Products tagged with 'ontario corporate form'

Sort by

Display per page

Ontario Annual Shareholder Meeting Package

Prepare for an annual shareholder meeting of an Ontario business corporation with this package of forms.

- The package contains documents which must be sent to each of the shareholders in preparation for the annual general meeting.

- The forms included in the package are:

- A template cover letter;

- Notice of Annual Meeting;

- Meeting Agenda;

- Solicitation of Proxy form;

- Declaration of Mailing Notice, to be completed by the corporate secretary or other officer who mailed the documents.

- Available in MS Word format.

- Intended to be used only in the Province of Ontario, Canada.

$17.99

Ontario Section 85 Share Rollover Agreement for Common Shares

Exchange shares for shares with this Ontario Section 85 Share Rollover Agreement for Common Shares.

- The vendor shareholder sells the subject shares to a holding company in exchange for common shares in the capital stock of the holding company, pursuant to Section 85 of the Income Tax Act (Canada).

- The parties agree to file joint elections under Section 85(1) under the ITA and as required under the Ontario Corporations Tax Act.

- The file includes a Section 116 Affidavit to be sworn by a corporate officer of the vendor, if applicable.

- This Section 85 Share Rollover Agreement for Common Shares is intended for use only in the Province of Ontario, Canada.

- Available in MS Word format, fully editable to fit your specific circumstances.

$17.99

Ontario Unanimous Shareholders Agreement Between Shareholders and Nominees

Shareholder nominees are included under the provisions of this Unanimous Shareholders Agreement for Ontario business corporations.

- Shareholder loans must be secured by a security agreement over the corporation's assets, are non-interest-bearing and become immediately due and payable upon the bankruptcy or receivership of the corporation.

- Clauses providing for employment and termination of shareholders as employees.

- Non-competition and non-solicitation provisions.

- Each shareholder indemnifies the other shareholders and the directors of the corporation against liability.

- All share certificates will be held in escrow by the corporation's lawyers.

- The remaining shareholders have a right of first refusal to purchase the shares of a departing shareholder.

- In the event of a take-over offer, the minority shareholders have the option to buy out a majority shareholder or, alternatively, to consent to the take-over.

- If a shareholder wishes to withdraw, the remaining shareholders must agree on a buy-out procedure, failing which they may vote to wind up the company, sell the shares to a third party, or offer all shares of the company for sale.

- AVailable in MS Word format.

- Intended to be used only in the Province of Ontario, Canada.

$46.99

Ontario Shareholder Buy-Sell Agreement

Ensure the continuity of ownership and management of your business with this Shareholder Buy-Sell Agreement for Ontario.

- The Agreement includes:

- a procedure for soliciting offers from third parties;

- the remaining shareholders have right of first refusal to purchase shares of a departing shareholder;

- the remaining shareholders have the right to piggyback the sale of their shares onto a proposed sale of more than 50% of the shares;

- a mandatory (shotgun) buy-sell;

- a mandatory buyout on death, to be funded by proceeds of a life insurance policy on the life of the deceased shareholder.

- This template is available in MS word format and is easy to customize to fit your circumstances.

- Intended to be used only in the Province of Ontario, Canada.

$29.99

Ontario Agreement to Adopt Pre-Incorporation Contract

If you entered into a contract on behalf of a company that was not incorporated yet, you can assign it to the corporation later under this Agreement to Adopt Pre-Incorporation Contract.

- The Agreement is made between a newly incorporated Ontario company and its principal shareholder. The new company agrees to adopt a contract between the shareholder and another party, which was entered into prior to its incorporation.

- The shareholder assigns its interest in the prior contract to the new company, and the new company becomes a party to the prior contract in place and stead of the shareholder, as if it had been an original party.

- As a principal of the corporation, it is advisable that you do this as soon as possible after incorporating to avoid any tax or other liability arising under the contract.

- This is a fully editable legal document that can be easily customized to meet your needs. Download it right after you purchase it.

$9.99

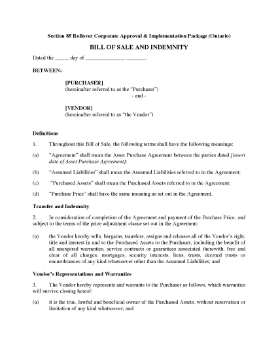

Ontario Section 85 Rollover Corporate Approval and Implementation Forms

Transfer shares under subsection 85(1) of the Income Tax Act (Canada) with this Ontario Section 85 Rollover Corporate Approval and Implementation Forms Package.

- The package of forms contains:

- Bill of Sale and Indemnity, including the vendor's indemnity of the purchaser, and representations and warranties with respect to the sale;

- Corporate Resolutions approving and authorizing the transaction;

- Share Transfer Form transferring shares from the vendor to the purchaser;

- Share Subscription from the vendor for new shares being issued by the purchaser as payment for the shares being transferred in the rollover.

- This package of forms is provided in MS Word format, and the forms are all fully editable to fit your specific circumstances.

- Intended to be used only in the Province of Ontario, Canada.

$17.99