Province of Ontario with this ready-made checklist.

- A short form horizontal amalgamation is an amalgamation of two or more subsidiaries of the same parent company.

- One of the subsidiary's structure will form the basis of the new amalgamated corporation.

- The checklist summarizes the information, documents and actions that need to be taken to complete the amalgamation.

- This checklist template is a downloadable and fully editable MS Word document.

- Intended for use only in the Province of Ontario, Canada.

Ontario Checklist for Short Form Vertical Amalgamation

Keep track of the steps required for a Short Form Vertical Amalgamation in the Province of Ontario with this ready-made checklist.

- A short form vertical amalgamation is an amalgamation of a holding company with one or more of its subsidiaries.

- The holding company's bylaws and articles will form the basis for the new amalgamated corporation.

- No securities will be issued and no assets distributed in connection with the amalgamation.

- The checklist summarizes the information, documents and actions that need to be taken to complete the amalgamation.

- This form is a downloadable and fully editable MS Word template.

- Intended for use only in the Province of Ontario, Canada.

Ontario Corporate Documents for Long Form Amalgamation

Do a long form amalgamation of two Ontario corporations with this package of corporate documents, which contains:

- Notice of special meeting of shareholders.

- Special resolution approving the amalgamation.

- Statement of Director or Officer as required by the Ontario Business Corporations Act.

- Organizational resolutions and Minute Book documents for the amalgamated company.

All of the amalgamation forms are contained in one downloadable digital file ready for you to download and use. Intended for use only in the Province of Ontario, Canada.

Ontario Corporate Documents for Short Form Horizontal Amalgamation

Prepare the corporate documents and resolutions required for a short form horizontal amalgamation in Ontario with this package of forms, which contains:

- Resolutions approving the amalgamation.

- Statement of Director or Officer as required by the Ontario Business Corporations Act.

- Organizational resolutions and Minute Book documents for the amalgamated company.

The package of amalgamation forms is available in MS Word format. Intended for use only in the Province of Ontario, Canada.

Ontario Corporate Documents for Short Form Vertical Amalgamation

Prepare the corporate documents and resolutions required for a short form vertical amalgamation in Ontario with this package of forms, which contains:

- Corporate resolutions approving the amalgamation.

- Statement of Director or Officer as required by the Ontario Business Corporations Act.

- Organizational resolutions and Minute Book documents for the amalgamated company.

The package of forms is available in MS Word format. Intended to be used only in the Province of Ontario, Canada.

Takeover Bid Offer to Purchase Securities | Canada

Make a takeover bid offer to purchase the securities of a publicly owned Canadian corporation with this customizable template.

- The purchaser reserves the right not to proceed if the offer is not accepted by sufficient security holders to represent a majority of the common shares of the corporation.

- The purchaser is not obligated to proceed if any undisclosed action results in a material change to the corporation.

- The terms of the takeover offer are for cash.

- If the purchaser acquires at least 90% of the outstanding securities, it will use any available statutory right of acquisition to acquire the remainder.

- Alternatively, it will propose an amalgamation or merger of the corporation with one of its affiliates, with the end result being that the corporation would no longer have any publicly held shares or securities convertible into shares.

- This legal form template is available in MS Word format and is fully editable to meet your needs.

- Intended for use only in Canada.